Products tagged with 'limited partnership form'

Sort by

Display per page

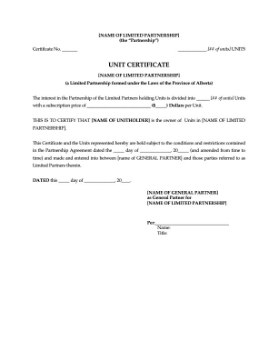

Alberta Certificate for Limited Partnership Units

Use this free template to prepare a Unit Certificate representing ownership of partnership units in an Alberta limited partnership.

- The form is available in MS Word format and can be used as a template to issue a certificate for each subscription for units.

- Easy to edit to fit your needs.

- Intended to be used only in the Province of Alberta, Canada.

$0.00

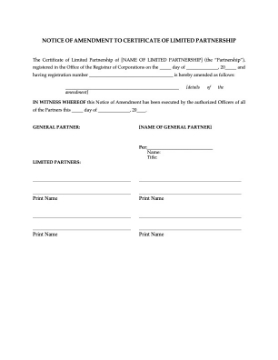

Alberta Notice of Amendment to Certificate of Limited Partnership

Give notice to interested parties of an amendment to the Certificate of Limited Partnership for an Alberta partnership with this free form.

- This form is available in MS Word format and is fully editable.

- Fill in the details, print, sign and send.

- Intended to be used only in the Province of Alberta, Canada.

$0.00

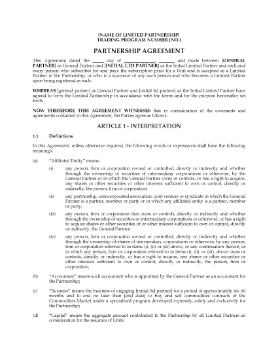

Alberta Limited Partnership Agreement for Buying and Selling Commodities Contracts

Set up an Alberta partnership for buying and selling commodities contracts with this Limited Partnership Agreement template.

- The partnership is being formed for the sole purpose of buying and selling commodities contracts.

- If the capital account drops below 50% of the aggregate capital contributions of the limited partners, the business will end immediately and the partnership will sell all of its commodities contracts.

- The limited partners do not have the authority to manage the partnership, or to execute contracts on its behalf or bind it in any way.

- Each limited partner grants the general partner a power of attorney to execute and register documents on their behalf with respect to establishing and eventually dissolving the partnership.

- If any partner defaults in payment of any amount which he has agreed to pay, the general partner may sell the defaulting partner's units to raise funds to remedy the default.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$39.99

Offering Memorandum for Limited Partnership Units | Canada

You can do a private placement of limited partnership units as a tax shelter under the provisions of this Offering Memorandum for Sale of Limited Partnership Units.

- The investment will qualify as a tax shelter, in accordance with the Income Tax Act (Canada).

- Any investment in the units should be considered as very risky, and should only be undertaken by investors who are financially able to risk losing their entire investment.

- The offering is made pursuant to certain exemptions under the applicable securities legislation in the jurisdictions in which the shares are being offered for sale.

- There are certain restrictions on the resale or transfer of the securities.

- The template contains a section on income tax consequences of investing in a tax shelter investment under the shelter provisions of the Income Tax Act.

- Available in MS Word format.

$29.99

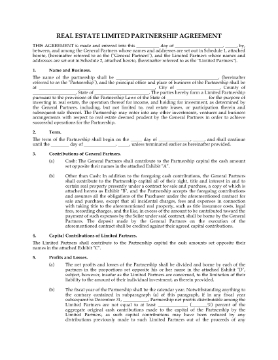

Real Estate Limited Partnership Agreement | USA

Create a limited partnership for purchasing investment real estate properties in the USA under this Real Estate Limited Partnership Agreement.

- In addition to cash contributions to capital, the general partners will contribute to the partnership certain real estate property under a contract for purchase and sale.

- The partnership assumes all of the purchaser's obligations under this contract, except for the payment of costs associated with the purchase transaction, which will be paid by the general partners.

- Partnership profits and losses will be distributed among or borne by the partners in proportion to their capital contributions.

- Proceeds from the sale of any property or asset held by the partnership will be allocated among the partners in amounts equal to their cash contributions, and a portion of the balance allocated proportionately among the partners in proportion to their capital contributions.

- None of the partners will receive a salary or be entitled to draws for services rendered on behalf of the partnership.

- No Limited Partner shall have the right to substitute an assignee as contributor in his place.

- This template is provided in MS Word format, and is easy to download, edit with your specific details, and print.

- This legal form is governed by the laws of the United States.

$19.99