CANADA

Raise capital, offer securities by public or private offering, and manage investor relations with these customizable Investor Forms for Canadian businesses.

The Canadian Investor Relations Institute is a national non-profit association whose mandate is to improve the transparency and integrity of the Canadian capital market by advancing the practice of investor relations and enhancing communications between public corporations, investors and the financial community.

Provincial securities regulators such as the Alberta Securities Commission provide information, assistance, forms and advice for issuing corporations, dealers, and investment fund managers.

Sort by

Display per page

Canada Offering Memorandum for Common Shares and Warrants

Make a private placement offering of common shares and share purchase warrants in several Canadian provinces under the terms of this template Offering Memorandum.

- In this example, the securities are being offered for sale in the Provinces of Alberta, British Columbia and Ontario.

- The sale of units must fall within the minimum and maximum number set in the Offering Memorandum.

- The investment is highly speculative and carries a high degree of risk.

- The securities are issued pursuant to applicable exemptions under the securities legislation in the jurisdictions in which the units are being offered for sale.

- There are restrictions on the resale or transfer of the securities.

- The document also contains sample Warrant Certificate, Transfer of Warrants, and Warrant Exercise forms.

This Offering Memorandum for Common Shares and Share Purchase Warrants is only for use in Canada. You can download the digital file immediately after purchase.

$29.99

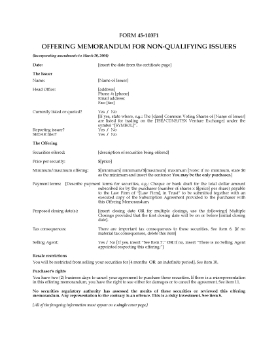

Canada Offering Memorandum for Non-Qualifying Issuers

Use this Form 45-103F1 to prepare an offering memorandum for a non-qualifying issuer in Canada (as defined by Multilateral Instrument 45-102, Resale of Securities).

- A non-qualifying issuer is an issuer which has not filed a current Annual Information Form, regardless of whether or not its securities are listed on a Canadian exchange.

- The template comes with a full set of instructions and examples showing you how to complete each section.

- Also included is a Risk Acknowledgement Form (Form 45-103F3).

- The form has been updated as of March 30, 2004.

If you're a non-qualifying issuer, you should use this Form 45-103F1to issue an Offering Memorandum.

$17.99

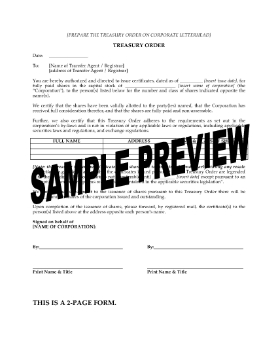

Canada Treasury Order

Instruct a corporation's transfer agent to issue shares with this template Treasury Order form for Canada.

- The Treasury Order is a directive from a corporation to the trust company acting as its transfer agent and registrar.

- The transfer agent is directed to issue fully paid and non-assessable shares to the parties named in the Treasury Order.

- The file also includes a Direction to Cancel form, to cancel shares that were issued in error.

To obtain the Canada Treasury Order form, add it to your shopping cart. Then go through our secure checkout and download the template to your PC or laptop.

$12.49

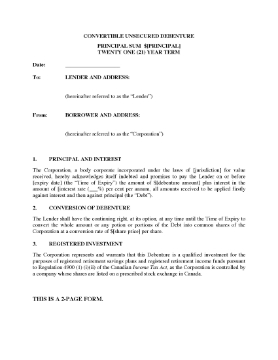

Convertible Debenture Certificate with RRSP and RRIF Eligibility | Canada

Issue debentures to investors and lenders with this Canada Convertible Debenture Certificate with RRSP and RRIF Eligibility.

- The Debenture has a 21-year term.

- This is a qualified investment for RRSP and RRIF funds under the Income Tax Act.

- The Debenture is convertible into shares of the issuing corporation.

- Available in MS Word format.

- Governed by Canadian tax laws and intended for use only in Canada.

$6.29

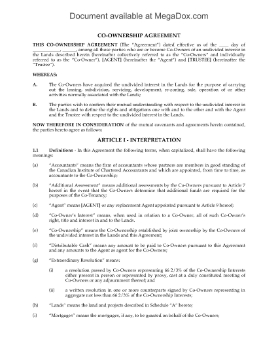

Co-Ownership Agreement for Syndicated Mortgage | Canada

Raise funds to complete a development through the sale of syndicated mortgage interests with this Co-Ownership Agreement for Canadian land developers.

- The agreement is between the various investors (co-owners of undivided interests in the syndicated mortgage), a trustee holding the land and an agent acting on behalf of the co-owners.

- The co-owners grant the agent power to act as attorney on their behalf with respect to leasing, subdividing, rezoning, sale or otherwise dealing with the lands which are subject to the mortgage.

- The mortgaged lands are registered in the name of the trustee, who holds the lands in trust for the co-owners. The co-owners each hold an undivided interest in the lands as tenants-in-common.

- The agent will collect funds under the mortgage on behalf of the co-owners and make distributions to the owners from those funds.

- The agreement provides for meetings of co-owners, and the keeping of books, records and financial information by the agent.

- This form is part of the paperwork required for a syndicated mortgage investment in Canada.

$29.99

Corporate Resolutions re Syndicated Mortgage | Canada

Use these templates to prepare corporate resolutions for a Canadian corporation to make a loan under a syndicated mortgage.

- The resolutions authorize the corporation to:

- lend money to a related corporation (typically a land development company) under the terms of a syndicated mortgage on the lands owned by the borrowing company, and

- enter into a co-ownership agreement with the investors who purchase fractional interests in the mortgage.

- This package of templates is available as a downloadable MS Word file.

- Intended for use only for corporations incorporated in Canada.

$6.29

Demand Debenture Certificate with RRSP and RRIF Eligibility | Canada

Issue debentures to investors and lenders with this Canada Demand Debenture Certificate with RRSP and RRIF Eligibility.

- The debenture certificate is for public companies only.

- The debenture has a 21-year term.

- This is a qualified investment for RRSP and RRIF funds under the Income Tax Act.

- Available in MS Word format.

- Governed by Canadian tax laws and intended for use only in Canada.

$2.29

Form 45-106F12 Risk Acknowledgment for Family, Friend and Business Associate Investors | Canada

Investors who are family, friends or business associates of the issuer must complete this form 45-106F12 when buying shares under an exempt private placement offering.

- This form comprises amendments in Ontario that came into effect on May 5, 2015.

- The investor acknowledges that the investment is risky and that they may lose their entire investment.

- This form can only be used by investors who are:

- a principal of the issuer,

- a family member, business associate or close friend of a majority shareholder, or

- a trust or estate of which all of the beneficiaries or a majority of the trustees or executors are one of the above.

- Available in PDF format.

- This free form is issued by the British Columbia Securities Commission.

$0.00

Information Memorandum for Syndicated Mortgage Transaction | Canada

Prepare an Information Memorandum for a syndicated mortgage investment in Canada with this fully customizable template.

- The offering will be made to Canadian residents who want to invest in the syndicated mortgage. Information contained in the memorandum includes:

- encumbrances which are allowed to be registered against title to the land,

- information relating to the land and the proposed development,

- the corporate history and details of the parties involved (lender, land developer),

- details of the purchase and sale agreement for the land,

- details of the co-owner agreement among all the co-owners

- a warning to investors about the speculative nature of the investment.

- This template is available as a fully editable MS Word document. Intended for use only in Canada.

$17.99

Investor Relations Manager Services Contract | Canada

Hire an investor relations manager to handle your company's dealings with its investors and shareholders with this easy template contract form for Canadian companies.

- The contractor is an independent contractor, not an employee.

- The contract is non-exclusive and the contractor is not required to devote all of his/her time and efforts to providing the services, provided that the contractor does not provide similar services to competitors or customers of the client.

- The fee will be as agreed between the parties, however a minimum monthly fee will be paid regardless.

- The contractor's confidentiality obligations survive the termination of the contract.

- Available in MS Word format and fully customizable.

- Intended to be used only in Canada.

$14.99