Related products

Business Succession Planning in Canada

Plan for the future of your small business - learn what you need to know about Business Succession Planning in Canada with this 8-page expert guide.

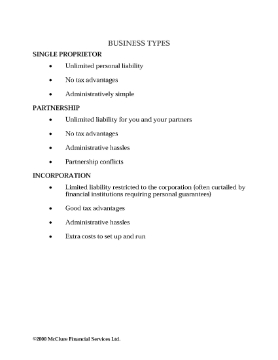

The guide describes the different types of business structures under Canadian laws, the pros and cons of each type of corporate entity. In addition, it discusses:

- how to extract value from your business,

- corporate investing,

- exit strategies,

- family businesses,

- tax planning and estate freezes.

Business Succession Planning in Canada is intended for Canadian businesses and is provided in PDF format.

$0.00

Trusts and Tax Planning in Canada

Learn about the various trust structures available to Canadians, and their tax benefits to the individual or business.

- This guide contains information on:

- family trusts (bearer, inter vivo or "living" trusts and testamentary),

- real estate investment trusts (REITs),

- royalty trusts,

- income trusts.

- The guide contains information relevant to Canadian residents and is available in Adobe PDF format.

$4.99

Estate Planning Analysis Worksheet

Do you know what the short-term and long-term financial impact would be for the survivor if you or your spouse or partner were to die?

- Use this Estate Planning Analysis Worksheet to help you determine:

- the immediate cash requirements of the surviving spouse / partner,

- ongoing monthly income needs, and

- available assets.

- This Estate Planning Analysis Worksheet should be completed by both you and your spouse or partner.

- It is provided in MS Word format and can be easily downloaded and filled in, either on the computer or by hand.

$0.00