Products tagged with 'seller financing form'

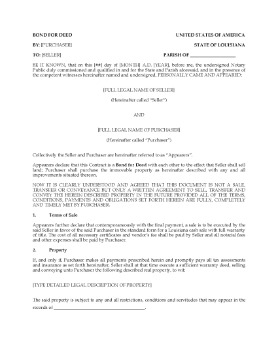

Louisiana Bond for Deed

If you are selling a real estate property in Louisiana, you can assist the buyer by carrying part or all of the purchase price with this Bond for Deed (also known as a land contract or purchase money mortgage).

- The Bond for Deed is not a sale contract or a transfer. It's basically an agreement to sell, meaning that the property will be conveyed to the buyer once all the terms and conditions have been fulfilled.

- In essence, the seller takes the place of a mortgage lender by allowing the buyer to pay off the purchase price of the real estate property over time.

- Once the final payment is made, the seller will provide the buyer with an executed warranty deed to transfer ownership of the property to the buyer.

- If the buyer fails to make the payments as set out in the agreement, the seller is entitled to keep all payments made and to take possession of the property. The seller is also entitled to keep all improvements made to the property by the buyer.

- This is a MS Word template form and is fully editable to fit your exact circumstances.

- Intended for use only in the State of Louisiana.

Purchase Money Promissory Note for Real Estate Purchase

If you are selling a real estate property and allowing the buyer to pay the purchase price over time, make sure the buyer signs this Purchase Money Promissory Note.

- Having a signed promissory note in place makes you a secured creditor if the buyer becomes bankrupt or insolvent.

- The buyer will pay off the balance of the purchase price in regular installments, rather than having to come up with all of the purchase money in order to close the sale.

- The Note contains an acceleration clause, meaning if the maker defaults in a payment, the entire balance together with interest becomes immediately due and payable.

- Get the Purchase Money Promissory Note signed at the same time that the other documents for the real estate purchase are executed by the buyer.

Selling Your Business - Structuring Earnouts and Deferred Payment Plans

This free article will steer you through the issues to consider if the sale of your business has an earn-out component or a deferred payment (seller financing) option.

Key Issues

This article covers a number of issues that must be considered, including:

- determining a fair price,

- negotiating reasonable terms and interest rate,

- determining the amount of money the buyer will put in at the outset,

- securing the unpaid balance of the purchase price,

- considering rights of setoff,

- setting payment milestones, and the consequences for missing a milestone,

- dealing with financial needs and operational decisions of the business until the purchase price has been paid in full.

Risk Management Strategies for Problems Arising After Closing

The writer also touches on how you should address potential problems that could arise after the closing, such as:

- Death of either party

- Default

- Insolvency of either party.

Planning Your Exit Strategy

The information provided in this article is intended to help small business owners exit from their businesses through a carefully structured seller-financed or earn-out sale arrangement.

Author Credit

This article was written by Phil Thompson, business lawyer and corporate counsel in Ontario, Canada.

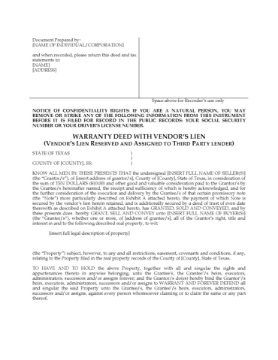

Texas Warranty Deed with Vendor's Lien

Transfer ownership of a real estate property in Texas from a seller to a buyer with this Warranty Deed with Vendor's Lien.

Purpose of Deed

The Warranty Deed gives the seller (the vendor) a lien over the property under a promissory note signed by the buyer and held by the vendor.

Key Provisions

- The seller can assign its vendor's lien to a mortgage lender after the promissory note is paid out of the proceeds of a new mortgage.

- The lender, who holds the promissory note and deed of trust, will retain superior title to the property until the loan is paid by the buyer.

- The form can also be used to place a lien by a third party lender.

Format and Jurisdiction

The form is available in MS Word format and is easy to use. It is governed by Texas law and is intended to be used only in the State of Texas.