Products tagged with 'probate form'

Sort by

Display per page

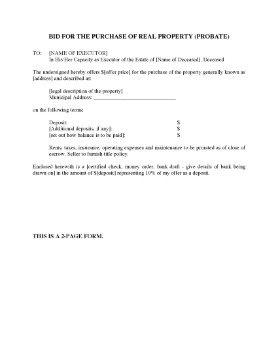

California Real Property Bid Form

Submit a bid to purchase real property from an estate in probate with this template form for California.

- When completed, the form should be submitted to the Superior Court, County of San Bernardino.

- Terms of all sales are cash.

- The Public Guardian has the right to refuse any bid.

- This is a fillable PDF form.

- Includes Terms of Sale by Order of Public Guardian-Conservator.

- Intended to be used in San Bernardino County, State of California.

$0.00

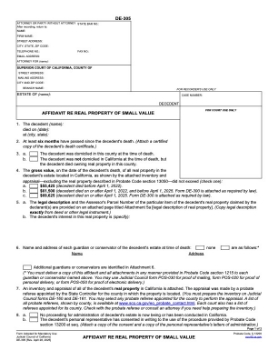

California Affidavits for Release of Estate Property without Probate

Prepare Affidavits to release the property of a deceased person without probate with this package of template California forms.

- If you are acting as executor of an estate in California which is not going through probate or administration, you will require affidavits from the beneficiaries under the Will before you can release property to them.

- This package contains:

- Affidavit re Real Property of Small Value (Form DE-305), rev. April 28, 2025.

- Affidavit Under Probate Code S. 13101 (Probate Affidavit), rev. 2015.

- Affidavit for Collection of Personal Property, to transfer property such as bank accounts, stocks or items held in safe deposit boxes, rev. Jan. 1, 2020.

- Available in PDF format.

- Intended to be used only in the State of California.

$0.00

Washington Community Property Survivorship Affidavit

This Community Property Survivorship Affidavit can be used by any resident of Washington State whose spouse is recently deceased.

Purpose of Survivorship Affidavit

Washington is a community property state. If both spouses jointly hold title to the home as community property and one spouse dies, this Affidavit form must be recorded with the County Recorder's Office in order to get the title insurance transferred to the surviving spouse.

Contents of Affidavit

The person making the affidavit must be the rightful successor to the title to the property. They must attest that:

- that the property is subject to a community property agreement which was recorded with the County Recorder,

- that no probate proceedings have begun for the deceased spouse's will,

- that no personal representative has been reported,

- that the community property agreement is still in effect, and

- that there are no unpaid debts or liabilities of the decedent, including funeral expenses.

Format and Jurisdiction

This Community Property Survivorship Affidavit is a downloadable MS Word document. It is intended for use only in the State of Washington.

$1.99

California Affidavit of Surviving Spouse

File this California Affidavit of Surviving Spouse if you and your spouse owned property which was NOT held as community property before he or she passed away.

- The Affidavit is made under California Probate Code section 13540.

- The surviving spouse states that he/she and the deceased spouse at all times considered the property to be community property.

- The Affidavit must be filed 40 days after the decedent's death to protect the interest of your successors in title and that of other parties with an interest in the property (such as title insurers).

- The affiant must also attest that no election to probate the deceased's interest in the property has been or will be filed.

- Available in MS Word format.

- Intended to be used only in the State of California.

$6.29

Nevada Deed Upon Death Forms Package

Avoid probate of your real estate upon your death by recording a Deed Upon Death with the appropriate County in the State of Nevada.

- This package contains two forms:

- Deed Upon Death form, and

- Revocation of Deed Upon Death form to cancel the transfer.

- Even though you are transferring the title deed into the beneficiary's name, you will still have rights to the property for as long as you live. That means you can deal with the property in any way you like, without having to get the permission or consent of the beneficiary.

- These are downloadable legal forms which you can fill in and sign in front of a Notary.

- Intended to be used only in the State of Nevada.

$6.29