UNITED STATES

Never loan money - not even to family - without getting a Promissory Note from the borrower. Some of these forms are State-specific, but most of these downloadable templates can be used anywhere in the United States or its territories.

Loaning money to family and friends can often be a recipe for disaster. Even with an IOU or promissory note, sometimes the borrower will fail to repay the debt, and you will have to decide whether you should sue them for the money. If you do take them to court, your signed promissory note is proof that you made the loan, and that the borrower promised to repay it on the terms agreed to in the note.

But often the actual signing of a legal document makes the transaction more business-like, more like dealing with a bank. That in itself can act as a catalyst to ensure that the borrower makes the payments on time and honors the terms of the loan, especially when the borrower considers that you have a signed promise from him / her to repay the debt which will stand up as evidence in court.

Balloon Mortgage Promissory Note | USA

Prepare a Balloon Mortgage Promissory Note with this downloadable template for U.S. lenders.

Monthly Payment Structure

Under the terms of this Balloon Mortgage Promissory Note, the borrower commits to making monthly payments toward the secured loan amount. These payments will continue until the designated date for the final payment.

Balloon Payment

On the date of the final payment, the borrower is required to pay a balloon payment. This payment consists of the entire remaining balance of principal and interest that is outstanding as of that date.

Security Interest

The Note is secured by a mortgage on the property owned by the borrower, providing assurance for the lender regarding repayment.

Intended Use and Availability

This template is intended solely for use within the United States. It is provided in a convenient MS Word format to facilitate easy access and editing by lenders.

Installment Note with Confession of Judgment | USA

USA lenders, secure repayment of a loan with this Installment Promissory Note and Confession of Judgment form, which allows the borrower to repay the debt in regular installments.

- In the event that the borrower defaults in payment, the borrower authorizes any attorney or official of the court to enter judgment by confession against the borrower.

- The Note contains an acceleration clause, so that if the borrower defaults in a payment under the Note, the entire balance together with interest becomes immediately due and payable.

- This installment note makes it easier for the borrower to repay the debt by breaking it up into equal payments.

- Available in MS Word format. Download the form immediately after purchasing it.

- Intended to be used only within the United States.

Mississippi Balloon Promissory Note

Secure the repayment of a loan in Mississippi with this easy template Balloon Promissory Note.

- The borrower agrees to make a series of equal monthly payments against the secured amount, until the date of the final payment which will be a balloon payment, i.e. payment in full of the entire balance of principal and interest outstanding at that date.

- The borrower may make additional payments in addition to the monthly installments by paying a prepayment penalty, which will be reduced each year of the term of the Note.

- Any finance charges payable to the lender will conform to the usury laws of the State of Mississippi.

Add the Balloon Promissory Note to your shopping cart and pay for it via the secure checkout. Then download it, fill it in, print it and get it signed.

Mortgage Promissory Note | USA

This Promissory Note form is for loans that are backed by a mortgage against the borrower's real property.

- You can use the template in any U.S. state.

- There is no prepayment penalty or premium if the borrower prepays the loan in whole or in part.

- If the borrower defaults under the note or the mortgage, the borrower promises to pay interest at the highest rate allowed by law.

- The borrower will pay any collection costs incurred by the lender, including reasonable legal fees.

- Intended to be used only in the United States.

- Available in MS Word format.

Multistate Fixed Rate Note (Biweekly) | USA

Prepare a Promissory Note for a mortgage loan to be paid in biweekly payments with this USA Multistate Fixed Rate Note template.

This Promissory Note is designed for use as part of a mortgage loan transaction. It is suitable for use in most U.S. states.

Borrower's Promise to Pay

By signing this Note, the borrower agrees to pay the principal amount of the loan, as well as interest and any applicable late charges or loan fees as permitted by the lender.

Payment Schedule and Application

Loan payments are required every two weeks (biweekly). Each payment will be applied in the following order: first, to any late charges if they exist; second, to accrued interest; and finally, any remaining amount will be applied toward reducing the principal balance.

Late Payment and Lender's Rights

If the borrower fails to make payments on time, the lender reserves the right to terminate the biweekly payment schedule. In such cases, the lender may require that all future payments be made on a monthly basis instead.

Security for the Loan

This Promissory Note may serve as security for a loan in connection with a mortgage, deed of trust, or security deed.

Format

The template is available in Microsoft Word format for easy use and customization.

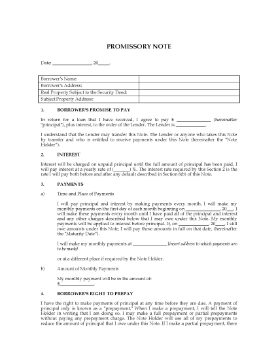

Plain Language Promissory Note | USA

USA lenders, secure repayment of a loan with this Plain Language Promissory Note.

- The Promissory Note form is drafted in language that is clear, concise, and easy for a borrower to understand.

- The principal and interest are to be repaid by a series of equal monthly installment payments.

- Any amount of principal and/or interest not paid on time bears late charges calculated as a percentage of the overdue payment amount.

- The template is not State-specific and can used anywhere in the United States.

- This is a downloadable and customizable legal form template in MS Word format.

Promissory Note for Interest Only | USA

Secure the repayment of interest on a loan with this USA Promissory Note (for interest only).

Deferred Repayment of Principal

This Promissory Note for Interest Only is designed to provide security for the repayment of interest on a loan. The structure of this note enables the borrower to make payments towards the interest only, with the repayment of the principal deferred until a date specified within the document.

Interest Payment Structure

Under this arrangement, the borrower is required to make interest payments in arrears, following a schedule of regular, predetermined dates. This ensures that interest obligations are consistently met throughout the term of the loan.

Principal Repayment Terms

The principal amount of the loan does not need to be repaid until the specified maturity date outlined in the Note. However, should the borrower wish to repay any or all of the principal before that date, they may do so without incurring any penalties or fees.

Template Format and Customization

The Promissory Note for Interest Only is provided in Microsoft Word format. This allows the document to be edited as necessary, so that all the particulars of your transaction can be accurately reflected within the Note.

The template was prepared to be used within the United States.

Promissory Note with Guarantee | USA

If you are loaning money to a person or a company, secure your interest with this Promissory Note and Guarantee for U.S. loan transactions.

If you are considering loaning money, it is important to protect your financial interest. This Promissory Note and Guarantee template provides a formal method to secure your loan, ensuring that both the repayment terms and additional guarantees are clearly outlined.

Repayment Terms

Under the terms of this Note, the borrower commits to repaying the secured amount through monthly payments. It is important to note that these payments may not necessarily be equal in amount each month, allowing for potential flexibility in the repayment structure.

Guarantee of Payment

To further secure the lender's position, the Note includes a guarantee of payment. If the borrower fails to make the required payments when they become due, a guarantor will step in to fulfil the payment obligations. The guarantor agrees to ensure that the creditor receives a monthly instalment payment, which is calculated as a specified percentage of the guarantor's net revenue.

Additional Information

- This document is available in Microsoft Word format for ease of use and editing.

- It is intended solely for use within the United States.

Promissory Note, Settlement Agreement and Guaranty | USA

Settle a past debt and get a promise for payment with this downloadable USA Promissory Note, Settlement Agreement and Personal Guaranty.

- This legal document is really three documents in one:

- Under the promissory note section, one party promises to pay the other party a settlement amount by making a series of payments. The date and amount of each payment are set out in a table.

- Under the terms of the Settlement Agreement, the two parties set out their respective claims for amounts owed by one to the other for invoices, set-offs, etc.

- Under the Personal Guaranty, a guarantor guarantees payment of the settlement amount. The guaranty is reduced against the guarantor with each payment made under the Settlement Agreement.

- The agreement is governed by the laws of the United States and is intended for use only within the USA.

- Available in MS Word format.

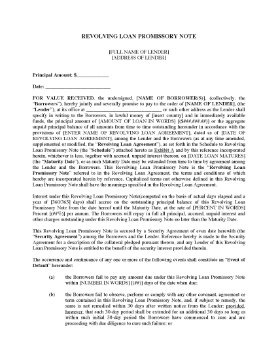

Revolving Loan Promissory Note | USA

Create a promissory note for repayment of a revolving loan with this customizable template for credit facilities.

- The Note is secured by a Security Agreement.

- The entire loan amount plus interest becomes payable if an event of default occurs.

- The prevailing party in a legal action is entitled to costs, including reasonable attorneys' fees.

- The Note can be used throughout the United States.

- Available in MS Word format, reusable and fully editable.

- 1

- 2