Products tagged with 'homestead declaration form'

Sort by

Display per page

Utah Declaration of Homestead for Mobile Home

Claim the mobile home you live in as your homestead by filing this Utah Declaration of Homestead (Mobile Home) form.

- Utah law allows you to protect the equity you have built up in your home up to $20,000 (or $40,000 if the property is jointly owned).

- Even if your property is sold by a bankruptcy trustee or a creditor, you will be entitled to receive a certain amount of the sale proceeds.

- This form is for mobile homes. You must live in the home in order to claim it as a homestead.

- After the document is signed, it must be filed with the County Recorder's Office for the county in which the home is located.

- Intended for use only in the State of Utah.

$2.29

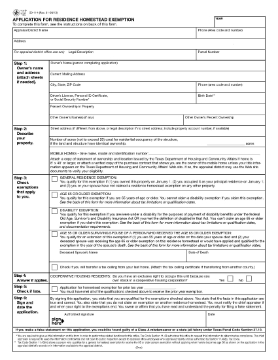

Texas Application for Residence Homestead Exemption

TX home owners, apply for a reduction in your property taxes with this Application for Residence Homestead Exemption Form 50-114.

- The form must be completed and submitted to your local appraisal district office.

- If you are over 65, disabled, or a disabled veteran, your exemption level is higher than the general amount available to other residents.

- The exemption application form can be used for a single family dwelling, or a mobile or manufactured home, provided that you live in the home. You must provide proof of residence.

- Instructions for completing the form are included.

- The form is available from the website of the Texas Comptroller of Public Accounts. Click the link to download the PDF.

$0.00

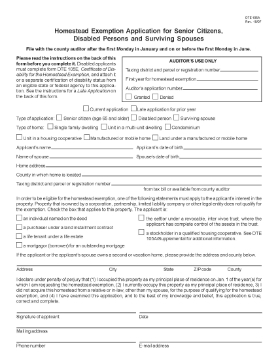

Ohio Homestead Exemption Application DTE 105A

Apply for a reduction in your property taxes with this free Ohio Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses.

- The home owner can apply to have the appraised value of his/her primary residence reduced by $25,000 with a corresponding savings in property taxes.

- The form must be completed and submitted to the county auditor.

- The exemption application form can only be used by seniors (age 65 or older), disabled persons, or the surviving spouse of a homeowner.

- The application for exemption can be made for single family dwellings, units in a multi-unit building, condominiums, cooperatives, manufactured and mobile homes.

- This is a free PDF form DTE 105A provided by the Ohio Department of Taxation. Click the link to download the form from their website.

$0.00

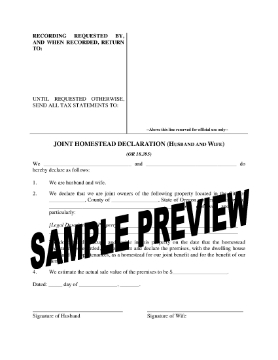

Oregon Joint Homestead Declaration

Do you and your spouse have debts or judgments against you? Protect your home to the maximum amount allowable under Oregon law with this Joint Homestead Declaration.

- The Declaration is made by a husband and wife, under Oregon Revised Statutes OR 18.395.

- A joint filing will protect the equity in your home to a maximum of $50,000 against sale by execution, judgment lien and liability for debts.

- The homestead exemption only applies to your actual residence. You can't use this form for revenue or vacation properties.

- When you have filled out the form, file it with the County Recorder's Office in the county in which your property is situated.

- Available in MS Word format.

- Intended to be used only in the State of Oregon.

$5.99

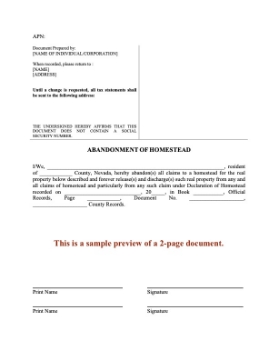

Nevada Abandonment of Homestead

If you have designated your home as a homestead and you are moving out, you need to file this Nevada Abandonment of Homestead form.

Purpose of Abandonment Form

Once filed, the form will become a public record that you are abandoning the property as your homestead (in other words, your principal residence, the place in which you live all or most of the time). This means that the property is no longer exempted under Nevada's homestead laws.

How to Use the Form

This Abandonment of Homestead Form should be used only in the State of Nevada. Download the form, fill it in and sign it, and file it with the County Recorder's Office.

The form is available in MS Word format.

$6.50

Idaho Declaration of Homestead

Protect the land that you own from attachment by creditors with this Idaho Declaration of Homestead.

- Every homeowner in Idaho is automatically protected by law for the first $100,000 of equity in their primary residence (Idaho Code 55-1003).

- This Declaration of Homestead form is used for either unimproved land (with no buildings) or for a property that you own but do not reside in.

- The homestead exemption will protect the first $100,000 of equity in the property against attachment, levy or sale by your creditors to satisfy outstanding debts.

- Fill in the form and file it with the County Recorder in the county in which the property is situated.

- Available in MS Word format.

- Intended to be used only in the State of Idaho.

$5.99

- 1

- 2