Products tagged with 'estate planning form'

Sort by

Display per page

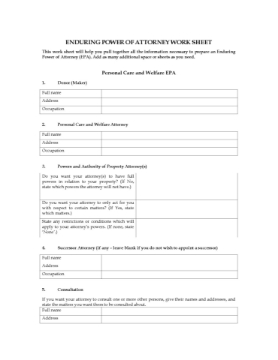

Enduring Power of Attorney Work Sheet | New Zealand

NZ residents, use this free Work Sheet to put together the information you will need to prepare an Enduring Power of Attorney.

- The work sheet can be used for both a Personal Care and Welfare EPA and a Property EPA.

- The form can be used by you and your spouse or partner, and by other adults in your family.

- Available as a free downloadable MS Word document.

- Intended for use only in New Zealand.

$0.00

Nova Scotia Enduring Power of Attorney

Appoint someone you trust to handle your financial affairs with this Nova Scotia Enduring Power of Attorney, under the Powers of Attorney Act.

- Everyone should make a Power of Attorney. It's an essential part of your estate planning.

- The person you appoint as your attorney will have the power and authority to handle your money, assets and property.

- The Power of Attorney does NOT grant your attorney the authority to make medical decisions for you.

- The form includes an Affidavit of Execution for the witness, and notes and instructions to help you understand and complete your Power of Attorney.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

$9.99

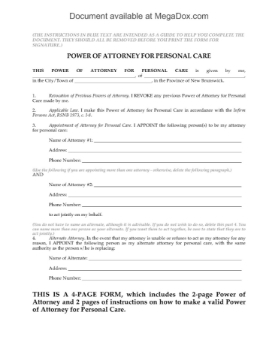

New Brunswick Power of Attorney for Personal Care

Appoint an attorney to make personal care and medical decisions for you with this New Brunswick Enduring Power of Attorney for Personal Care.

- The Power of Attorney is in accordance with the Enduring Powers of Attorney Act.

- This document allows you to appoint someone you trust to make decisions on your behalf in the event that you can no longer do so, with respect to such things as health care, consent for or refusal of medical treatment, nutrition, clothing, hygiene, personal safety, etc.

- This Power of Attorney does NOT grant your attorney authority to manage your finances or property.

- You can place restrictions or conditions on your attorney's powers, if you wish.

- The form includes instructions on how to complete and execute the Power of Attorney to ensure that it is valid, as well as other information about the effect of a Power of Attorney.

- This is a downloadable legal template which is easy to use and understand. For use only in the Province of New Brunswick.

$12.49

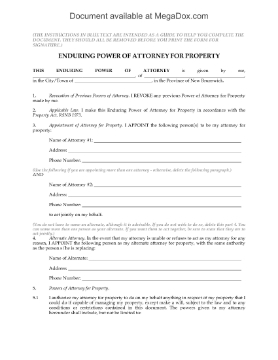

New Brunswick Enduring Power of Attorney for Property

Appoint an agent (attorney) to manage your finances and property in the event that you can no longer do so, with this New Brunswick Enduring Power of Attorney for Property.

- The Power of Attorney is in accordance with the New Brunswick Enduring Powers of Attorney Act and is current to July 2021.

- This document allows you to appoint someone you trust to make decisions on your behalf for issues relating to your property, finances and business affairs.

- The Power of Attorney does NOT grant your agent authority to make health care or personal care decisions for you.

- You can impose conditions and restrictions on your agent's powers as you see fit.

- This is an enduring power of attorney, which means that it will remain in effect even if you are judged mentally incapable at some future time.

- The form includes instructions on how to complete and execute it to ensure that it is valid, as well as additional information on powers of attorney.

- This is a downloadable legal template which is easy to use and understand.

- This form should only be used by New Brunswick residents.

$12.49

Estate Planning Analysis Worksheet

Do you know what the short-term and long-term financial impact would be for the survivor if you or your spouse or partner were to die?

- Use this Estate Planning Analysis Worksheet to help you determine:

- the immediate cash requirements of the surviving spouse / partner,

- ongoing monthly income needs, and

- available assets.

- This Estate Planning Analysis Worksheet should be completed by both you and your spouse or partner.

- It is provided in MS Word format and can be easily downloaded and filled in, either on the computer or by hand.

$0.00

Revocable Trust Deed | Canada

Keep your estate assets out of probate by setting up a living trust under this Revocable Trust Deed form for Canadian residents.

- The trust can be used to hold many kinds of assets including cash, real property, personal property, stocks and bonds.

- The trustees can use cash held in the trust fund to pay taxes, mortgage payments, maintenance and other costs associated with any real estate properties that form part of the trust assets.

- The beneficiaries can use and enjoy any real property held in trust until the division date (i.e. the date on which the trust assets are distributed and the trust is wound up).

- The trustees are authorized to divide and distribute any share of the trust in order to ensure that taxable capital gains required to be paid by the trust are kept to a minimum.

- The trustees are given specific instructions for handling payments to be made to minor beneficiaries or beneficiaries who are incapacitated.

- Trustees must disclose any potential conflict of interest and refrain from voting on any decisions which may put them in a position of conflict.

- The trustees are indemnified and held harmless against claims and losses arising from their acting in good faith as a trustee.

- This is a revocable trust which can be revoked by the trustees in their discretion.

- The package includes:

- a Consent of Trustee form which should be signed by each trustee and successor trustee at the time they accept the appointment,

- a Resolution of the Trustees to establish the trust,

- a Trustees Register.

- Available in MS Word format.

- The Trust Deed template can be used in most provinces and territories of Canada. Some jurisdictions, such as Quebec, may require a French translation.

$49.99