UNITED STATES

Document a loan to a borrower with these customizable Loan Transaction Forms for US lenders.

Q. Why do I need to do paperwork for a loan to a family member or a friend?

A. No matter who you're lending money to, you need to document the loan and charge simple interest on the principal amount. If you don't document the loan, you may end up paying gift taxes on the proceeds. And if you don't set an interest rate, the tax department will do it for you and they will charge income tax on interest income you never received.

Q. What interest rate should I charge?

A. Each state has its own legal lending rate, being the highest rate of interest that can be charged on personal loans. They may also have a usury limit, which is a statutory maximum rate of interest. Anything in excess of this rate is deemed to be usury. In states that do not have a usury limit, the federal government may still impose a limit on the interest rate. Late fees or other charges may also be counted as interest.

Revolving Loan Agreement | USA

Provide revolving credit facilities to a corporate borrower under the terms of this Revolving Loan Agreement.

- This is a digital template for lenders in the United States.

- The Loan Agreement allows the borrower to borrow and reborrow funds up to a specified maximum amount.

- The borrower grants the lender a security interest in all of the borrower's assets and proceeds.

- Interest is computed daily and is payable monthly on the last day of the month.

- The loan may be paid out in whole or in part at any time without penalty.

- Available as a downloadable and fully editable MS Word document.

Security Agreement | USA

Every commercial loan transaction should require the borrower to sign a Security Agreement. Use this customizable downloadable template.

- This form is only for use in the United States.

- The borrower (debtor) grants the lender (secured party) a security interest in certain property of the borrower, as collateral to secure repayment of the borrower's indebtedness under a promissory note.

- The parties intend the agreement to be a security agreement under the Uniform Commercial Code.

- The secured party has the right to take whatever action it considers necessary to protect its security interest.

- All amounts secured by the agreement become immediately due and payable if the borrower files for bankruptcy or becomes insolvent.

- The debtor waives any statute of limitations with respect to enforcement of the secured party's lien.

No lender should be without a standard form Security Agreement. If you don't have one yet, download your copy now.

Term Loan Agreement | USA

Write up a Term Loan Agreement for a borrower using this downloadable template form.

- This customizable legal template is governed by the laws of the United States.

- The borrower has the option to pay all or part of the term loan on any interest payment date, without premium or penalty, provided that a specified minimum prepayment amount is paid.

- The borrower has the option of selecting an interest period of more than one month's duration (up to but not including the next interest payment date).

- If the borrower fails to properly notify the lender, the interest period will automatically be set at one month's duration.

- The borrower may elect to have more than one interest period outstanding at any one time, provided that no interest period extends beyond the maturity date.

- Available in MS Word format.

- Governed by U.S. laws and intended to be used within the United States.

USA Assignment of Rents and Repurchase Agreement

Prepare an Assignment of Rents and Repurchase Agreement as security for a loan with this easy-to-use template form for the United States.

- The borrower (assignor) assigns to the lender the rents due under a lease on a property owned by the borrower, to secure repayment of a loan advanced from the lender.

- The borrower guarantees payment under the terms of the lease, and on default by the tenant, agrees to repurchase the rights assigned to the lender by paying the total unpaid balance of rental payments.

- Buy the form once, use as often as required.

USA Environmental Indemnity Agreement

Any commercial loan transaction which uses business property as security should require an Environmental Indemnity from the borrower, like this template for lenders in the USA.

- The indemnity specifically covers the real property which the borrower is mortgaging as security for repayment of the loan.

- The borrower indemnifies the lender against any claims for environmental contamination of or damage to the property or from any violation of federal, state or local environmental regulations.

- The liability of the borrower as indemnitor will survive the repayment of the loan in perpetuity.

- The form can be used anywhere in the United States.

Protect against expensive and onerous legal claims. Download the Environmental Indemnity Agreement for your loans officers.

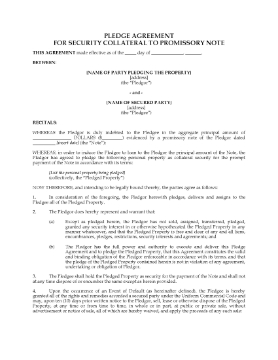

USA Pledge of Security Collateral to Promissory Note

USA lenders who require additional collateral security can have their customers sign this Pledge of Security form as part of the loan documentation package.

- The borrower agrees to pledge personal property for the lender to hold as collateral security to ensure repayment of a loan under a promissory note.

- If the borrower defaults in payment, the lender has all the rights and remedies of a secured party under the Uniform Commercial Code, and has the right to sell, lease or dispose of the property as it sees fit.

- Once you have purchased the form, you can customize it for your business and use it over and over. There are no additional licensing or restocking fees.