Products tagged with 'canadian tax planning form'

Sort by

Display per page

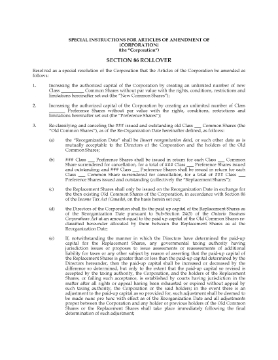

Ontario Section 86 Rollover Resolutions (Fixed Redemption Amount)

Prepare the required corporate resolutions to reorganize an Ontario corporation's share capital with this Section 86 Rollover Resolutions Package.

- These documents are required for a rollover with a fixed redemption amount, under s. 86 of the Income Tax Act (Canada).

- The package contains:

- Special Resolution with instructions for wording of the Articles of Amendment, fixing the redemption amount on the new preference shares to be created;

- Share Subscription for the replacement shares;

- Corporate Resolutions accepting the subscriptions, setting the redemption amount for the new shares and including an undertaking of the directors not to declare dividends if it would reduce the corporation's assets and make it unable to redeem the shares at their full redemption amount;

- Share Subscription from the new shareholder for the new shares;

- Corporate Resolutions issuing the new shares.

- Completing the paperwork for an asset exchange is so much easier with this package of documents.

- Available in MS Word format.

- Intended to be used only in the Province of Ontario, Canada.

$19.99

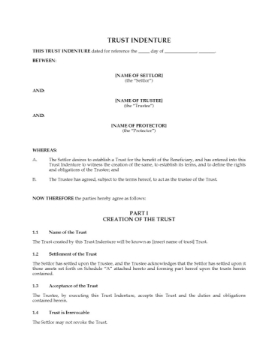

Alter Ego Trust Deed | Canada

Prepare an Alter Ego Trust Deed with this easy-to-use template, pursuant to the provisions of the Income Tax Act (Canada).

- Who Can Use This Form. An alter ego trust can only be created by an individual aged 65 or older, who will have the exclusive right to receive all income from the trust.

- Trust Income. During the settlor's lifetime no person other than the settlor may receive or otherwise obtain the use of any part of the trust's income or capital.

- Distribution of Trust AssetsUpon the settlor's death, the trust will hold any remaining assets for the benefit of other beneficiaries named in the Trust Deed. The trust will be able to distribute those assets to the other beneficiaries without the assets having to go through the probate process.

- Legal Jurisdiction. This Alter Ego Trust Deed template is governed by Canadian tax laws and is intended to be used only within Canada.

- Format. The template is available in MS Word format and is fully editable.

$29.99

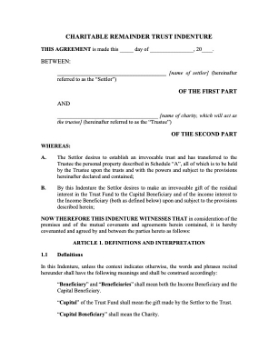

Charitable Remainder Trust | Canada

Prepare a charitable remainder trust with this downloadable template for Canadian residents.

How a Charitable Remainder Trust works

A charitable remainder trust allows the donor to retain a life interest in property transferred into the trust but makes an irrevocable gift of the residual interest to a registered charity.

The charity then issues a donation receipt for the fair market value of the residual interest in the property at the time that the residual interest vests in the charity.

Key Provisions

- Tax Credit. The tax credit can be carried forward in whole or in part for up to five years.

- Capital Gains. All capital gains are allocated to the capital beneficiary, i.e. the charity, which is tax-exempt.

- Trust Income. The net income of the trust is paid to the income beneficiary (the settlor and their spouse, and/or whoever else the settlor may designate in the trust).

- Expenses. Trust expenses are paid from the trust income.

- Irrevocable Trust. This is an irrevocable trust.

Format and Legal Jurisdiction

The template is available in MS Word format and is fully customizable. This trust deed is governed by Canadian tax laws and is intended to be used only in Canada.

$29.99

Joint Spousal Trust Deed | Canada

Prepare a Joint Spousal Trust Deed with this downloadable template, pursuant to the provisions of the Income Tax Act (Canada).

- A joint spousal trust is an inter vivos trust established to benefit both spouses during their lifetimes and includes provisions for the remaining spouse after one passes away.

- When both spouses die, the trust property passes to the remainder beneficiaries named in the trust agreement.

- The assets held within the trust bypass the probate process.

- The trust deed is governed by Canadian tax laws and is intended to be used only within Canada.

- Available in MS Word format.

$14.99

Recently viewed products