Mortgage Forms

Before you lend money to someone to buy real estate, secure the loan with these downloadable, customizable Mortgage Forms.

According to Wikipedia.com, the word 'mortgage' is French for 'death contract'. As ominous as that may sound, it merely means that the charge against the land which was created by the mortgage ends (dies) when the debt that it secures is paid or, alternatively, if the property is foreclosed.

Few individuals or businesses can afford to buy real estate without getting a loan to fund the purchase. Because the amount being borrowed is so high, the only collateral of sufficient value that can adequately secure the repayment of the debt is the property itself.

Kansas Fixed Rate Mortgage

Kansas mortgage lenders can easily prepare a fixed rate mortgage on a residential property with this downloadable digital template.

- The mortgage form contains the uniform covenants required by U.S. federal laws.

- The template also includes State-specific provisions for acceleration on default, release of the mortgaged premises when the debt is satisfied, and waiver of redemption.

- The mortgage is collateral security to a home loan agreement and promissory note.

- Available in MS Word format.

- Intended for use only in the State of Kansas.

Kentucky Fixed Rate Mortgage

Place a mortgage on a residential property in Kentucky with this Fixed Rate Mortgage form.

This Kentucky Fixed Rate Mortgage form enables borrowers to place a mortgage on a residential property. The form is specifically designed to comply with both federal and state laws, providing a reliable and standardized approach for securing a loan.

Legal Provisions

The mortgage form incorporates uniform covenants, which align with applicable federal law. In addition, it contains important provisions required under Kentucky law, including terms for acceleration of the loan, release or satisfaction of the mortgage, waiver of homestead rights, tax obligations, and protective advances. These provisions ensure the mortgage agreement is comprehensive and compliant with laws.

Loan Security

This mortgage creates a security interest for the lender in connection with a mortgage loan and the associated promissory note. By executing this form, the borrower agrees to use the property as collateral to guarantee repayment of the loan.

Template Availability and Usage

The Fixed Rate Mortgage form is available as a downloadable legal template in MS Word format. The template is intended for residential mortgage transactions within the Commonwealth of Kentucky.

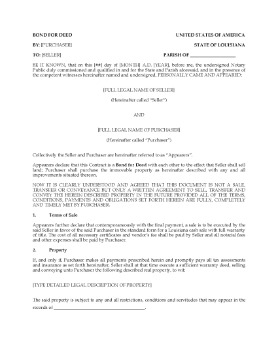

Louisiana Bond for Deed

If you are selling a real estate property in Louisiana, you can assist the buyer by carrying part or all of the purchase price with this Bond for Deed (also known as a land contract or purchase money mortgage).

- The Bond for Deed is not a sale contract or a transfer. It's basically an agreement to sell, meaning that the property will be conveyed to the buyer once all the terms and conditions have been fulfilled.

- In essence, the seller takes the place of a mortgage lender by allowing the buyer to pay off the purchase price of the real estate property over time.

- Once the final payment is made, the seller will provide the buyer with an executed warranty deed to transfer ownership of the property to the buyer.

- If the buyer fails to make the payments as set out in the agreement, the seller is entitled to keep all payments made and to take possession of the property. The seller is also entitled to keep all improvements made to the property by the buyer.

- This is a MS Word template form and is fully editable to fit your exact circumstances.

- Intended for use only in the State of Louisiana.

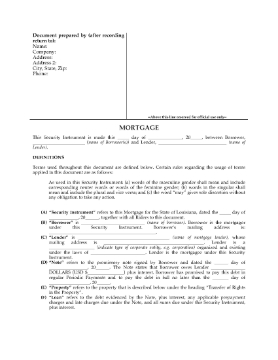

Louisiana Fixed Rate Mortgage

This Fixed Rate Mortgage template is for residential home loans in the State of Louisiana.

- Acceleration of the mortgage if the borrower defaults.

- Borrower's right to reinstate after acceleration.

- Lender's right to commence foreclosure proceedings after acceleration.

- Appointment of a keeper after seizure.

- Cancellation after payment in full of the mortgage loan.

- Waiver of homestead rights.

- Inclusion of servitude and component parts under the mortgage.

- Modification of certain provisions for community-owned property.

- Available in MS Word format.

- Intended to be used only in the State of Louisiana.

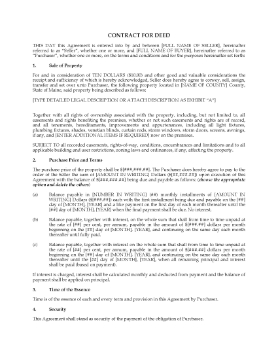

Maine Contract for Deed

If you are selling a real estate property in Maine, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or land installment contract).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- This Contract for Deed form is available in MS Word format and is fully editable to fit your exact circumstances.

- Intended to be used only in the State of Maine.

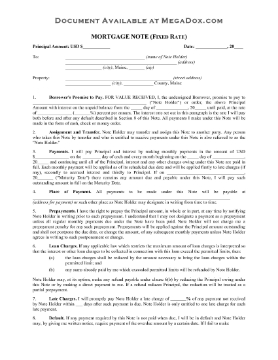

Maine Fixed Rate Mortgage Note

A promissory note is part of every mortgage transaction. Fill in the details and have the borrower sign this Fixed Rate Mortgage Note for the State of Maine.

- The terms of the Note require the borrower to repay the loan by making monthly payments of principal and accrued interest.

- If on the maturity date there remains any amount outstanding, the borrower will pay the balance in full at that time.

- As the note holder, you (the lender) have the right to demand repayment of the entire outstanding balance of the loan, plus interest, if the borrower defaults in making payments.

- This is an easy-to-use legal form template drafted in plain English in accordance with the Maine plain language law.

- To download the Fixed Rate Mortgage Note, add it to your cart and pay for it. You'll have instant access to the form.

Maine Mortgage Deed

Register a mortgage loan on a real estate property in the State of Maine with this Mortgage Deed form.

- The Mortgage Deed sets out the total amount of the loan, the interest rate, and the amount of the payments to be made by the borrower.

- The form references the statutory condition set out in MRS Title 33, Section 769, and a copy of the statutory condition is included for your convenience.

- This is a digital download in MS Word format.

- Intended to be used only in the State of Maine.

Maryland Contract for Deed

If you are selling a real estate property in Maryland, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- This Contract for Deed form is available in MS Word format and is fully editable to fit your exact circumstances.

- Intended to be used only in the State of Maryland.

Maryland Deed of Trust

Transfer a Maryland real estate property from a seller to a trustee with this downloadable Deed of Trust form.

- Maryland is a "Deed of Trust state" and typically, a Deed of Trust is used instead of a mortgage loan to finance the purchase of real estate.

- Title to the property is conveyed by the seller to a trustee instead of to the purchaser. The trustee holds the title as security to ensure that the purchaser makes the loan payments on time and honors its obligations under the loan.

- If the purchaser defaults, the balance of the loan becomes immediately payable and the trustee may sell the property to satisfy the debt.

- The Deed of Trust contains uniform covenants regarding payments, funds for taxes and insurance, prior mortgages, hazard insurance, occupancy as principal residence, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- Available in MS Word format.

- Intended to be used only in the State of Maryland.

Massachusetts Contract for Deed

This Massachusetts Contract for Deed form offers buyers and sellers an alternative to traditional mortgage financing for the purchase of a residential property.

- The seller basically takes on the role of the mortgage lender, and the buyer makes monthly payments against the purchase price.

- Interest accrues on the unpaid balance.

- If the buyer defaults in making payments or in performing its other obligations under the contract, the seller must serve notice of the default with a date by which the breach must be cured.

- If the breach is not cured within the allotted time, the seller can retake possession of the property. All of the payments made by the buyer would then be forfeited.

- The template is available in MS Word format.

- Intended to be used only in the Commonwealth of Massachusetts.