Financial

Create paperwork for your financial transactions and do your tax planning with these downloadable legal documents from MegaDox.com.

- Download customizable and reusable templates for lending, borrowing, and collecting money.

- We offer easy-to-use documents and information to help you manage your debt, accounts payable and receivables.

- Protect your assets and lower your taxes with effective tax planning strategies.

- Download template mortgages, bills of sale, loan agreements, promissory notes, and supporting documentation.

- Find information and forms to help you with retirement and succession planning.

Jurisdictions Covered

MegaDox.com carries financial contracts, forms and documents for buyers and sellers, lenders and borrowers in various countries, including Canada, the United States, Australia, United Kingdom, New Zealand, Mexico, China and India.

Browse through our catalog of professionally prepared documents.

Access a comprehensive library of professional, well-written documents that are affordable, reusable, and fully editable.

These forms are not AI-generated. They were prepared and vetted by financial professionals.

MegaDox.com offers instant access and flexible purchasing options.

- Instantly download forms that can be easily customized to fit your specific requirements.

- There is no subscription required—pay as you go, purchase only the documents you need when you need them.

- All forms are reusable. Buy once, use as often as required.

- Monthly, half-yearly, and annual subscription options are available on request.

Loan Agreement for Syndicated Mortgage Transaction | Canada

Prepare a Loan Agreement for a syndicated mortgage transaction with this template form for Canada.

- The syndicated mortgage is being offered as an investment opportunity to raise capital for development of the subject lands.

- Part of the loan advance will be set aside as security for repayment of the interest on the loan. The remainder of the loan proceeds will be used to purchase, develop, finance or refinance the land.

- Additional security for the loan includes the mortgage, an assignment of rents and leases, and a reserve fund.

- Interest accrues daily, is calculated quarterly in advance and is payable quarterly in arrears.

- Available as a fully editable Microsoft Word document.

- Intended for use only for transactions in Canada.

Loan and Charging Agreement | Canada

Canadian lenders can use this downloadable Loan and Charging Agreement to prepare loan documents for a borrower.

- The template includes both the Loan Agreement and a promissory note for the principal amount of the loan plus interest.

- The borrower agrees to register an encumbrance against title to real estate owned by the borrower, as collateral security for the loan.

- If the borrower defaults in repaying the loan, title to the property will be transferred to the lender.

- Available in MS Word format.

- Intended to be used only in Canada.

Loan Participation Sale and Trust Agreement | USA

Under this Agreement, a lead lender (Seller) participates in one or more loans by transferring an undivided participation ownership interest in the loan to another lender (Buyer).

- The Buyer receives a percentage yield on its interest, plus a pro rata participation in any interest collected.

- The Seller is entitled to the remainder of the interest plus any default penalties, late charges, etc.

- The Seller will act as trustee with fiduciary duties to hold the participation ownership and legal title to the loans and receipts, and to make the required remittances.

- The Seller, as trustee, will retain all loan documents, mortgage notes, and related items.

- The Seller will continue to service the loans in the same manner as it services loans for its own account.

- Available as a fully editable MS Word template.

- Intended to be used only in the United States.

Loan Security Forms Package | Canada

Are you loaning money or extending credit facilities to a customer or other party? Document your security interest as a creditor with this Loan Security Forms Package for Canadian lenders.

- The package contains the following forms:

- General Security Agreement,

- Unconditional Guarantee and Postponement of Claim,

- Promissory Note to be executed by the borrower.

- Available in MS Word format.

- Intended to be used only in Canada.

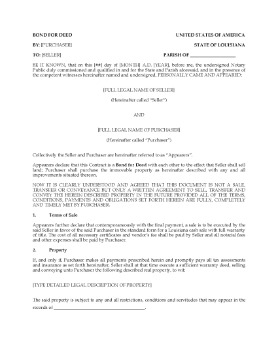

Louisiana Bond for Deed

If you are selling a real estate property in Louisiana, you can assist the buyer by carrying part or all of the purchase price with this Bond for Deed (also known as a land contract or purchase money mortgage).

- The Bond for Deed is not a sale contract or a transfer. It's basically an agreement to sell, meaning that the property will be conveyed to the buyer once all the terms and conditions have been fulfilled.

- In essence, the seller takes the place of a mortgage lender by allowing the buyer to pay off the purchase price of the real estate property over time.

- Once the final payment is made, the seller will provide the buyer with an executed warranty deed to transfer ownership of the property to the buyer.

- If the buyer fails to make the payments as set out in the agreement, the seller is entitled to keep all payments made and to take possession of the property. The seller is also entitled to keep all improvements made to the property by the buyer.

- This is a MS Word template form and is fully editable to fit your exact circumstances.

- Intended for use only in the State of Louisiana.

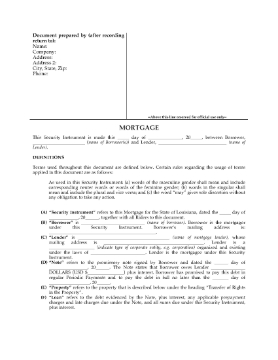

Louisiana Fixed Rate Mortgage

This Fixed Rate Mortgage template is for residential home loans in the State of Louisiana.

- Acceleration of the mortgage if the borrower defaults.

- Borrower's right to reinstate after acceleration.

- Lender's right to commence foreclosure proceedings after acceleration.

- Appointment of a keeper after seizure.

- Cancellation after payment in full of the mortgage loan.

- Waiver of homestead rights.

- Inclusion of servitude and component parts under the mortgage.

- Modification of certain provisions for community-owned property.

- Available in MS Word format.

- Intended to be used only in the State of Louisiana.

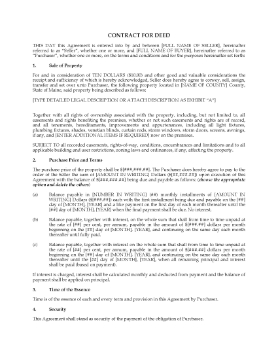

Maine Contract for Deed

If you are selling a real estate property in Maine, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or land installment contract).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- This Contract for Deed form is available in MS Word format and is fully editable to fit your exact circumstances.

- Intended to be used only in the State of Maine.

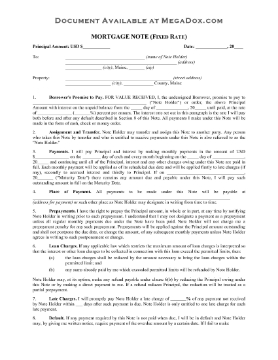

Maine Fixed Rate Mortgage Note

A promissory note is part of every mortgage transaction. Fill in the details and have the borrower sign this Fixed Rate Mortgage Note for the State of Maine.

- The terms of the Note require the borrower to repay the loan by making monthly payments of principal and accrued interest.

- If on the maturity date there remains any amount outstanding, the borrower will pay the balance in full at that time.

- As the note holder, you (the lender) have the right to demand repayment of the entire outstanding balance of the loan, plus interest, if the borrower defaults in making payments.

- This is an easy-to-use legal form template drafted in plain English in accordance with the Maine plain language law.

- To download the Fixed Rate Mortgage Note, add it to your cart and pay for it. You'll have instant access to the form.

Maine Mortgage Deed

Register a mortgage loan on a real estate property in the State of Maine with this Mortgage Deed form.

- The Mortgage Deed sets out the total amount of the loan, the interest rate, and the amount of the payments to be made by the borrower.

- The form references the statutory condition set out in MRS Title 33, Section 769, and a copy of the statutory condition is included for your convenience.

- This is a digital download in MS Word format.

- Intended to be used only in the State of Maine.

Management Buyouts - Selling Out to Senior Management

This guide for small business owner managers explains how you can include senior employees in your business succession plan.

Why You Should Include Employees in Succession Planning

There are a number of good reasons to include your long-time employees in your business continuity planning:

- It is a way to give deserving employees an opportunity to acquire the business.

- This is a viable alternative if your family members have no interest in taking over the business.

- Senior employees often represent the best possible buyers for the business, as they are already actively involved in its operation.

Contents of the Guide

This guide sets out the pros and cons of this exit strategy, the issues you need to consider, and how to structure the deal in the best interests of all parties.

Author Credit

This expert guide was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.