UNITED STATES

Rent out your vacation property, cabin, cottage or home with these ready-made short-term rental forms for the United States.

In order to maximize the tax benefits available for vacation properties, there are certain minimum and maximum limits for the number of days you can use the property for personal use in order to make sure that it is considered an investment property for tax purposes. If you exceed those limits, your vacation home is treated as a personal residence and that reduces the amount you can claim for utilities, repairs, taxes and depreciation.

Before you rent your property out, talk to your accountant to find out how the vacation home tax laws apply to your situation. It could result in significant tax savings for you.

Sort by

Display per page

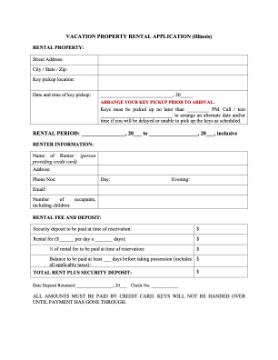

Illinois Vacation Property Rental Application Form

Take applications from prospective renters for your Illinois vacation home with this Vacation Property Rental Application.

- Before they rent your lakeside cottage, cabin or summer house, have your potential guests fill out this form. When completed, the Application Form will contain the following information:

- Rental period desired (based on availability).

- Amount of deposit required and paid (as of the application date).

- Number of persons in the applicant's party.

- Length of stay.

- This is a downloadable template which you can customize to meet your needs.

- Prepared for use in the State of Illinois.

$0.00

Recently viewed products