Mortgage Forms

Before you lend money to someone to buy real estate, secure the loan with these downloadable, customizable Mortgage Forms.

According to Wikipedia.com, the word 'mortgage' is French for 'death contract'. As ominous as that may sound, it merely means that the charge against the land which was created by the mortgage ends (dies) when the debt that it secures is paid or, alternatively, if the property is foreclosed.

Few individuals or businesses can afford to buy real estate without getting a loan to fund the purchase. Because the amount being borrowed is so high, the only collateral of sufficient value that can adequately secure the repayment of the debt is the property itself.

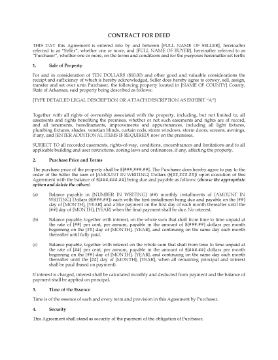

Arkansas Contract for Deed

This Contract for Deed form allows the seller of a property in Arkansas to assist the buyer by carrying part or all of the purchase price.

- The seller effectively becomes the mortgage lender for the balance of the purchase money.

- When the seller has received payment in full of the principal and interest, title to the property will be transferred over to the buyer.

- The seller has the right to take back the property if the buyer defaults on the payments.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- Available in MS Word format.

- This legal form is intended to be used solely within the State of Arkansas.

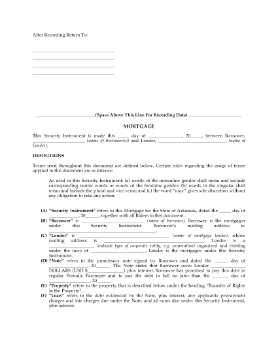

Arkansas Fixed Rate Mortgage

Secure a loan for a residential property with this Arkansas Fixed Rate Mortgage.

- The mortgage template contains both uniform (multistate) covenants and non-uniform covenants specifically for the State of Arkansas.

- The mortgage is given as additional security for a loan under a promissory note signed by the borrower.

- The debt secured by the mortgage includes interest and any additional prepayment or late payment charges payable by the borrower.

- This mortgage form is a downloadable and fully editable digital template in MS Word format.

- Intended to be used only in the State of Arkansas.

Balloon Mortgage and Security Agreement | USA

Prepare a Balloon Mortgage and Security Agreement for borrowers with this easy-to-use template.

- The entire unpaid balance of the mortgage loan and interest is due on the maturity date.

- The borrower (mortgagor) will pay all taxes, rates and assessments levied against the mortgaged property.

- The borrower must keep the mortgaged property insured for such risks and in such amounts as the lender may require.

- The borrower must get the lender's consent before making any alterations to the property, and must maintain the property in good condition and repair.

- If the borrower attempts to transfer all or any part of the property, the mortgage loan plus interest will immediately become due.

- The borrower waives all right of homestead exemption in the property.

- The mortgage will secure not only the borrower's existing debt to the lender, but any future advances made within 20 years of the date of the mortgage to the same extent as if they were made on the date of execution of the mortgage.

- This template is not state-specific. Some state laws require specific wording to be added to balloon mortgages. Check your state legislation online for details.

- Intended to be used only within the United States.

Balloon Mortgage Promissory Note | Canada

Use this customizable template to prepare a Balloon Mortgage Promissory Note for mortgage loans made in Canada.

Repayment Terms

- Under this note, the borrower is required to make monthly payments toward the secured amount. These payments will continue until the date of the final payment.

- On the maturity date, the borrower must make a balloon payment that covers the entire remaining balance of both principal and interest outstanding. This structure ensures that the loan is fully repaid at maturity.

Security

The Balloon Mortgage Promissory Note is secured by a mortgage on the borrower’s property. This security measure provides protection for the lender and helps ensure repayment of the loan.

Format and Scope of Template

This Balloon Mortgage Promissory Note template is available in MS Word format. It is fully editable and reusable. There are no additional fees for multiple use. Once you pay, the form is yours.

The Promissory Note can be used throughout Canada. A French language version may be required for use in Quebec.

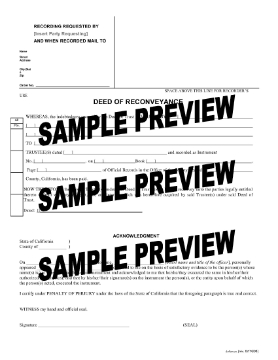

California Deed of Reconveyance

When a loan on a property secured by a Deed of Trust is paid back in full, the title must be transferred back to the owner under this California Deed of Reconveyance.

- The provisions of the Deed of Trust require the lender to transfer the title from the trustee back to the borrower, but the borrower is usually responsible for paying the costs of the conveyance.

- The digital file includes a Request for Reconveyance form which the lender uses to instruct the trustee to reconvey the title back to the owner.

- The property is transferred back to the owner without warranty.

- Available in MS Word format.

- Intended to be used only in the State of California.

California Deed of Trust

This California Deed of Trust is based on the Fannie Mae / Freddie Mac form and contains all the required standard and non-standard covenants and provisions.

- A Deed of Trust takes the place of a mortgage in California and is used to secure repayment of a home loan.

- Title to the property is transferred to a neutral third party trustee, who holds the title until the loan is paid or the borrower defaults in payment.

- If a borrower breaches the terms of the Deed of Trust and, after receiving written notice of the breach from the lender, has failed to remedy the breach, the lender can accelerate repayment of the balance owing plus costs.

- The lender has the right to invoke a power of sale and have the trustee sell the property at public auction to the highest bidder.

- Available in MS Word format.

- Intended to be used only in the State of California.

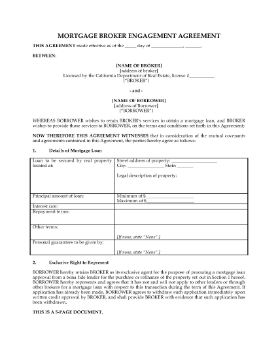

California Mortgage Broker Agreement

Mortgage brokers in California can sign up clients for their services with this customizable contract template.

- The borrower retains the broker as its exclusive agent for obtaining mortgage loan approval from a lender.

- The broker will obtain a credit report and property appraisal, and prepare the loan application.

- Provisions covering the broker's compensation based on the rate and fee combination that the borrower chooses.

- The broker agrees that no hidden compensation will be received from the lender or any other source.

- The borrower agrees to provide the broker with truthful and complete information as required for the purpose of the loan application.

- The broker stipulates that there is no guarantee or promise that the borrower will obtain a mortgage loan as a result of the broker's efforts.

- The parties agree to binding arbitration in the event of a dispute.

You can download the Mortgage Broker Agreement right after you purchase it. See how easy your client paperwork can be with a good digital template!

California Notice of Default

Has a borrower failed to make a payment on time under their mortgage or contract for deed? You can now serve this Notice of Default under Section 2924 of the California Civil Code.

- The Notice must be filed and served properly before you can take possession of the mortgaged property.

- The Notice instructs the borrower on how to remedy the default, and how many days s/he has to take action.

- The form also contains a copy of the applicable Section of the Civil Code.

The foreclosure process starts here. Get your copy of the California Notice of Default form and start the ball rolling.

Collateral Substitution Agreement | USA

Replace the property which is collateral for a mortgage with a different one under this Collateral Substitution Agreement.

Purpose of Agreement

This Collateral Substitution Agreement would be used by a mortgage lender in circumstances where a borrower wants to sell their mortgaged property in order to buy another property of approximately equal value.

The original real estate property is released from the mortgage, and the borrower's new property replaces the original one as collateral for the mortgage.

Original Provisions to Remain in Effect

The provisions of the original promissory note and all other loan documentation respecting the mortgage will remain in full force and effect against the borrower and the new property.

Format and Scope of Use

The Collateral Substitution Agreement is available in MS Word format and is fully editable and reusable, making it flexible and cost-effective.

This legal document is intended for use within the the United States. It does not contain any state-specific references.

Colorado Contract for Deed

If you have a buyer for your home who can't qualify for a mortgage, you can carry all or part of the purchase price under this Contract for Deed.

- This legal template is governed by Colorado laws.

- A Contract for Deed is also referred to as a purchase money mortgage, owner financed mortgage, land contract, and installment agreement.

- The buyer has possession of the property as long as he/she is not in default.

- The seller can still sell or mortgage the property, but if the seller fails to make the mortgage payments, the buyer has the right to make them and the seller will reimburse the buyer.

- If the buyer defaults the seller can terminate the agreement and retake possession of the property. All payments made by the buyer are forfeited.

- Available in MS Word format.