Product tags

Related products

Utah Declaration of Covenants, Conditions and Restrictions - residential

Utah property developers can use this ready-made template to easily prepare a Declaration of Covenants, Conditions and Restrictions for a residential subdivision.

- The Declaration (also called a CC&R) contains covenants, easements, terms and conditions to govern the use and development of the lots, such as:

- completion of construction prior to occupancy,

- location of buildings and proximity of buildings, fences, etc. to property lines,

- types of construction materials and methods allowed in the subdivision,

- restrictions on parking, noise, commercial use, and other activities which could become a nuisance or be disruptive to other residents,

- trash removal and sewage disposal,

- installation and maintenance of utility easements,

- powers and authority of the Architectural Review Committee.

- The CC&R must be filed with the County Records Office upon completion.

- This form is a MS Word document template that you can customize to fit your specific circumstances.

- Intended to be used only in the State of Utah.

$29.99

Utah Declaration of Homestead for Mobile Home

Claim the mobile home you live in as your homestead by filing this Utah Declaration of Homestead (Mobile Home) form.

- Utah law allows you to protect the equity you have built up in your home up to $20,000 (or $40,000 if the property is jointly owned).

- Even if your property is sold by a bankruptcy trustee or a creditor, you will be entitled to receive a certain amount of the sale proceeds.

- This form is for mobile homes. You must live in the home in order to claim it as a homestead.

- After the document is signed, it must be filed with the County Recorder's Office for the county in which the home is located.

- Intended for use only in the State of Utah.

$2.29

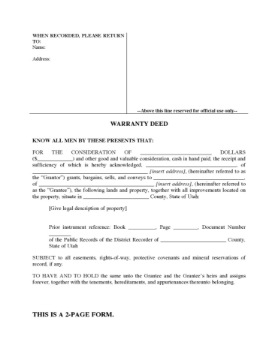

Utah General Warranty Deed Form

Transfer a real estate property in Utah from a seller to a buyer with this easy-to-use General Warranty Deed form.

What is a general warranty deed?

A warranty deed is a legal document that transfers ownership of a real estate property from the seller to the buyer. A general warranty deed provides the buyer with the broadest protection of any form of title deed.

Covenants of Seller (Grantor)

The seller (the grantor) gives the buyer (the grantee) the following covenants:

- that the grantor has good and marketable title to the property,

- that the grantor has the right and power to transfer the title to the grantee, and

- that the grantor will forever defend the grantee's right to possession of the property.

Format and Legal Jurisdiction

The Warranty Deed form is available as a downloadable legal document in MS Word format. It is intended to be used only in the State of Utah.

$5.99