Products tagged with 'plain language legal form'

Sort by

Display per page

New York Mortgage - Plain Language

Place a mortgage on a residential property in New York with this plain-language standard form.

- The mortgage form contains both uniform covenants pursuant to federal laws, and additional provisions for foreclosure and sale, and the borrower's promise to comply with Section 13 of the New York Lien Law.

- The document is written in accordance with the New York Plain English Law.

- This is a downloadable legal template which can be used for single family or multi-unit dwellings.

- Intended for use only in the State of New York.

$17.99

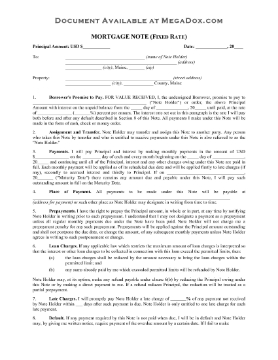

New York Fixed Rate Mortgage Note

Prepare a Fixed Rate Promissory Note for a mortgage loan with this downloadable template for New York State.

- This Note provides for monthly payments of principal and interest.

- If there is any amount still outstanding on the maturity date, the borrower agrees to pay the full balance owing.

- If the borrower defaults in any payments, the note holder has the option to demand repayment of the entire outstanding balance of principal and interest.

- The borrower promises to pay the note holder's costs of enforcing the note, including attorneys' fees.

- This is a plain language legal form which is governed by the laws of the State of New York.

$6.29

Virginia Fixed Rate Note

This template is a fixed rate Promissory Note signed by a borrower in connection with a loan secured by the borrower's property. The form is for loans in Virginia.

- In addition to the Note, the borrower will execute a Deed of Trust, transferring the title deed to a trustee until the loan is repaid.

- The borrower will make monthly payments on the outstanding balance of the loan.

- If the borrower defaults in making the payments, the note holder has the right to accelerate the loan and demand repayment of the entire loan balance in 30 days.

- The borrower also promises to pay the note holder's costs in enforcing the Note, including reasonable attorneys' fees.

- The Virginia Fixed Rate Note is prepared in plain language so it is easy to understand.

$6.29

Wisconsin Fixed Rate Mortgage Note

Wisconsin mortgage lenders can prepare a promissory note for a mortgagor to sign with this template Fixed Rate Mortgage Note.

- The borrower will repay the loan by making monthly payments against the principal balance, plus accrued interest.

- If on the maturity date there is still a balance outstanding, the borrower will pay the entire balance at that time.

- The note holder has the right to accelerate the loan if the borrower defaults in making payments, and the entire loan balance will become due and payable.

- This is a downloadable legal form template written in plain English so it is easy to understand.

- Intended to be used only in the State of Wisconsin.

$6.50

Maine Fixed Rate Mortgage Note

A promissory note is part of every mortgage transaction. Fill in the details and have the borrower sign this Fixed Rate Mortgage Note for the State of Maine.

- The terms of the Note require the borrower to repay the loan by making monthly payments of principal and accrued interest.

- If on the maturity date there remains any amount outstanding, the borrower will pay the balance in full at that time.

- As the note holder, you (the lender) have the right to demand repayment of the entire outstanding balance of the loan, plus interest, if the borrower defaults in making payments.

- This is an easy-to-use legal form template drafted in plain English in accordance with the Maine plain language law.

- To download the Fixed Rate Mortgage Note, add it to your cart and pay for it. You'll have instant access to the form.

$6.29