Real Estate Forms

Are you buying or selling real estate? When you purchase one of our template Real Estate Forms, you get a convenient ready-made product that saves you money on costly legal fees.

- Standardized forms for residential or commercial real estate property.

- Downloadable, customizable, fill-in-the-blank templates.

- Country, state, and province specific legal forms.

- Offers, real estate purchase and sale contracts, For Sale by Owner packages.

- Title deeds and conveyancing forms.

- Realtor and broker listing contracts.

- Forms updated regularly to comply with changes to laws and regulations.

Kentucky Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Kentucky Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

Kentucky Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Kentucky Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Kentucky Special Warranty Deed

Transfer ownership of a KY real estate property with this easy-to-use Kentucky Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This Kentucky Special Warranty Deed form is a downloadable legal document in MS Word format.

Kentucky Warranty Deed for Joint Ownership

Transfer ownership of a Kentucky real estate property from two sellers to two buyers with this Kentucky Warranty Deed for Joint Ownership.

- This form of Warranty Deed is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, title to the property will pass to the surviving joint tenant.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

Land Co-Ownership Agreement

Purchase land with one or more other parties and protect the interests of all purchasers with this Co-ownership of Land Agreement.

- The parties are buying the property as tenants in common.

- Costs will be borne, and capital gains or losses distributed, proportionate to each of the owners' interest.

- The relationship between the parties is NOT a joint venture.

- If one owner wishes to sell its interest, the other owner(s) will be granted a right of first refusal, and must follow the procedure for buying out a co-owner.

- Owners have the right to transfer title to a holding company or to a trust.

- This is a generic Land Co-Ownership Agreement template which is not specific to any country or region.

- Available in MS Word format and fully editable to meet your needs.

Land Development Agreement for Commercial Project

Land developers, prepare a Development Agreement for Commercial Project with this comprehensive template.

- The parties to the agreement are the developer and a municipal corporation (City), in connection with the City issuing a permit to the developer for construction and development of a commercial office and retail project.

- Provisions of the agreement include:

- restrictions on setback lands;

- requirements for structural drawings, load calculations, below grade structures, and other elements of construction;

- development and construction of parking, loading bays and messenger stalls;

- construction of, access to and control over public areas, including handicapped access;

- disputes to be settled by arbitration.

- This template is provided in MS Word format and is totally editable to meet your needs.

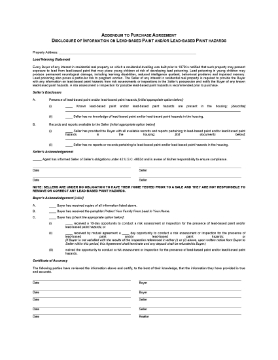

Lead Based Paint Disclosure | USA

Download this free Lead Based Paint Disclosure form for USA real estate properties.

- The disclosure form must be attached as an addendum to any offer or contract for purchase and sale of real estate properties in the United States which were built prior to 1978.

- The seller of the property must disclose to the buyer any information regarding the use of lead-based paint and lead-based paint hazards in the property, as required by 42 U.S.C. 4852d.

- This free form is available in MS Word format.

Letter of Intent to Purchase Commercial Real Estate Property | Canada

Set out the terms of agreement for a purchase of commercial real estate in Canada with this template Letter of Intent.

A Letter of Intent (LOI) is used to outline the preliminary terms and intentions for the purchase of commercial real estate in Canada. Signing this document serves as a signal to lenders and contractors that the parties intend to move forward with the transaction. This step allows for an early start on site development, construction, and financing activities prior to the execution of the formal purchase and sale contract.

Summary of Discussions

The LOI serves as a summary of the discussions that have taken place between the vendor and purchaser up to this point. It formally records the preliminary agreements and mutual understandings of the parties regarding the transaction.

Vendor Obligations

The vendor is responsible for providing the purchaser with all documentation related to the property. This includes documents concerning any leasehold tenants. These materials must be delivered early enough to give the purchaser adequate time to review them before the closing date.

Purchaser Requirements

Prior to the transaction closing, the purchaser must be satisfied with both the document review and the physical inspection of the property. Additionally, the purchaser must be able to secure sufficient financing to complete the purchase.

Applicability and Format

This LOI template can be used for commercial real estate transactions in any Canadian province or territory (with the possible exception of Quebec). It is available in MS Word format and is intended strictly for properties located within Canada.

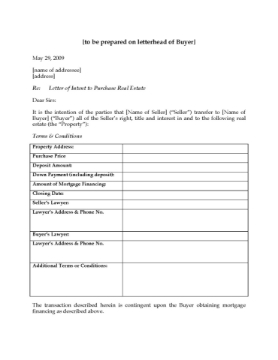

Letter of Intent to Purchase Real Estate | Canada

Put your negotiations for buying a large real estate property in place to secure closing financing with this Letter of Intent form for Canada.

When would I need this Letter of Intent?

When buying a large real estate property for development, there is work that needs to be done or financing that needs to be in place before the transaction is complete. That's when you should put a letter of intent (LOI) in place.

The Letter of Intent indicates to the seller, the lender, contractors and suppliers that you are committed to complete the deal. The LOI outlines the conditions that the buyer and seller have negotiated and are willing to put in writing.

Conditional Purchase

The purchase would be conditional upon the buyer obtaining sufficient mortgage financing to cover the purchase price of the property.

Format and Language

The Letter of Intent template is available as a downloadable and customizable MS Word document. This document can be used anywhere in Canada. English-language version only.

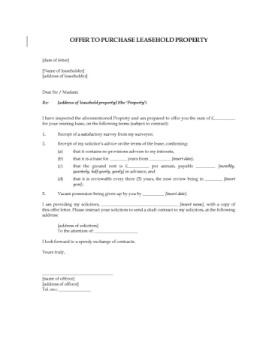

Letter Offer to Purchase Leasehold Property | UK

Make an Offer to Purchase a Leasehold Property with this free template form for the United Kingdom.

- The Offer to Purchase sets out the terms on which the offer is being made, including confirmation from the offeror's solicitor regarding the terms of the lease.

- The offer is conditioned upon receipt of a satisfactory survey of the property.

- This free offer letter is available in MS Word format and is easy to download, fill in and print.

- Intended for use only in the United Kingdom.