Products tagged with 'ohio property tax form'

Sort by

Display per page

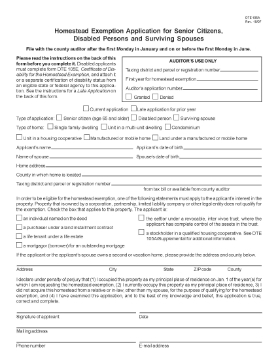

Ohio Homestead Exemption Application DTE 105A

Apply for a reduction in your property taxes with this free Ohio Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses.

- The home owner can apply to have the appraised value of his/her primary residence reduced by $25,000 with a corresponding savings in property taxes.

- The form must be completed and submitted to the county auditor.

- The exemption application form can only be used by seniors (age 65 or older), disabled persons, or the surviving spouse of a homeowner.

- The application for exemption can be made for single family dwellings, units in a multi-unit building, condominiums, cooperatives, manufactured and mobile homes.

- This is a free PDF form DTE 105A provided by the Ohio Department of Taxation. Click the link to download the form from their website.

$0.00

Recently viewed products