Products tagged with 'united states trust form'

Sort by

Display per page

Revocation of Revocable Living Trust Deed | USA

Terminate a living trust with this free Revocation Form for US-based trusts.

- This revocation form can only be used to collapse a revocable trust. By its very nature, an irrevocable trust cannot be revoked.

- The grantor (the person who set up the trust) has the authority to wind up the living trust.

- The grantor gives directions to the trustee to return all remaining trust property to the grantor.

- The trustee's appointment as trustee is revoked once the trust property has been returned.

- Available in MS Word format.

$0.00

Amendment to Living Trust for Charitable Gift | USA

Amend your Revocable Living Trust to make a charitable gift with this downloadable template form for USA trusts.

- This Amendment lets you gift some of the trust property to a charity or non-profit organization.

- You can change the original Trust Agreement giving the trustee instructions to make the charitable gift.

- This template is only for trust agreements made in the United States.

- The form is provided in MS Word format and is easy to fill in and print.

$6.29 $5.99

Receipt for Trust Assets and Discharge of Trustee | USA

Terminate a trust and discharge the trustee with this Receipt for Trust Assets and Discharge of Trustee form for the USA.

- The beneficiaries of the trust must sign the form.

- The receipt portion of the form states that all of the trust property has been distributed to the beneficiaries.

- The trustee is discharged from his/her duties as trustee following the distribution.

- The form is available in MS Word format.

- Intended to be used only for trusts established in the United States.

$2.49

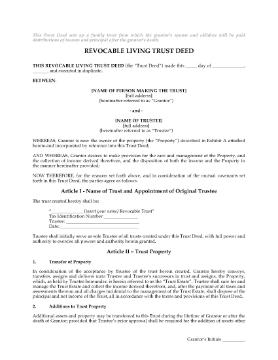

Revocable Living Trust Deed for Family Trust | USA

Protect your assets and avoid probate proceedings by placing your estate property into a family trust with this USA Revocable Living Trust Deed.

- This Trust Deed sets up a family trust from which the grantor's spouse and children will be paid distributions of income and principal after the grantor's death.

- During the grantor's lifetime, the trustee will pay the income and principal of the trust to the grantor as the grantor directs, or failing any instructions, as the trustee sees fit.

- The grantor will act as the original trustee of the Trust.

- If the grantor becomes unable to manage his/her affairs, the trustee may pay the trust income and principal to the grantor's spouse and/or children.

- On the grantor's death, his/her tangible personal property is to pass to his/her spouse, or if the spouse has predeceased, in equal shares per stirpes to the children.

- The trust estate is protected against claims, encumbrances, pledge or seizure as the result of any act of a beneficiary.

- On the death or incompetency of the grantor, the grantor's spouse or, alternatively, a majority of the grantor's children have the power to remove the trustee and appoint a successor.

- Available in MS Word format.

- Intended to be used only in the United States.

$29.99