Financial

Create paperwork for your financial transactions and do your tax planning with these downloadable legal documents from MegaDox.com.

- Download customizable and reusable templates for lending, borrowing, and collecting money.

- We offer easy-to-use documents and information to help you manage your debt, accounts payable and receivables.

- Protect your assets and lower your taxes with effective tax planning strategies.

- Download template mortgages, bills of sale, loan agreements, promissory notes, and supporting documentation.

- Find information and forms to help you with retirement and succession planning.

Jurisdictions Covered

MegaDox.com carries financial contracts, forms and documents for buyers and sellers, lenders and borrowers in various countries, including Canada, the United States, Australia, United Kingdom, New Zealand, Mexico, China and India.

Browse through our catalog of professionally prepared documents.

Access a comprehensive library of professional, well-written documents that are affordable, reusable, and fully editable.

These forms are not AI-generated. They were prepared and vetted by financial professionals.

MegaDox.com offers instant access and flexible purchasing options.

- Instantly download forms that can be easily customized to fit your specific requirements.

- There is no subscription required—pay as you go, purchase only the documents you need when you need them.

- All forms are reusable. Buy once, use as often as required.

- Monthly, half-yearly, and annual subscription options are available on request.

Statement of Amount Owing on Mortgage | Canada

Download this free Statement of Amount Owing on Mortgage for Canadian mortgage lenders.

- This form is typically used when a mortgaged property is being sold and the mortgage is being paid out from the sale proceeds.

- The Statement sets out the principal and interest amounts owing up to the date of the statement, with a per diem thereafter, and the terms of repayment.

- This is a free downloadable MS Word document.

- Intended for use only in Canada.

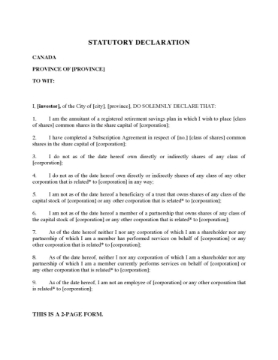

Statutory Declaration by Investor re RRSP Eligibility of Investment | Canada

Investors in an RRSP-eligible investment in Canada must provide this Statutory Declaration as part of the required documentation.

- This form of Declaration would be used by an investor purchasing shares in a Canadian corporation pursuant to a private placement offering.

- The declaration is required for the purpose of putting the investment through the investor's Registered Retirement Savings Plan (RRSP).

- Available in MS Word format. Re-usable and customizable.

- Intended to be used only in Canada.

Subordination Agreement

Get an existing creditor to allow a new lender's security to take priority under this short-form Subordination Agreement.

- The secured creditor agrees to subordinate its security interest in a borrower's personal property (inventory, equipment, accounts, book debts) to the new lender's security interest.

- The Agreement is being signed as an inducement for the new lender to provide loan financing or credit facilities to the borrower.

- This is a generic legal form which can be used in many countries.

- Available as a downloadable MS Word document.

Subordination Agreement (long form)

Prepare a Subordination Agreement between two lenders with this long form template.

- The purpose of the Subordination Agreement (also called a Postponement Agreement) is to induce a new lender to extend a loan to a borrower.

- One lender (postponing creditor) agrees to subordinate and postpone its security interest under a loan agreement or similar instrument to the interest of a second lender (senior creditor) until the indebtedness owing to the senior creditor has been satisfied.

- If the borrower's assets are distributed among its creditors, the indebtedness owing to the senior creditor would be paid out first, before distribution to any other creditors.

- If the borrower is not in default under its obligations to the senior creditor, it may continue to make payments to the postponing creditor in accordance with the terms of the agreement.

- If the borrower is in default under its obligations to the senior creditor, no payments on the subordinated indebtedness shall be made by the borrower. If the postponing creditor receives any such payments, it must pay them over to the senior creditor.

- This generic Subordination Agreement is provided in MS Word and is fully editable to meet your needs.

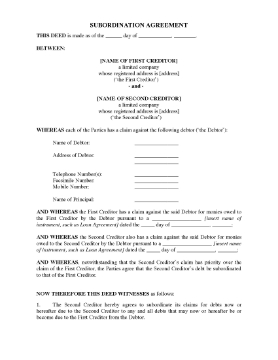

Subordination Agreement | UK

This simple short-form Subordination Agreement can be used by lenders anywhere in the United Kingdom.

- The Agreement is between two creditors who have both provided lending or credit facilities to the debtor.

- The second creditor agrees to subordinate its claims against the debtor to the claims of the first creditor.

- The subordination covers the whole amount of the creditor's secured and unsecured claims, and is for an unlimited duration.

- This form is provided in MS Word format. It is customisable and easy to use.

- Intended to be used only in the United Kingdom.

Subscription Form for Warrant Shares | Canada

Prepare a Subscription Form for Warrant Shares with this easy template form for Canada.

- The shares will be issued to a warrant holder exercising his/her warrants according to the terms of the Warrant Indenture.

- The warrant holder must complete the Subscription Form and send it to the corporation along with the purchase price for the shares.

- This form is available as a downloadable and fully editable template.

- Intended for use only in Canada.

Succession Planning 101 - Building Success Into Your Succession Plan

Plan for the future of your business with this 8-page guide entitled Succession Planning 101 - Building 'Success' Into Your Succession Plan.

Sooner or later illness, death or old age will force you to either pass on your business or wind it up. But most owner managers have no succession plan in place and no plans to make one.This expert guide walks you through the basics of succession planning. Topics include:

- events that trigger a succession crisis,

- various succession planning options, including passing the business on to family members, senior management, or outsiders,

- common mistakes and pitfalls,

- a checklist for doing it right.

Get expert advice with this valuable guide, written by a lawyer who specializes in succession planning.

Succession Planning and the Family Business

Every family business should have a succession plan in place.

This article will help you identify the issues to consider when planning your succession plan / exit strategy so that you can retire and pass on your business to the next generation.

Why does a family business need a succession plan?

This article by the Harvard Business Review discusses the reasons why family business owners need to design a transition plan to avoid tension, discord and disruption to business operations.

Topics Discussed

The topics covered in "Succession Planning and the Family Business" include:

- Examining the reasons for leaving the business to a specific family member.

- The most common mistakes in crafting a family-based succession plan.

- Determining what is best for succeeding generations.

- Tips for creating a successful succession plan.

Author Credit

This expert guide was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.

Tennessee Contract for Deed

Selling a real estate property in Tennessee but the buyers can't qualify for mortgage financing? You can finance all or part of the purchase price with this Contract for Deed.

- A Contract for Deed is also known as a purchase money mortgage or installment purchase contract.

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At your option, the balance can be repaid by monthly payments with or without interest until paid, or by monthly payments with interest for a fixed number of payments and a final balloon payment at the end.

- The form is in MS Word format and is fully editable to fit your exact circumstances.

- Intended to be used only in the State of Tennessee.

Tennessee Deed of Trust

Transfer title of a real estate property in Tennessee from a seller to a trustee with this Tennessee Deed of Trust form.

- A Deed of Trust can be used in place of a mortgage in the sale and purchase of real estate (other than agricultural farm land).

- Title to the property is conveyed by the seller to a trustee instead of to the purchaser. The trustee holds the title as security for performance of the purchaser's obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the purchaser (borrower) defaults in payment, the balance becomes due and payable and the trustee may sell the property.

- The Deed of Trust contains uniform covenants regarding payments, funds for taxes and insurance, prior mortgages, hazard insurance, occupancy as principal residence, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- The borrower waives all homestead exemptions or other statutory right or redemption in the property that he/she may be entitled to under State law.