Customers who bought this item also bought

Alberta Collateral Mortgage and Promissory Note

Use this template Collateral Mortgage and Promissory Note for credit facilities in Alberta.

- A collateral mortgage can be used to secure a line of credit, a revolving loan, or other credit facility where the balance owing changes from time to time.

- The borrower is responsible for insuring, repairing, and maintaining the mortgaged property and for paying all taxes and assessments.

- The lender is appointed as the borrower's attorney (agent) for the purpose of recovering any insurance proceeds with respect to the property.

- The lender has power of attorney to sell, lease or encumber the property if the borrower defaults in its obligations.

- The full balance owing is immediately payable if the borrower sells the property or, if the borrower is a corporation, there is a change in control.

- This is a downloadable legal template in MS Word format.

- Intended for use in the Province of Alberta, Canada.

$29.99

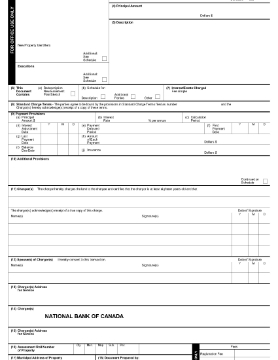

Fixed Rate Closed Term Mortgage | Canada

Prepare a Fixed Rate Closed Term Mortgage with this template form for Canada.

- Standard provisions of the mortgage include:

- Equal monthly payments of blended principal and interest (and taxes, if the lender requires).

- On default, the lender has the right to take possession of the property by distress warrant or by foreclosing on the property.

- The lender has the right to bring legal action to recover mortgage arrears and costs, plus interest and any other amounts owing.

- Available in MS Word format.

- This template can be used in most Canadian provinces except for Quebec.

$29.99

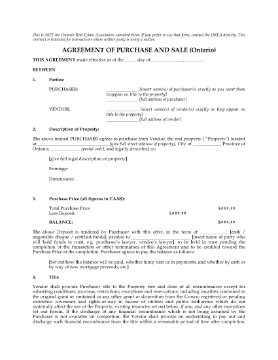

Ontario Standard Terms for Straight Charge / Mortgage

Ontario lenders can use this template form to prepare Standard Charge Terms for a straight charge or mortgage under Section 9 of the Land Registration Reform Act.

- When you file your initial set of Standard Charge Terms with the Land Titles Office, they issue you a filing number.

- Each time you submit a Form 2 Charge / Mortgage of Land to secure a loan, you refer to the filing number.

- That will ensure that the loan agreement secured by the mortgage is governed by this set of standard terms.

- The form is provided in MS Word format and is fully editable and reusable.

- For use only in the Province of Ontario, Canada.

$32.99