Real Estate Forms

Are you buying or selling real estate? When you purchase one of our template Real Estate Forms, you get a convenient ready-made product that saves you money on costly legal fees.

- Standardized forms for residential or commercial real estate property.

- Downloadable, customizable, fill-in-the-blank templates.

- Country, state, and province specific legal forms.

- Offers, real estate purchase and sale contracts, For Sale by Owner packages.

- Title deeds and conveyancing forms.

- Realtor and broker listing contracts.

- Forms updated regularly to comply with changes to laws and regulations.

California Quitclaim Deed

Transfer title to a real estate property in California from one person to another with this easy-to-use Quitclaim Deed.

- Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

- This form is provided in MS Word format and is easy to download, fill in and print.

- Intended for use only in the State of California.

California Quitclaim Deed from Two Persons to One Person

Transfer title to a California real estate property from two persons to one person with this easy-to-use Quitclaim Deed form.

What Is a Quitclaim Deed?

A Quitclaim Deed is a legal instrument through which the property owner (transferor) conveys their ownership of a property to a different owner (transferee). The transferor does not offer any warranties regarding the property’s title, condition, or any other aspect. A Quitclaim Deed simply transfers whatever interest the transferor holds at the time of execution.

Common Uses

This type of deed is frequently used in situations where a straightforward transfer of ownership is needed, such as removing one spouse’s name from the title following divorce proceedings. It is particularly useful when the parties do not require extensive guarantees.

Form Features

The California Quitclaim Deed form is available in Microsoft Word format. It can be easily downloaded, filled in with the required information, and printed for use, making the process simple and convenient for users.

Jurisdiction

This Quitclaim Deed is governed by the laws of California and should only be used for properties located in that State.

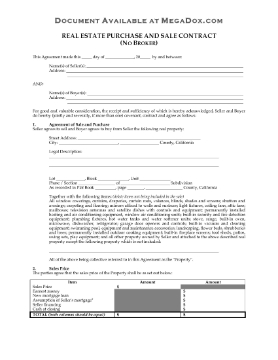

California Real Estate Contract (No Broker)

This Purchase and Sale Contract is for real estate sales in California which do not involve a broker (e.g. a For Sale by Owner transaction).

This template can be used in transactions:- where the buyer is obtaining new mortgage financing, including FHA and VA loans,

- where the buyer is assuming the seller's mortgage loan,

- where the buyer is paying cash, and

- where the seller is financing part of the sale price.

This California Real Estate Purchase and Sale Contract (No Broker) is downloadable, easy to use, and can be edited wherever necessary to reflect your particular circumstances.

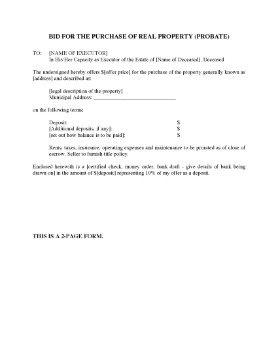

California Real Property Bid Form

Submit a bid to purchase real property from an estate in probate with this template form for California.

- When completed, the form should be submitted to the Superior Court, County of San Bernardino.

- Terms of all sales are cash.

- The Public Guardian has the right to refuse any bid.

- This is a fillable PDF form.

- Includes Terms of Sale by Order of Public Guardian-Conservator.

- Intended to be used in San Bernardino County, State of California.

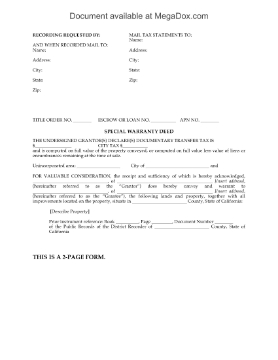

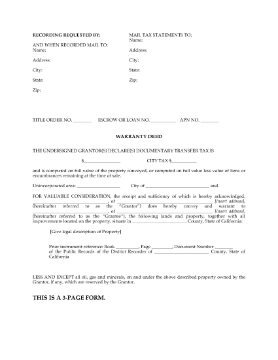

California Special Warranty Deed

Transfer title for a California real estate property to a new owner with this downloadable California Special Warranty Deed form.

- Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.

- Title is transferred subject to current taxes and assessments, easements, encumbrances, liens and liabilities.

- Special warranty deeds are often used by executors and trustees to transfer estate property to a beneficiary.

- This form is a downloadable legal document in MS Word format.

- Intended for use only in the State of California.

California Substitution of Trustee

Replace the original trustee named in a previously recorded Deed of Trust with this California Substitution of Trustee form.

- The form sets out the name and contact information for the replacement trustee.

- The new trustee must sign the form to acknowledge the appointment.

California Trust Transfer Deed

Transfer California real estate into a trust under Section 62 of the Revenue and Taxation Code with this California Trust Transfer Deed.

- This form of grant deed is excluded from Reappraisal under Proposition 13, and the grantor declares that no consideration has been paid for the transfer.

- This is a downloadable and fully editable legal form.

- Available in MS Word format.

- Intended to be used only for property located in the State of California.

California Warranty Deed

Transfer a California real estate property from a seller to a buyer with this easy-to-use California Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

Closing Settlement Statement | USA

Use this free Closing Settlement Statement to adjust amounts due from the buyer and seller in a real estate sale.

- The Statement sets out any final adjustments to be made for taxes, special assessments, closing costs, legal fees and realtor commissions.

- The buyer and seller complete the form jointly, and each one certifies that the information they have given is true and correct.

- It can be completed either by hand or on the computer.

- The form can be used in any State.

- Download the free USA Closing Settlement Statement and fill in the blanks, then print it for signature.

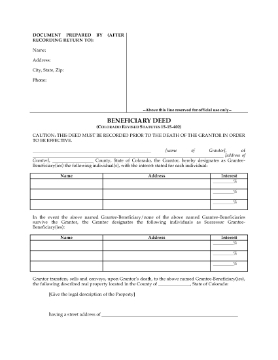

Colorado Beneficiary Deed Forms

Make sure your real estate property passes to the beneficiary you choose when you die with these Colorado Beneficiary Deed forms.

- You must complete, sign and record the beneficiary deed (also called a Transfer on Death Deed) with the County Recorder's Office during your lifetime. It cannot be recorded after your death.

- Even though the title is transferred to your beneficiary, you still retain ownership rights over the property and you can deal with it as you see fit without the consent of the beneficiary.

- You can revoke the transfer at any time by recording the enclosed Revocation of Beneficiary Deed.

- Note that in Colorado, executing a Beneficiary Deed means your home is no longer an exempt resource for Medicaid and you run the risk of losing Medicaid.

- The Colorado Beneficiary Deed Forms are downloadable MS Word templates.