Products tagged with 'canadian tax planning form'

Demand Debenture Certificate with RRSP and RRIF Eligibility | Canada

Issue debentures to investors and lenders with this Canada Demand Debenture Certificate with RRSP and RRIF Eligibility.

- The debenture certificate is for public companies only.

- The debenture has a 21-year term.

- This is a qualified investment for RRSP and RRIF funds under the Income Tax Act.

- Available in MS Word format.

- Governed by Canadian tax laws and intended for use only in Canada.

Establishing an Offshore Structure for Canadians

This in-depth article describes a variety of offshore structures available to residents of Canada, for the purpose of asset protection. In particular, opportunities in the Bahamas are discussed.

The article provides a variety of information, including:

- a summary of how each structure is established,

- the purposes, advantages and disadvantages of each type of structure,

- international business corporations,

- settlement trusts,

- international foundations,

- universal life insurance,

- international deferred compensation programs,

- income stabilization plans,

- individual and corporate funding methods.

Establishing an Offshore Structure for Canadians is intended for residents of Canada, and is provided in Adobe PDF format.

The Trust Structure in Canada

Learn about the trust structure in Canada in this free expert guide.

The guide provides an overview of the structure of a trust, the advantages of a tax structure as a vehicle for income splitting and tax planning for residents of Canada, and the characteristics of specific types of discretionary trusts, such as:

- spousal (family) trusts;

- trusts for minor children;

- trusts for adult children;

- trusts for long-term maintenance of a handicapped child;

- spendthrift trusts.

The Trust Structure in Canada is information for Canadian residents and is copyright by the author.

Asset Transfer Agreement (Land for Shares) | Canada

Make an exchange of land for shares under section 85 of the Income Tax Act (Canada) with this Asset Transfer Agreement.

- The parties are both Canadian corporate entities.

- The seller transfers the land to the buyer. In exchange the buyer assumes the mortgage on the land and issues shares of its capital to the seller.

- The parties agree to jointly file an election under Section 85.

- The Asset Transfer Agreement is part of an asset exchange (rollover) transaction.

- This document complies with Canadian tax laws and is only for use in Canada.

Bills of Sale for Spousal Trust Asset Transfer | Canada

Prepare four Bills of Sale for an asset transfer into a spousal trust, for use only in Canada.

This package contains bill of sale templates for the following:

- a transfer of assets from the spousal trust to an individual,

- a transfer of assets from the individual to a holding company,

- a transfer of assets from the holding company to an international investment corporation,

- a transfer of assets from the investment corporation to the trust.

The forms are available in MS Word format and are fully editable. Governed by Canadian laws and intended to be used only in Canada.

Business Succession Planning in Canada

Plan for the future of your small business - learn what you need to know about Business Succession Planning in Canada with this 8-page expert guide.

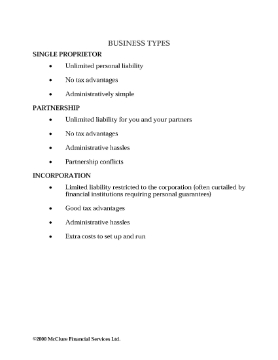

The guide describes the different types of business structures under Canadian laws, the pros and cons of each type of corporate entity. In addition, it discusses:

- how to extract value from your business,

- corporate investing,

- exit strategies,

- family businesses,

- tax planning and estate freezes.

Business Succession Planning in Canada is intended for Canadian businesses and is provided in PDF format.