Legal Forms

MegaDox.com has the legal forms, contracts, agreements, deeds and court forms you need to handle your business and personal affairs with confidence.

Our platform provides access to a wide variety of downloadable legal documents, ensuring you have the right tools for any situation.

Jurisdictions Covered

MegaDox.com carries contracts and legal forms specifically tailored for:

- Canada, including provincial and territorial forms

- United States, including state-specific forms

- Australia, including state and territorial forms

- New Zealand

- United Kingdom, including country-specific forms

- China

- India

- Mexico.

Build Your Library of Professional Documents

- Access a comprehensive library of professional legal documents that are affordable, reusable, and fully editable.

- These forms are not AI-generated. They have been written and vetted by legal professionals.

Instant Access and Flexible Purchasing

- Instantly download forms that are designed to meet your specific needs, whether for business agreements or personal matters.

- There is no subscription required—simply pay as you go and purchase only the documents you need.

- Subscription options are available on request.

Ideal for a Range of Users

Our legal forms offer an economical and efficient solution for legal practitioners, entrepreneurs, self-employed freelancers, and SMBs. These do-it-yourself forms are ideal for individuals looking to save money while ensuring legal compliance.

Find a Lawyer Feature

In addition to providing legal forms, our platform allows you to locate lawyers in your area with our Find A Lawyer feature, connecting you with qualified professionals for additional support when needed.

No AI-Generated Forms

None of the forms you find on MegaDox.com were generated using AI tools. Each legal document template has been written and vetted by legal professionals.

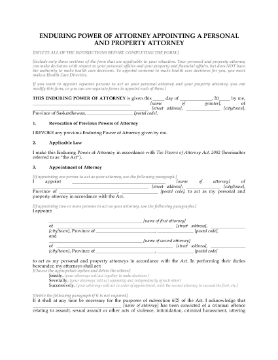

Saskatchewan Enduring Power of Attorney for Personal and Property Attorney

Make an Enduring Power of Attorney Appointing a Personal and Property Attorney with this template form for Saskatchewan residents.

- The Enduring Power of Attorney allows you to choose someone as your personal and property attorney, to make lifestyle decisions for you and to look after your property and financial affairs if you are unable to do so, whether due to absence, illness or incapacity.

- You can name the same person to fill both roles, or different people to handle personal decisions and property decisions. You can appoint more than one person as your attorney, to act jointly or separately, as you direct.

- A personal attorney can make decisions about where you live, your social activities, what sort of education or training you receive, and any other powers you decide to give him/her, but CANNOT make health care decisions for you.

- The Power of Attorney form includes a Legal Advice and Witness Certificate, and a Non-Lawyer Witness Certificate (if required).

- The form also includes information about making a Power of Attorney and instructions on how to complete the form.

- The Enduring Power of Attorney form is available in Microsoft Word format. Fully editable and easy to use.

- For use only in the Province of Saskatchewan, Canada.

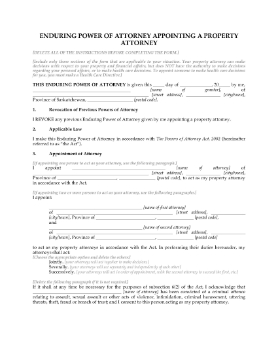

Saskatchewan Enduring Power of Attorney for Property Attorney

Saskatchewan residents, make an Enduring Power of Attorney Appointing a Property Attorney with this template form.

- The Enduring Power of Attorney allows you to choose someone as your property attorney, to look after your property and financial affairs if you are unable to do so, whether due to absence, illness or incapacity.

- You can appoint more than one person as your attorney, to act jointly or separately, as you direct.

- A property attorney can run your businesses, manage your money and bank accounts, make investments, buy, sell, lease and manage property, and any other powers you decide to give him/her.

- The Power of Attorney form includes a Legal Advice and Witness Certificate, and a Non-Lawyer Witness Certificate (if required).

- The form also includes information about making a Power of Attorney and instructions on how to complete the form.

- This document does not give your attorney the authority to make personal and lifestyle decisions for you. For that, you need to make an Enduring Power of Attorney - Personal Attorney.

- This legal form is available in Microsoft Word format. Fully editable and easy to use.

- For use only in the Province of Saskatchewan, Canada.

Saskatchewan Estate Planning Package

Prepare your will and plan for the future with this package of estate planning documents for the Province of Saskatchewan.

This package contains the following documents:

- Saskatchewan Power of Attorney for Property Attorney, which lets you name someone you trust to manage your property and financial affairs on your behalf.

- Saskatchewan Power of Attorney for Personal Attorney, which lets you name an agent to make personal care decisions for you.

- Saskatchewan Power of Attorney for Personal and Property Attorney, which lets you name an agent to make both property / financial and personal care decisions for you.

- Saskatchewan Revocation of Power of Attorney form.

- Saskatchewan Advance Health Care Directive, which allows you to give instructions regarding medical treatment and health care decisions and name a proxy to make those decisions for you, in the event you are not able to communicate those instructions at some point in the future.

- Legal will kit for Canada, which includes a will form, a Saskatchewan Affidavit of Execution of Will in accordance with provincial laws, and a comprehensive estate planning questionnaire.

Save over 75% off the regular price of your estate planning documents with this all-in-one downloadable package. The forms can be used by more than one person in your household.

Give yourself and your family the peace of mind that comes with knowing you have made arrangements for future eventualities.

Saskatchewan Immediate Notice to Vacate

Before you can evict your tenants for rent or utility arrears, you must first serve them with this Saskatchewan Immediate Notice to Vacate and Notice of Arrears.

- The form includes instructions for the landlord on how to properly serve the Notice on the tenant(s).

- This form is only to be used if the rent or utilities are over 15 days in arrears.

- This is a free fillable PDF form from the Saskatchewan Office of Residential Tenancies.

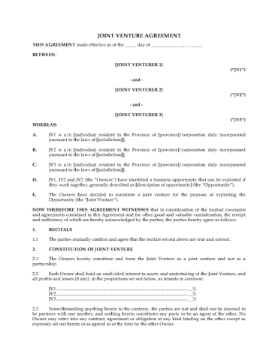

Saskatchewan Joint Venture Agreement

Set up a joint venture with this template Joint Venture Agreement for Saskatchewan.

- One of the co-venturers will manage the joint venture, and will be paid a management fee.

- No co-venturer may transfer their interest without the consent of the other venturers, except upon their death when their interest will automatically pass to their spouse or children.

- Each co-venturer has a right of first refusal and piggyback rights on the interest of the other parties, in the event of a sale or transfer.

- Any co-venturer may exercise a shot-gun (buy-sell) provision with respect to the interest of another co-venturer.

- Available as a downloadable Microsoft Word file which is fully editable to meet your needs.

- Intended to be used only in the Province of Saskatchewan, Canada.

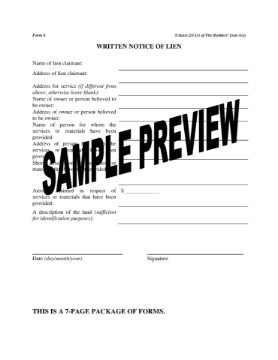

Saskatchewan Lien Claim Forms Package

Preserve your lien rights and file your claims with this Lien Claim Forms Package under The Saskatchewan Builders' Lien Act.

- The package contains the following forms:

- Written Notice of Lien (Form A),

- Certificate of Substantial Performance of Contract (Form C.1),

- Certificate of Substantial Performance of Subcontract (Form C),

- Claim of Lien (Form E).

- This package of forms can be used by both general contractors and subcontractors.

- Available in MS Word format, editable and reusable.

- For use only in the Province of Saskatchewan, Canada.

Saskatchewan Lien Discharge Forms Package

Saskatchewan contractors, if you have received a payment from a client on a construction project, you can release your lien rights with this package of Lien Discharge Forms.

- The package contains the following items:

- Partial Discharge of Lien as it Relates to Amount (Form L),

- Partial Discharge of Lien as it Relates to Land (Form M),

- Discharge of Lien (Form N).

- Purchase and download the MS Word file, then use the forms as often as your business requires. No need to buy multiple copies, no additional fees.

- For use only in the Province of Saskatchewan, Canada.

Saskatchewan Notice of Rent Increase

Saskatchewan landlords, before you can raise the rent on a tenant's rental unit you must with this Notice of Rent Increase.

- Landlords must give 1 year's notice prior to a rent increase.

- Landlords cannot raise the rent within the first 18 months of a new tenancy.

- This is an easy-to-use PDF form and is free to download. Just fill it in and print. You can re-use it over and over.

- Issued by the Saskatchewan Office of Residential Tenancies.

Saskatchewan Notice to Landlord of Tenant Improvements

Saskatchewan contractors, give notice to a landlord that you are supplying labour or materials for a tenant's improvements with this Notice to Landlord form.

Statutory Form

This is Form B, in accordance with clause 31(2)(b) of The Builders' Lien Act of Saskatchewan and the Regulations (B-7.1 Reg 1).

- Part A is the Notice to Landlord, setting out the details of the contract and the improvements.

- Part B is the Endorsement by Landlord, which states that the landlord assumes no responsibility for the improvements.

Format and Source

The form is provided in PDF format. This is the Notice form issued by Publications Saskatchewan.

Saskatchewan Notice to Landlord to Terminate Periodic Tenancy

Give notice that you plan to move out by serving your landlord with this Saskatchewan Form 6 Notice to Landlord to Terminate Tenancy.

- This is a free fillable PDF form provided by the Office of Residential Tenancies.

- It also contains information to help tenants get their security deposit back.

- This form is for periodic tenancies, e.g. month-to-month or week-to-week.

- Just download the PDF, save it and follow the instructions.

- For use only in the Province of Saskatchewan.