Products tagged with 'purchase and sale of controlled land'

Sort by

Display per page

Offer to Purchase Controlled Land | Canada

Buy farm land in Canada for development with this Offer to Purchase Controlled Land.

- Controlled land means land that falls outside of the boundaries of a city, town, village or summer village (for example, farm land).

- This type of Offer is often used by a developer to purchase land adjacent to city limits for future development.

- The vendor warrants that it is not aware of any proposed expropriation of the land.

- The vendor has not received notice of any circumstance which might affect the zoning or use of the land.

- The vendor is not aware of any environmental issues affecting the land.

- The vendor will transfer title to the land over to the purchaser, on trust conditions, to allow the purchaser to secure mortgage financing in order to complete the sale.

- This legal form is not province-specific and can be used in many regions in Canada with minimal changes.

$17.99

Alberta Foreign Ownership Declaration Form 1

This Foreign Ownership Declaration Form 1 is to be used by Canadian citizens and permanent residents of Canada when they purchase an interest in controlled land in Alberta.

- 'Controlled land' is land that lies outside of municipal boundaries, such as farm land.

- A foreign ownership declaration must be completed and filed by every beneficial owner of controlled land in the Province of Alberta.

- The form is available in MS Word format and can be completed either by hand or on a computer and filed with the Foreign Ownership of Land Administration office.

- Access the free form from Service Alberta through the link provided.

$0.00

Alberta Foreign Ownership Declaration Form 2

Canadian corporations purchasing an interest in controlled land in Alberta must file this Foreign Ownership Declaration Form 2 for Corporations that are Not Foreign Controlled.

- Controlled land is any land that does not fall within the boundaries of a municipality, such as farm land, but does not include crown land or mineral rights.

- Every beneficial owner of controlled land in the Province of Alberta is required to file a Foreign Ownership Declaration.

- This Form 2 is to be used only by corporations that have a majority of voting shareholders who are either Canadian citizens or permanent residents of Canada.

- You can access the fillable PDF directly from Service Alberta through the link provided.

$0.00

Alberta Foreign Ownership Declaration Form 3

This Form 3 Foreign Ownership Declaration must be filed by all non-Canadians, non-permanent residents and foreign controlled corporations when they purchase an interest in controlled land in the Province of Alberta.

- The Land Titles Act defines controlled land as land in Alberta that does not include crown lands (excluding land held by the Public Trustee), land within the boundaries of a city, town, village or summer village, and mines and minerals.

- A foreign ownership declaration must be completed and filed by every beneficial owner of controlled land in the Province of Alberta. This Form 3 Declaration is for persons who are either not Canadian citizens or are not normally resident in Canada, and for corporations in which a majority of the voting shares are held by non-Canadians.

- The form is a Microsoft Word template which can be completed either by hand or on a computer and filed with the Foreign Ownership of Land Administration office.

- You can access the fillable PDF directly from Service Alberta by using the link provided.

$0.00

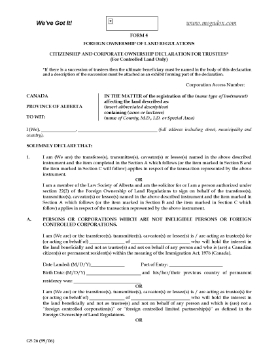

Alberta Foreign Ownership Declaration Form 4 (Trustees)

Any trustee who holds an interest in controlled land in Alberta on behalf of another party must file this Form 4 Foreign Ownership Declaration.

- Any person, firm or corporation who owns an interest in controlled land in the Province of Alberta must file a foreign ownership declaration, in accordance with the Land Titles Act.

- Controlled land refers to any land which falls outside of municipal boundaries (i.e. it is not part of the land owned by a city, town, village or summer village).

- This Form 4 must be filed by any person who will be acting as a trustee in holding the interest in trust for or on behalf of another party.

- You can access the fillable PDF directly from Service Alberta through the link provided.

$0.00