Real Estate Forms

Are you buying or selling real estate? When you purchase one of our template Real Estate Forms, you get a convenient ready-made product that saves you money on costly legal fees.

- Standardized forms for residential or commercial real estate property.

- Downloadable, customizable, fill-in-the-blank templates.

- Country, state, and province specific legal forms.

- Offers, real estate purchase and sale contracts, For Sale by Owner packages.

- Title deeds and conveyancing forms.

- Realtor and broker listing contracts.

- Forms updated regularly to comply with changes to laws and regulations.

Sort by

Display per page

Assignment of GST New Home Rebate | Canada

Assign a GST rebate on a new home purchase to the builder with this free Assignment Form for Canadian real estate properties.

- The assignment is made under Section 254 or Section 266 of the Excise Tax Act.

- This form is used when a purchaser of a new home assigns their GST rebate to the builder.

- Downloadable and easy to use.

- Available in MS Word format.

- Only for use in Canada.

$0.00

Bare Land Purchase and Sale Agreement | Canada

Put in an offer to buy bare land for development with this Purchase and Sale Agreement for Canada.

- Bare land (or raw land) is land on which there is currently no structure, landscaping or other development. It can include vacant city lots on which buildings once stood but have since been demolished.

- The agreement is conditional upon the vendor obtaining a Phase I and Phase II Environmental Assessment satisfactory to the purchaser. The purchaser may elect not to proceed with the transaction after reviewing the assessment.

- The agreement is also conditioned upon the purchaser obtaining a commitment for sufficient mortgage loan financing to complete the transaction.

- The contract form does not contain specific references to provincial laws and regulations. It can be used in most Canadian provinces and territories (Quebec excluded).

- Writing up your offer is easy with this template Purchase and Sale Agreement. Buy, download, modify to fit your unique needs.

$29.99

BC Agreement of Purchase and Sale of Commercial Property

Buy commercial real estate property in British Columbia with this Agreement of Purchase and Sale.

- The transaction is conditional upon the buyer conducting an inspection of the environmental conditions and state of title of the property, and being satisfied with the results of the inspection.

- The seller has the right to continue to market the property for sale prior to fulfillment of the buyer's condition.

- From the date the Agreement is signed, the buyer is authorized to conduct any due diligence, surveys, inspections and tests of the property it deems necessary.

- As of the closing date, the buyer assumes all responsibility for and releases the seller from any liability with respect to environmental issues connected to the property.

- Available in MS Word format.

- Intended to be used only in the Province of British Columbia, Canada.

$29.99

BC Purchase and Sale Contract for Investment Property

Buy commercial investment property in British Columbia from a bare trustee company with this Purchase and Sale Contract.

- The land is held by a bare trustee company on behalf of the seller.

- The transaction is conditional upon the buyer obtaining a satisfactory development feasibility study and an environmental review of the property.

- After the buyer's conditions have been removed, the buyer will have the option to purchase the trustee company shares.

- The document includes a disclosure statement by the parties' real estate agents in accordance with the Canadian Real Estate Association's Code of Ethics.

- Available as a downloadable and customizable MS Word document.

- Intended to be used only in the Province of British Columbia, Canada.

$29.99

British Columbia Assignment of Real Estate Purchase Contract

Assign your interest as purchaser under a real estate contract with this easy-to-use British Columbia Assignment of Real Estate Purchase Contract.

- The original purchaser under the contract assigns its rights under the purchase contract to another party (the assignee).

- The assignee agrees to take over the original purchaser's obligations under the purchase contract and complete the purchase of the property.

- This legal form template is available as a MS Word document.

- Intended for use only in the Province of British Columbia, Canada.

$6.29

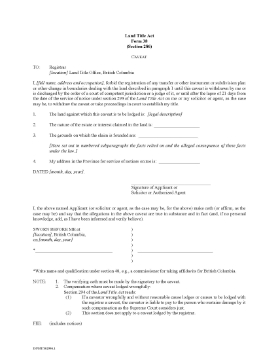

British Columbia Caveat

File a caveat against real property in British Columbia with this Land Title Form 38.

- The caveat forbids the registration of any transfer or other instrument on the title until the caveat is withdrawn or discharged.

- A caveat is generally registered on title by the purchaser of a property to protect their interest under the purchase contract, so that no other encumbrances or interests can be filed until the transaction has been completed.

- BC Land Title Act Form 38 Caveat is a free download. Click the link to download the form directly from the LTSA.ca website.

$0.00

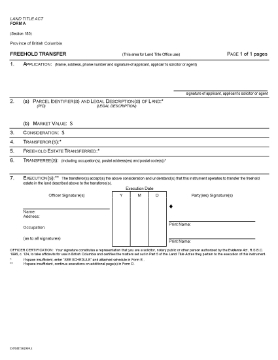

British Columbia Freehold Transfer

Use this free BC Land Title Act Form A Freehold Transfer to transfer title of a real estate property in BC.

- The transfer form must be signed in front of an officer authorized to take affidavits in British Columbia, such as a solicitor or notary public.

- This is a free downloadable form in PDF format.

- For use only in the Province of British Columbia, Canada.

$0.00

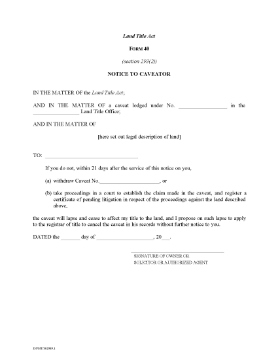

British Columbia Notice to Caveator

Give notice to a caveator that they must withdraw their caveat or file a lawsuit to back up their claim with this free BC Land Title Form 40.

A person who files a caveat (caveator) must commence an action to establish their claim against the property within 2 months after registering the caveat, or it will lapse. The caveator has 21 days from receipt of the notice to commence its action.

British Columbia Notice to Caveator form, available in PDF format.

$0.00

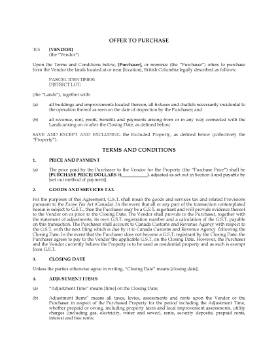

British Columbia Offer to Purchase Land for Development

Buy land in British Columbia for development into a subdivision with this template Offer to Purchase Land for Development.

- The purchaser is responsible for paying any GST payable on the transaction.

- The seller must provide a recent surveyor's certificate for the property.

- The seller's house and outbuildings and the land on which the buildings are located are excluded from the sale.

- This form is available as a downloadable and fully editable MS Word document.

- Intended to be used only in the Province of British Columbia, Canada.

$17.99

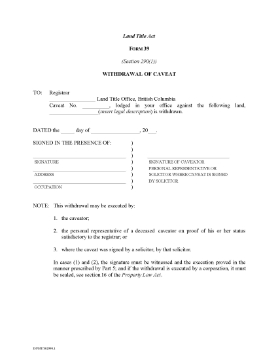

British Columbia Withdrawal of Caveat

Discharge a caveat from title to real property in British Columbia with this Withdrawal of Caveat Form.

- A Caveat can only be discharged by the caveator (the party who registered it), or by the caveator's personal representative or solicitor.

- This form is a free PDF download.

- For use only in the Province of British Columbia, Canada.

$0.00