Real Estate Forms

Are you buying or selling real estate? When you purchase one of our template Real Estate Forms, you get a convenient ready-made product that saves you money on costly legal fees.

- Standardized forms for residential or commercial real estate property.

- Downloadable, customizable, fill-in-the-blank templates.

- Country, state, and province specific legal forms.

- Offers, real estate purchase and sale contracts, For Sale by Owner packages.

- Title deeds and conveyancing forms.

- Realtor and broker listing contracts.

- Forms updated regularly to comply with changes to laws and regulations.

Sort by

Display per page

Receipt for Non-Refundable Deposit | USA

Issue a receipt for a non-refundable deposit to a property buyer with this free downloadable form for U.S. real estate transactions.

- The deposit will be applied toward the purchase of the property.

- The seller agrees to remove the property from the market until the balance of the purchase price is paid.

- The buyer acknowledges that the deposit is non-refundable and will be retained by the seller as damages if the buyer cannot complete the transaction.

- Available in MS Word format.

- Intended to be used only within the United States.

$0.00

Restrictive Covenant for Trees and Shrubs | Canada

Register a Restrictive Covenant for the planting of trees and shrubs in a residential subdivision with this customizable template for Canadian land developers.

- The Restrictive Covenant sets out the restrictions governing the height, appearance, pruning and removal of trees and shrubs in the subdivision being developed on the land.

- The restrictions run with the land, and the rights of the developer under the covenant will transfer to the new owners of the lots as they are developed and sold.

- This form is a downloadable MS Word template and can be easily edited to fit your circumstances.

- Intended for use only in Canada.

$6.29

Restrictive Covenant on Subdivision Lots | Canada

Draw up a Restrictive Covenant governing the use, development and appearance of lots in a residential subdivision with this customizable template for Canadian developers.

- The Restrictive Covenant will be registered on the title for all residential lots in the subdivision.

- Development is restricted to one detached single family dwelling on each lot, and accessory buildings such as garages, sheds, etc.

- Mobile homes and modular structures are not allowed.

- No building may be moved onto a lot, and all buildings must be constructed on site, from new materials.

- The developer must give approval for all buildings, fences, and other structures.

- The restrictive covenant runs with the land, and the rights of the developer under the covenant will transfer to the new owners of the subdivision lots as they are developed and sold.

- This legal document template is available in MS Word format and can be easily edited to fit your circumstances.

- Intended to be used only in Canada.

$17.99

Rhode Island Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in Rhode Island from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Rhode Island Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Rhode Island Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Rhode Island Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in Rhode Island from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Rhode Island Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Rhode Island Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

Rhode Island Special Warranty Deed

Transfer ownership of a RI real estate property with this easy-to-use Rhode Island Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This Rhode Island Special Warranty Deed form is a downloadable legal document in MS Word format.

$6.29

Rhode Island Warranty Deed for Joint Ownership

Transfer ownership of a RI real estate property from two sellers to two buyers with this Rhode Island Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

$6.29

Right of First Refusal to Purchase Property | Canada

Prepare a Right of First Refusal to purchase a real estate property with this ready-made template for Canada.

- The owner of the real estate (the grantor) grants another party (the grantee) an irrevocable right of first refusal to purchase the property.

- The right cannot be revoked and will not expire until the grantee exercises the right to purchase or, alternatively, decides to waive its rights.

- This downloadable legal form is available in MS Word format and is fully editable.

- Governed by the laws of Canada.

$17.99

Saskatchewan Declaration of Residency

Download this free Saskatchewan Declaration of Residency forms for real estate sales in Saskatchewan.

- If you are the vendor of the real estate property, you will need to provide the purchaser with the Declaration of Residency in order to fulfill the residency requirement of the Income Tax Act (Canada).

- This is a free form provided in MS Word format.

- For use in the Province of Saskatchewan, Canada.

$0.00

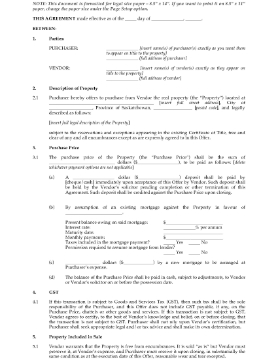

Saskatchewan Offer to Purchase Residential Real Estate

Make an offer to buy a residential property in Saskatchewan with this Offer to Purchase Residential Real Estate.

- GST. The purchaser is responsible for paying any GST payable on the purchase of the property.

- Conditions Precedent. The offer is conditional upon the purchaser obtaining mortgage financing and a satisfactory home inspection report.

- Condominiums. If the property is a condominium, the seller must provide the purchaser with condominium documents (estoppel certificate, bylaws, etc).

- Binding on Acceptance. Upon acceptance by the seller, the offer will form a legally binding contract between the parties for the purchase and sale of the real estate property.

- The form includes a Property Disclosure Statement to be completed by the seller, as required by provincial law.

- Available as a Microsoft Word file, and is fully editable to fit your circumstances.

- Intended to be used only in the Province of Saskatchewan, Canada.

$17.99

Recently viewed products