Products tagged with 'business leasing form'

Sort by

Display per page

Michigan Commercial Triple Net Lease Agreement

Lease office or retail space to a business tenant with this Commercial Triple Net Lease Agreement for Michigan.

- A triple net lease means that the tenant pays for everything to do with the premises, including structural repairs.

- The tenant has the option to renew the lease for an additional term.

- The tenant will pay all expenses, taxes, and charges levied against the premises, except for the landlord's income taxes.

- The tenant must carry adequate fire and extended coverage insurance.

- The tenant is responsible for all alterations, improvements, maintenance and repairs to the premises.

- Provisions for abatement of rent or termination of the lease the event of damage, destruction, or condemnation of the building.

- The tenant accepts the lease subordinate to any mortgage or other lien.

- Available in MS Word format.

- Intended to be used only in the State of Michigan.

$34.99

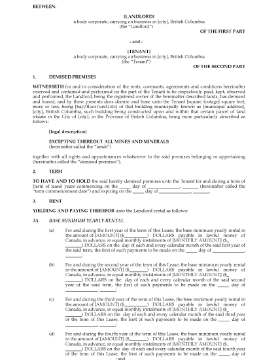

British Columbia Commercial Triple Net Lease Agreement

BC landlords, rent out office or retail premises to a tenant with this Commercial Triple Net Lease Agreement for British Columbia.

What is a triple net lease?

This lease is a triple net lease carefree to the lessor (landlord). This means that the lessee (tenant) is responsible for paying all costs and expenses associated with the leased premises, except for the landlord's income taxes.

Key Features of the Lease

- The tenant has an option to renew the lease for an additional term.

- The base minimum yearly rent will be adjusted for each year of the lease term.

- The tenant is responsible for carrying fire and extended coverage insurance.

- Clauses outlining abatement of rent or termination of the lease the event of damage, destruction, or condemnation of the building.

- The tenant accepts the lease subordinate to any mortgage or other lien.

- The tenant must provide an estoppel certificate on request by the landlord.

Indemnification of Landlord

The tenant indemnifies the landlord against all liabilities, claims, damages, demands and actions arising from the tenant's breach or nonperformance under the lease. The landlord will not be liable for any loss or injury suffered by any person on the premises at any time.

Format and Use of Document

The document template is available in MS Word format and is fully editable to meet your particular circumstances. It is intended to be used only in the Province of British Columbia, Canada.

$37.99

Deed of Lease for Commercial Property | New Zealand

NZ landlords, lease office or retail space to a business tenant with this template New Zealand Deed of Lease for Commercial Property.

- Expiry.The Deed of Lease includes a right to renew, but if the tenant does not renew the lease and continues to occupy the space after the expiry of the tenancy, the lease becomes month to month.

- Rent Review. The document sets out a mechanism for current market rent reviews.

- Outgoings and GST. The tenant is responsible for paying service charges for the premises and a proportionate share of outgoings for the building, as well as any GST payable on the lease or the outgoings.

- Maintenance. The tenant is responsible for the care and maintenance of the leased premises.

- Insurance. The landlord must insure the building for full replacement and reinstatement insurance or indemnity to full insurable value on the premises.

- Guarantee. The guarantor guarantees performance of the tenant's obligations and indemnifies the landlord against claims.

- Car Park. Provisions for rental of the car park.

- Sublets. This Deed of Lease form can also be used for subleases.

- Schedules. The file includes a copy of Article 11 of the First Schedule of the Arbitration Act 1996.

- This lease contract template is fully editable and can be easily customised to meet your needs.

- Intended for use only within New Zealand.

$31.99

Alberta Standard Form Commercial Lease

Rent out office or retail business premises in Alberta to a tenant with this Standard Form Commercial Lease Agreement.

- The tenant has the option to renew the lease after the initial term expires.

- The lease template contains alternate paragraphs depending on whether the landlord is responsible for mechanical and structural repairs, or if the tenant is responsible for all repairs.

- The lease also contains alternate paragraphs for payment of the property taxes, depending on whether the landlord or the tenant will be paying the taxes.

- The tenant agrees not to register the lease against title to the property, but has the right to register a caveat so long as the tenant discharges the caveat at the end of the lease.

- The landlord is not responsible for death or injury to persons on the premises, or for any loss or damage of personal property. The tenant indemnifies the landlord against any claims or actions arising from the lease or the tenant's use of the premises.

- This legal form is intended for use only in the Province of Alberta, Canada.

$29.99

Ontario Standard Form Commercial Lease

Rent out office or retail premises in Ontario to a business tenant with this Standard Form Commercial Lease Agreement.

- The three parties to the lease are the landlord, the tenant, and an indemnifier (typically, a principal of a corporate tenant) who covenants to perform all of the tenant's obligations and will pay any amounts due under the lease if the tenant defaults.

- The lease contains environmental covenants by both Tenant and Landlord.

- Landlord will provide heat, ventilation and cooling systems for the premises and the building, electric power sources, and maintenance and repair of same.

- Landlord is responsible for the operation, maintenance and repair of all systems, facilities and equipment necessary for the proper operation of the building in which the premises are located.

- Other provisions of the lease include (among others):

- Landlord and Tenant taxes,

- Landlord and Tenant insurance,

- mutual release and indemnity,

- surrender and holding over,

- Landlord's rights on default.

- Exhibits to the lease include:

- Determination of occupancy costs,

- Rules and Regulations,

- Landlord's and Tenant's Work.

- Available in MS Word format and fully editable to fit your needs.

- Intended to be used only in the Province of Ontario, Canada.

$64.99

Saskatchewan Standard Form Commercial Lease

Rent out office or retail business premises in Saskatchewan to a tenant with this Standard Form Commercial Lease Agreement.

- The tenant has the option to renew the lease after the initial term expires.

- The lease template contains alternate paragraphs depending on whether the landlord is responsible for mechanical and structural repairs, or if the tenant is responsible for all repairs.

- The lease also contains alternate paragraphs for payment of the property taxes, depending on whether the landlord or the tenant will be paying the taxes.

- The tenant agrees not to register its leasehold interest against title to the property, but has the right to register a caveat so long as the tenant discharges the caveat at the end of the lease.

- The landlord is not responsible for death or injury to persons on the premises, or for any loss or damage of personal property. The tenant indemnifies the landlord against any claims or actions arising from the lease or the tenant's use of the premises.

- Available in MS Word format.

- Intended for use only in the Province of Saskatchewan, Canada.

$31.99