Legal Forms

MegaDox.com has the legal forms, contracts, agreements, deeds and court forms you need to handle your business and personal affairs with confidence.

Our platform provides access to a wide variety of downloadable legal documents, ensuring you have the right tools for any situation.

Jurisdictions Covered

MegaDox.com carries contracts and legal forms specifically tailored for:

- Canada, including provincial and territorial forms

- United States, including state-specific forms

- Australia, including state and territorial forms

- New Zealand

- United Kingdom, including country-specific forms

- China

- India

- Mexico.

Build Your Library of Professional Documents

- Access a comprehensive library of professional legal documents that are affordable, reusable, and fully editable.

- These forms are not AI-generated. They have been written and vetted by legal professionals.

Instant Access and Flexible Purchasing

- Instantly download forms that are designed to meet your specific needs, whether for business agreements or personal matters.

- There is no subscription required—simply pay as you go and purchase only the documents you need.

- Subscription options are available on request.

Ideal for a Range of Users

Our legal forms offer an economical and efficient solution for legal practitioners, entrepreneurs, self-employed freelancers, and SMBs. These do-it-yourself forms are ideal for individuals looking to save money while ensuring legal compliance.

Find a Lawyer Feature

In addition to providing legal forms, our platform allows you to locate lawyers in your area with our Find A Lawyer feature, connecting you with qualified professionals for additional support when needed.

No AI-Generated Forms

None of the forms you find on MegaDox.com were generated using AI tools. Each legal document template has been written and vetted by legal professionals.

Utah Lien Waiver and Release on Final Payment

UT contractors, fully release your lien rights on a project with this Utah Waiver and Release of Lien Upon Final Payment.

Statutory Requirements

This Waiver and Release of Lien upon Final Payment form contains the statutory language set out in Utah laws.

State law prohibits a party from waiving its lien rights in the contract before work commences, or prior to payment. All waivers must be accompanied by an endorsed joint payee check which lists a "restrictive endorsement" that meets the requirements set out in the legislation.

Purpose of Waiver and Release

This Waiver and Release authorizes a full and final release of any lien rights, bond rights and payment rights which the claimant may have against the owner's property for labor, services and/or materials furnished for construction or improvements to the property.

The claimant also warrants that they have either paid, or will pay from the final payment, all laborers, subtrades and suppliers.

Waiver Conditional on Payment

The Waiver and Release only becomes effective once final payment has been received and the payment has cleared the claimant's bank.

Format and Jurisdiction

This is a downloadable MS Word document. Buy the form once, and it's yours to use as often as you require.

This Waiver and Release of Lien upon Final Payment template is intended to be used only in the State of Utah.

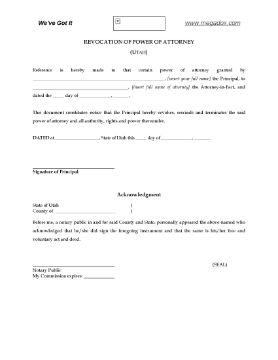

Utah Revocation of Power of Attorney

Cancel your Power of Attorney with this Utah Revocation of Power of Attorney form.

- So long as you have mental capacity and can understand the impact of what you are doing, you have the right to cancel an existing Power of Attorney at any time, and revoke the powers you gave to your attorney-in-fact.

- Once you have signed the form, give a copy of it to the attorney-in-fact.

- You should also give a copy to any bank, trust company, and other firms or people that your attorney has been dealing with on your behalf.

- This is a free downloadable legal form in MS Word format.

- Intended to be used in the State of Utah.

Valuation of Shares Clause for Shareholder Agreement

Make provision for determining the fair market value of shares with this downloadable Valuation of Shares clause for a Shareholder Agreement.

- The clause sets out the process by which the fair market value (FMV) of the shares will be arrived at in the event that the shareholders cannot agree, following a triggering event which has affected the FMV of the shares.

- This form is provided in MS Word format and is fully editable.

- This clause is generic (not country-specific) and can be used in many jurisdictions.

Vermont Conditional Lien Waiver and Release on Final Payment

Vermont contractors, release your lien rights after receipt of final payment on a project with this Conditional Waiver and Release of Lien Upon Final Payment.

- The Waiver and Release authorizes a release of any lien rights or claims for payment which the contractor may have against the owner's property.

- The release is conditioned upon the final payment from the Customer clearing the bank.

- The document also includes a Notice of Completion form.

- This release form should only be used if the contractor has received final payment (except for any disputed amounts).

- The template is available in MS Word format. Pay for the form once, and it's yours to use as often as you need.

- For use only in the State of Vermont.

Vermont Conditional Lien Waiver and Release on Progress Payment

Vermont contractors, release your lien rights up to the date of a progress payment with this Conditional Waiver and Release of Lien Upon Progress Payment.

- The Waiver and Release authorizes a release of any lien rights or claims for payment which the contractor may have for labor, materials or equipment supplied for improvements to a property only for the period specified in the release.

- The release is conditional. It is given on the condition that the progress payment from the Customer clears the bank.

- Pay for the form once, download it, and use it as often as you like.

- This template form is provided in MS Word format and is editable and easy to use.

- Intended to be used only in the State of Vermont.

Vermont General Durable Immediate Power of Attorney

This Power of Attorney is effective immediately and remains in effect even if you become disabled or incompetent. You can choose to give your attorney-in-fact the power to deal with a number of matters, including:

- your real estate property,

- banking and financial transactions,

- stocks and bonds,

- personal property,

- insurance,

- pension and employment benefits,

- tax and legal matters,

- your business affairs and operations.

This Vermont General Durable Immediate Power of Attorney form is available in MS Word format, and is easy to fill in and print. No need to buy additional copies - you and your spouse can each prepare a Power of Attorney with this form.

Vermont General Durable Springing Power of Attorney

A "springing" Power of Attorney becomes effective only if you become incapacitated. You can grant your attorney-in-fact the power to deal with a number of matters for you, including:

- your real estate property,

- banking and financial transactions,

- stocks and bonds,

- personal property,

- insurance,

- pension and employment benefits,

- tax and legal matters,

- your business affairs and operations.

This Vermont General Durable Springing Power of Attorney form is available in MS Word format, and is easy to fill in and print. No need to buy additional copies - you and your spouse can each prepare a Power of Attorney with this form.

Vermont Revocation of Power of Attorney

Cancel your Power of Attorney with this Vermont Revocation of Power of Attorney form.

- So long as you have mental capacity and can understand the impact of what you are doing, you have the right to cancel an existing Power of Attorney at any time, and revoke the powers you gave to your attorney-in-fact.

- Once you have signed the form, give a copy of it to the attorney-in-fact.

- You should also give a copy to any bank, trust company, and other firms or people that your attorney has been dealing with on your behalf.

- This is a free downloadable legal form in MS Word format.

- Intended to be used in the State of Vermont.

Vermont Unconditional Lien Waiver and Release on Final Payment

Vermont contractors, release your lien rights after receipt of final payment on a construction project with this Unconditional Waiver and Release of Lien Upon Final Payment.

- The Waiver and Release authorizes a release of any lien rights or claims for payment which the contractor may have against the owner's property, and indicates that final payment has been made in full.

- A Notice of Completion form is included.

- This release form should only be used when the contractor has received final payment (except for any disputed amounts).

- The form is available in MS Word format. Buy the form once, and it's yours to use as often as you require.

- For use only in the State of Vermont.

Vermont Unconditional Lien Waiver and Release on Progress Payment

Vermont contractors, release your lien rights up to the date of a progress payment with this Unconditional Waiver and Release of Lien form.

- The Waiver and Release authorizes a full and complete release of any lien rights or claims for payment which the contractor may have against the owner's property.

- The release becomes effective upon receipt of a progress payment from the owner or owner's agent.

- The template is provided in MS Word format. Buy the form once, and it's yours to use as often as you require.

- Intended to be used only in the State of Vermont.