Products tagged with 'canada shareholder agreement'

Sort by

Display per page

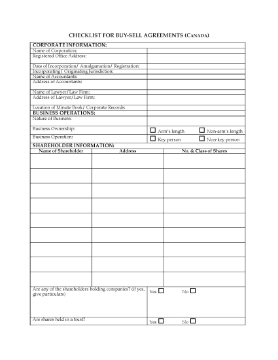

Checklist for Shareholder Buy-Sell Agreement | Canada

Learn how to prepare a Shareholder Buy-Sell Agreement with this checklist for Canadian companies.

- What would happen to your business if one of the owners dies or is no longer able to work? A Shareholder Buy-Sell Agreement provides for continuity of the business in those events.

- Topics included in the Checklist are:

- qualification of shares for capital gains exemption;

- provisions of any existing formal shareholder agreement;

- terms of purchase or redemption (or both) of a deceased shareholder's shares using proceeds of life insurance policies on the life of the deceased;

- whether life insurance policies will be held by the corporation, by the other shareholders or by a trustee.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

$12.49

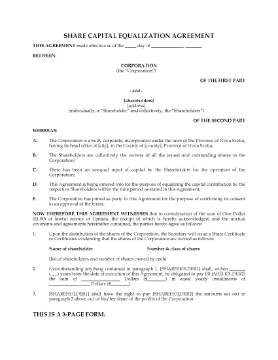

Nova Scotia Share Capital Equalization Agreement

Equalize the capital contributions of each of the shareholders of a Nova Scotia corporation with this Share Capital Equalization Agreement.

- The intent of the Agreement is that both of the shareholders will end up with half of the issued shares.

- The contributing shareholder will make equal yearly instalment payments to the other shareholder for a proportionate number of shares, to bring his/her shareholdings up to 50% of the corporation's issued shares.

- The shares will be held in trust until all payments are made, at which time the additional shares will be released to the contributing shareholder.

- Available in MS Word format, fully editable to fit your specific circumstances.

- Intended to be used only in the Province of Nova Scotia, Canada.

$12.49

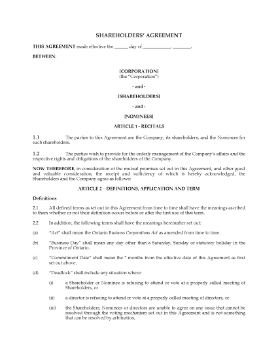

Ontario Unanimous Shareholders Agreement Between Shareholders and Nominees

Shareholder nominees are included under the provisions of this Unanimous Shareholders Agreement for Ontario business corporations.

- Shareholder loans must be secured by a security agreement over the corporation's assets, are non-interest-bearing and become immediately due and payable upon the bankruptcy or receivership of the corporation.

- Clauses providing for employment and termination of shareholders as employees.

- Non-competition and non-solicitation provisions.

- Each shareholder indemnifies the other shareholders and the directors of the corporation against liability.

- All share certificates will be held in escrow by the corporation's lawyers.

- The remaining shareholders have a right of first refusal to purchase the shares of a departing shareholder.

- In the event of a take-over offer, the minority shareholders have the option to buy out a majority shareholder or, alternatively, to consent to the take-over.

- If a shareholder wishes to withdraw, the remaining shareholders must agree on a buy-out procedure, failing which they may vote to wind up the company, sell the shares to a third party, or offer all shares of the company for sale.

- AVailable in MS Word format.

- Intended to be used only in the Province of Ontario, Canada.

$46.99

Shareholder Agreement Guide | Canada

Discover the legal and practical issues you need to consider when entering into a shareholder agreement with this Shareholder Agreement Guide and Checklist for Canadian companies.

- Topics in the Guide include:

- how to avoid misunderstandings between shareholders;

- distribution of profits;

- decision-making;

- exit strategies;

- employee shareholders;

- default by a shareholder;

- disability or death;

- loss of shareholder control.

- Available as a PDF download.

- This checklist was created for use in Canada.

$29.99

Unanimous Shareholder Agreement with License to Use Trade Mark | Canada

Prepare a Unanimous Shareholder Agreement for a Canadian corporation with this fully editable template.

- Under this Agreement, one of the shareholders gives the corporation the right to operate a business as a distributor of certain licensed products, and grants the corporation a license to use its trade marks and other proprietary marks in connection with those products.

- Other provisions of the Agreement include:

- restrictions on the sale and transfer of shares,

- business of the corporation to be conducted by the directors,

- shareholder loans to be repaid on a proportional basis,

- annual valuation of shares, based on the net book value of the company's tangible assets,

- shares of a deceased shareholder to be repurchased for cancellation by the company,

- departing shareholders have a put option,

- non-competition provisions,

- buy-sell provisions for selling the interest of a departing shareholder.

- Available in MS Word format.

- Governed by Canadian laws and intended to be used only in Canada.

$39.99

Triggering Events for Share Sales in Shareholder Agreements

Learn about the types of events which trigger a sale of shares under a Unanimous Shareholder Agreement, and the methods used to implement the sale.

- Triggering events include:

- right of first refusal;

- default buy-sell;

- shotgun or forced sale;

- transfer on death.

- Available as a PDF download.

$0.00