Customers who bought this item also bought

Share Exchange Agreement for Reorganization | Canada

Issue new shares to shareholders in exchange for their existing shares with this downloadable template for Canadian corporations.

- A share exchange of this nature is done as part of a corporate reorganization.

- The parties to the Share Exchange Agreement are the corporation and all of the shareholders.

- The shareholders agree to exchange their existing shares for new shares of a particular class following the reorganization.

- The template also includes Directors and Shareholders Resolutions which are required to authorize the share exchanges.

- Intended to be used only by corporations incorporated in Canada.

$12.49

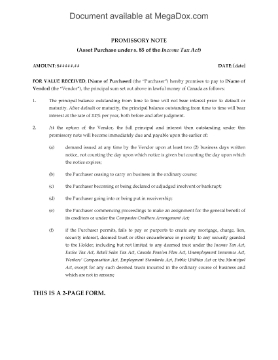

Section 85 Rollover Agreement (Common to Preferred Shares) | Canada

Prepare a Section 85 Rollover Agreement for a share exchange between a corporation and a shareholder with this template form, pursuant to s. 85 of the Income Tax Act (Canada).

- The shareholder sells common shares it holds in the capital stock of the corporation back to the corporation in exchange for new preferred shares, to be issued from Treasury.

- The parties agree to file a joint election for fair market value of the old common shares.

- The purchase price is adjusted to ensure that the redemption amount for the new shares does not exceed any reassessment of the fair market value of the old shares, or vice versa.

- This document package contains:

- a template Share Purchase Agreement, and

- a set of corporate resolutions of the directors and shareholders approving and authorizing the rollover.

- The rollover forms package is provided in MS Word format and is fully editable to fit your specific circumstances.

- This legal document is compliant with Canadian tax laws and is intended for use only in Canada.

$29.99

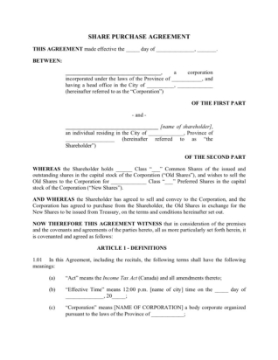

Ontario Section 86 Rollover Agreement

Prepare a Section 86 Share Purchase (Rollover) Agreement with this easy-to-use template for Ontario companies, pursuant to s. 86 of the Income Tax Act (Canada).

- The vendor shareholder sells the subject shares to a holding company in exchange for preference shares in the capital of the holding company.

- The parties agree to file joint elections under Section 86 under the Income Tax Act and as required under the Ontario Corporations Tax Act.

- The file also includes a Section 116 Affidavit Of Residency to be sworn by a corporate officer of the vendor, if applicable.

- Available in MS Word format and fully editable to fit your specific circumstances.

- Intended to be used only in the Province of Ontario, Canada.

$18.99

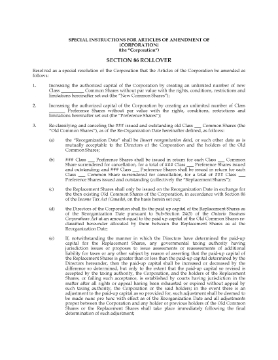

Ontario Section 86 Rollover Resolutions (Fixed Redemption Amount)

Prepare the required corporate resolutions to reorganize an Ontario corporation's share capital with this Section 86 Rollover Resolutions Package.

- These documents are required for a rollover with a fixed redemption amount, under s. 86 of the Income Tax Act (Canada).

- The package contains:

- Special Resolution with instructions for wording of the Articles of Amendment, fixing the redemption amount on the new preference shares to be created;

- Share Subscription for the replacement shares;

- Corporate Resolutions accepting the subscriptions, setting the redemption amount for the new shares and including an undertaking of the directors not to declare dividends if it would reduce the corporation's assets and make it unable to redeem the shares at their full redemption amount;

- Share Subscription from the new shareholder for the new shares;

- Corporate Resolutions issuing the new shares.

- Completing the paperwork for an asset exchange is so much easier with this package of documents.

- Available in MS Word format.

- Intended to be used only in the Province of Ontario, Canada.

$19.99

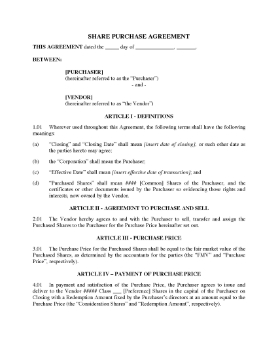

Section 85 Rollover Agreement for Land | Canada

Use this Section 85 rollover agreement to transfer real property to a corporation in exchange for shares while avoiding capital gains tax.

- A rollover allows you to transfer the asset under Section 85 of the Income Tax Act (Canada) without attracting capital gains tax on the transaction.

- In exchange for the land, the corporation purchasing the land issues shares to the vendor in an amount equal to the fair market value of the land.

- The purchaser and vendor agree to jointly file an election under subsection 85(1) of the Income Tax Act.

- A section 85 rollover agreement gives you a means to preserve your assets and reduce your tax liability.

- This document is governed by Canadian tax laws and is intended for use in Canada only.

$31.99