Farm Land Leases

Lease farm land to a tenant, grant third parties access over your land, and manage the use of rural land with these Farm Land Leases and Contracts.

More and more farms that were once traditional family farms are now being leased and run by tenant operators. There are several different types of farm leases, the most common ones being cash rent, crop share and custom farming contracts.

- A cash rent lease can be either fixed or flexible. Rent is paid in cash payments.

- Under a crop share lease, the farm owner receives a share of the crop instead of a cash rent payment.

- In a custom farming arrangement, the land owner receives the crop and pays the operator a fixed amount for performing all the services and providing the labor and equipment required.

Farm land can also be leased for operations other than traditional agricultural purposes, such as wind farms, sports fields, campgrounds, and recreational use.

Indiana Cash Rent Farm Lease

Lease farming land to a tenant with this Indiana Cash Rent Farm Lease.

- The template includes optional clauses for either (i) a fixed annual cash rent or (ii) flexible rent based on the crops planted and the yield per ton â„ acre.

- The tenant will run all the farming operations.

- The landlord is responsible for all maintenance and repairs.

- The tenant's responsibilities include weed control and soil erosion control.

- At the end of the lease the tenant will be reimbursed for field work and crop costs for the next year's harvest.

- The Indiana Cash Rent Farm Lease template is a customizable legal document that you can use over and over again.

Iowa Cash or Crop Share Farm Lease

Iowa land owners, lease farm land to a tenant with this Iowa Cash or Crop Share Farm Lease.

- The Lease contains provisions for either (i) payment of the rent in cash, or (ii) for the tenant to pay the landlord a share of the crops grown on the leased lands as rent.

- In addition to the crop shares, the tenant agrees to pay as additional rent certain fixed amounts for pasture, hay land, timber, wasteland and other non-variable cropland.

- The tenant agrees to store the landlord's share of the crops, provided that it does not exceed a certain percentage of the storage available to the tenant.

- The parties will each provide certain items of equipment, materials, and labor, and pay a share of the expenses to run the farming operations.

- The tenant agrees to use the land for agricultural purposes only, and to farm the land in accordance with proper farming practices.

- The tenant is responsible for obtaining crop, liability, property damage and workers' compensation insurance.

- Participation in USDA programs may be (i) at the option of each party, or (ii) as a mutual decision by both parties.

Ontario Farm Land Cash Lease

Lease farm land in Ontario to a tenant on a cash basis with this Ontario Farm Land Cash Lease.

- Annual rent is calculated by multiplying the number of acres leased by a base rent per acre.

- The rent will be paid in a series of installment payments.

- The tenant agrees to use the land for farming and agricultural purposes only.

- The tenant is responsible for care and maintenance of the land, including soil erosion and weed control.

- The tenant is also responsible for maintaining fences and other improvements on the land.

- The tenant must comply with all federal, provincial and local environmental laws, rules and regulations, and must ensure proper waste disposal and storage of chemicals.

- The tenant must carry sufficient insurance satisfactory to the landlord, including spill insurance.

- Available in MS Word format and fully editable to fit your needs.

- Intended to be used only in the Province of Ontario, Canada.

Ontario Farm Land Lease with Land Trust

Lease out Ontario agricultural land owned by a land trust with this Ontario Farm Land Lease Agreement.

Parties to the Agreement

The Farm Land Lease Agreement is between a land trust which purchased land from an Ontario land owner (lessor) and the land owner who is now leasing it from the land trust (lessee).

This strategy is sometimes used for tax purposes, to avoid creditors, or to avoid probate.

Lessee's Obligations Under the Lease

- The lessee agrees to use the land for agricultural and wildlife management purposes only.

- The lessee will pay all realty taxes and other assessments with respect to the land.

- The lessee is responsible for carrying all required insurance.

- The lessee will cultivate the land, control weeds and grass, and maintain culverts and underdrains to ensure proper drainage.

Format and Legal Jurisdiction

The Farm Land Lease Agreement template is available in MS Word format and is fully customizable to meet your exact needs.

This legal document was prepared in accordance with the Ontario Short Forms of Leases Act and should only be used in the Province of Ontario, Canada.

Ontario Farm Lease for Buildings Only

ON farm owners, lease the buildings on your property to a tenant with this Ontario Farm Lease Agreement template.

Term of Lease

The lease can either be for a fixed period of time or can run year to year. The lease is for the buildings only, not the farm land.

Tenant Obligations

- The tenant must allow incoming tenants or purchasers access to the land in order to harvest the crops and work the land.

- The tenant agrees to keep all buildings and fences in good repair.

- The tenant agrees not to keep vehicles of any kind in barns or sheds without the landlord's consent.

Right of Way

The landlord allows the tenant a right of way over the land owned by the landlord in order to access the buildings.

Dispute Resolution

The parties agree to arbitration in the event of a dispute.

Format and Jurisdiction

This Ontario Farm Lease Agreement template is provided in MS Word format and is fully editable to fit your circumstances.

This legal document is intended to be used only in the Province of Ontario, Canada.

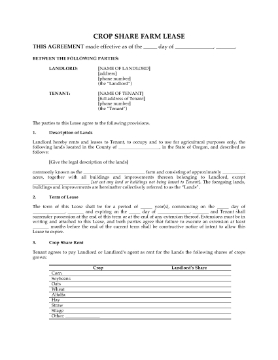

Ontario Farm Lease for Crop Shares

ON farmland owners, rent out your farm land to a tenant with this Ontario Farm Lease for Crop Shares.

- This Lease allows the tenant to use a percentage of the crops grown on the land as payment of the rent.

- The landlord and tenant will each pay a portion of the costs of planting, growing and harvesting the crop.

- The tenant agrees to use the land for farming and agricultural purposes only.

- The tenant is responsible for care and maintenance of the land, including soil erosion and weed control.

- The tenant is also responsible for maintaining fences and other improvements on the land.

- The tenant must comply with all federal, provincial and local environmental laws, rules and regulations, and must ensure proper waste disposal and storage of chemicals.

- The tenant must carry sufficient insurance satisfactory to the landlord, including spill insurance.

- Available in MS Word format, fully customizable to meet your needs.

- Intended to be used only in the Province of Ontario, Canada.

Ontario Pasture Lease

ON land owners, lease pasture land to a tenant with this Ontario Pasture Lease template.

- The term of the lease can be either for a fixed number of years with an option to renew, or a continuing term which reverts to a yearly lease after the initial term expires.

- The lease contains two options to determine how rent will be calculated - either based on (i) the number of acres of pasture land, or (ii) the number of livestock grazing the land.

- The tenant is responsible for ensuring that livestock do not break through fences, and must ensure that all animals meet the landlord's approval with respect to health, breed, sex, age, and number of animals.

- The tenant must use the land for agricultural purposes only.

- The tenant must comply with all federal, provincial and local environmental laws, rules and regulations, and must ensure proper waste disposal and storage of chemicals.

- The tenant must carry sufficient insurance satisfactory to the landlord, including spill insurance.

Oregon Cash Rent Farm Lease

Oregon landowners, do you have farm land you want to lease out? Prepare your paperwork with this template Cash Rent Farm Lease.

- The tenant will pay the landlord a fixed annual rent, that can be paid in installments.

- The tenant will provide all unskilled labor to run the farm, and the landlord will provide all skilled labor required for maintenance and repairs.

- The tenant is responsible for weed control and soil erosion control.

- The landlord will reimburse the tenant at the end of the lease for field work and crop costs for the next year's harvest.

- This is a downloadable legal contract form that is easy to customize for your purposes.

- Intended for use only in the State of Oregon.

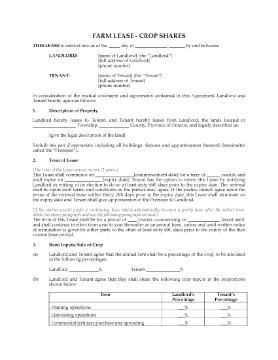

Oregon Crop Share Farm Lease

Rent out Oregon farm land to a tenant with this Crop Share Farm Lease.

- The tenant agrees to pay the landlord, as rent, a share of the crops grown on the leased farmland.

- In addition to the crop shares, the tenant agrees to pay a certain amount per acre for land used for pasture, hay and silage. Rent will be paid in a series of installment payments.

- The tenant agrees to store the landlord's share of the crops, provided that it does not exceed a certain percentage of the storage available to the tenant.

- The parties agree to provide certain items of equipment, materials, and labor, and to pay a share of the expenses to run the farming operations.

- The tenant agrees to use the land for agricultural purposes only, and to farm the land in accordance with proper farming practices.

- The tenant is responsible for obtaining crop, liability, property damage and workers' compensation insurance.

- The parties will share in the decision making and management of the farming operations to the extent set out in the lease.

- Available as a MS Word document, fully editable.

- Intended to be used only in the State of Oregon.

Pasture Lease | Canada

Canadian farm owners, rent out pasture land to a tenant with this Canada Pasture Lease template.

- The term of the lease can be either for a fixed number of years with an option to renew, or a continuing term which reverts to a yearly lease after the initial term expires.

- The lease contains two options to determine how yearly rent will be calculated - either based on the number of acres of pasture land, or on the number of livestock grazing the land.

- The tenant is responsible for ensuring that livestock do not break through fences, and must ensure that all animals meet the landlord's approval with respect to health, breed, sex, age, and number of animals.

- The tenant must carry adequate and satisfactory liability insurance throughout the term of the lease.

- The landlord must pay all taxes levied against the pasture land.

- The lease does not confer any mineral rights on the tenant with respect to the land being leased.

- Compensation for damage or loss of crops or property will be paid to the party suffering the loss.

- The parties agree to binding arbitration in the event of a dispute.

- Available in MS Word format, fully editable to fit your needs.

- Intended to be used only in Canada.