Investor Forms

Raise venture capital, manage investor relations and keep investors informed with these contracts, notices and legal forms.

If your company has outside shareholders and investors, you should delegate someone to handle investor relations. This person should be fluent in the language of finance, and have good communication and marketing skills. He or she must also keep current on all securities laws and regulations that apply to your company, and knowledgeable in the areas of compliance, reporting and fiduciary duty.

Most securities commissions provide information and seminars, and there are national organizations in many countries which hold training courses and ongoing informational sessions for investor relations officers.

Sort by

Display per page

Angel Investors in Canada: Structuring Deals That Work

What are angel investors? Find out with this insightful expert guide.

- Angel investors are independent investors who may demand a level of participation and control in return for their investment.

- The guide discusses the special issues that may arise in such situations, such as what the advantages are of bringing angel investors into your company.

- Learn how to balance the deal favorably for both the investor and the business.

- Angel Investors: Structuring Deals That Work is available in PDF format, and is geared toward companies seeking investors in Canada.

$0.00

California Loan Servicing and Tenancy in Common Agreement

Use this downloadable template to create a Loan Servicing and Tenancy in Common Agreement as part of an offering of fractional undivided interests in a promissory note.

- The agreement is between the investors (lenders) and a loan servicer who has arranged the loan between the lenders and the borrower.

- The servicer is acting as agent for the investors with respect to the promissory note, and no other relationship exists between the parties.

- The borrower will make all payments on the note to the servicer.

- The servicer will provide each lender with monthly statements and with the appropriate tax forms at the end of each year.

- The servicing fees will be paid monthly and will be calculated as a percentage of the principal balance outstanding at that date.

- If a foreclosure of the property is necessary and the servicer is required to manage the property, an additional property management fee will be charged.

- The servicer has the right to hold back a reserve sufficient to pay two months interest payments.

- If an investor fails to pay its pro rata share of any assessment within 10 days of request, that investor's right to receive principal and interest payments will be subordinated to the rights of all investors who have paid their share.

- This is a comprehensive legal form that you can tailor to your specific requirements.

- Intended to be used only in the State of California.

$29.99

California Offering Circular for Fractional Loan

This California Offering Circular contains the details of an offering of fractional undivided interests in a promissory note.

- The promissory note is secured by either a first mortgage or by other promissory notes secured by other collateral.

- The circular should be provided to any potential investors who may want to purchase interests.

- The document describes the fractional interests, the particulars of the loan and the loan servicing.

- The compensation being paid to the loan servicer and affiliates is disclosed, as are any conflicts of interest.

- The issuer must disclose any risks, ERISA and federal tax considerations with respect to the investment.

- Available in MS Word format.

- Intended to be used only in the State of California.

$35.00

Canada Offering Memorandum for Common Shares and Warrants

Make a private placement offering of common shares and share purchase warrants in several Canadian provinces under the terms of this template Offering Memorandum.

- In this example, the securities are being offered for sale in the Provinces of Alberta, British Columbia and Ontario.

- The sale of units must fall within the minimum and maximum number set in the Offering Memorandum.

- The investment is highly speculative and carries a high degree of risk.

- The securities are issued pursuant to applicable exemptions under the securities legislation in the jurisdictions in which the units are being offered for sale.

- There are restrictions on the resale or transfer of the securities.

- The document also contains sample Warrant Certificate, Transfer of Warrants, and Warrant Exercise forms.

This Offering Memorandum for Common Shares and Share Purchase Warrants is only for use in Canada. You can download the digital file immediately after purchase.

$29.99

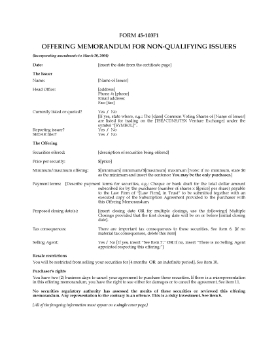

Canada Offering Memorandum for Non-Qualifying Issuers

Use this Form 45-103F1 to prepare an offering memorandum for a non-qualifying issuer in Canada (as defined by Multilateral Instrument 45-102, Resale of Securities).

- A non-qualifying issuer is an issuer which has not filed a current Annual Information Form, regardless of whether or not its securities are listed on a Canadian exchange.

- The template comes with a full set of instructions and examples showing you how to complete each section.

- Also included is a Risk Acknowledgement Form (Form 45-103F3).

- The form has been updated as of March 30, 2004.

If you're a non-qualifying issuer, you should use this Form 45-103F1to issue an Offering Memorandum.

$17.99

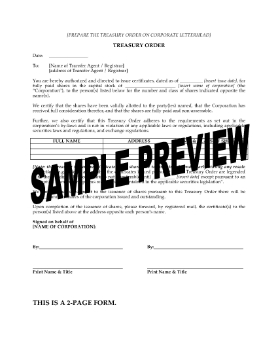

Canada Treasury Order

Instruct a corporation's transfer agent to issue shares with this template Treasury Order form for Canada.

- The Treasury Order is a directive from a corporation to the trust company acting as its transfer agent and registrar.

- The transfer agent is directed to issue fully paid and non-assessable shares to the parties named in the Treasury Order.

- The file also includes a Direction to Cancel form, to cancel shares that were issued in error.

To obtain the Canada Treasury Order form, add it to your shopping cart. Then go through our secure checkout and download the template to your PC or laptop.

$12.49

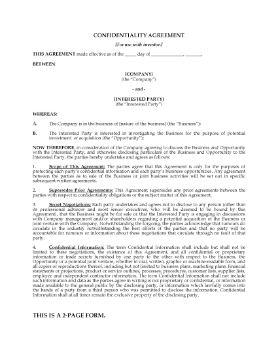

Confidentiality Agreement for Investors

Potential investors want to know all about your business before they decide to put money into it. Before you divulge your sensitive information, get them to sign this Confidentiality Agreement.

- You can use this form anytime you are in discussions regarding a potential acquisition or investment in the company.

- The Agreement template includes a no solicitation clause, under which the investor agrees not to solicit either your customers or employees.

- This is a generic legal form that can be used anywhere.

- Don't risk the loss of trade secrets or proprietary information. Download the Investor Confidentiality Agreement for your business.

- Available in MS Word format.

$12.49

Convertible Debenture

Issue debentures as security for funding with this downloadable Convertible Debenture template.

- The Debenture is issued by a corporation to a lender as security for a commercial loan.

- The Debenture is convertible into shares in the capital of the corporation at any time prior to the repayment of the principal amount of the loan (but not including any accrued but unpaid interest).

- This is a generic legal form which is not specific to any country, state or province.

- The Convertible Debenture template is fully editable and can be easily customized to meet your needs.

$12.49

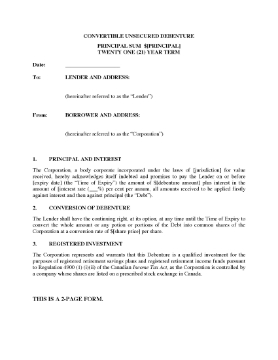

Convertible Debenture Certificate with RRSP and RRIF Eligibility | Canada

Issue debentures to investors and lenders with this Canada Convertible Debenture Certificate with RRSP and RRIF Eligibility.

- The Debenture has a 21-year term.

- This is a qualified investment for RRSP and RRIF funds under the Income Tax Act.

- The Debenture is convertible into shares of the issuing corporation.

- Available in MS Word format.

- Governed by Canadian tax laws and intended for use only in Canada.

$6.29

Co-Ownership Agreement for Syndicated Mortgage | Canada

Raise funds to complete a development through the sale of syndicated mortgage interests with this Co-Ownership Agreement for Canadian land developers.

- The agreement is between the various investors (co-owners of undivided interests in the syndicated mortgage), a trustee holding the land and an agent acting on behalf of the co-owners.

- The co-owners grant the agent power to act as attorney on their behalf with respect to leasing, subdividing, rezoning, sale or otherwise dealing with the lands which are subject to the mortgage.

- The mortgaged lands are registered in the name of the trustee, who holds the lands in trust for the co-owners. The co-owners each hold an undivided interest in the lands as tenants-in-common.

- The agent will collect funds under the mortgage on behalf of the co-owners and make distributions to the owners from those funds.

- The agreement provides for meetings of co-owners, and the keeping of books, records and financial information by the agent.

- This form is part of the paperwork required for a syndicated mortgage investment in Canada.

$29.99