UNITED STATES

Don't let income and estate taxes eat up your personal or business assets. Put them into a trust with these easy to use Trust Agreement templates.

- State-specific as well as generic document templates available.

- All forms are easy to edit and customize to fit your unique needs.

- Prepared in accordance with U.S. tax laws.

Sort by

Display per page

USA Declaration of Nominee Trust

Keep your assets out of probate when you die with this USA Declaration of Nominee Trust.

- A nominee trust is a trust created for the purpose of holding property on behalf of beneficiaries whose identities are kept secret.

- The trustee's sole duty is to hold the trust property and pay over any trust income to the beneficiaries. The trustee has no power to deal with the property except as directed by the beneficiaries.

- Unless terminated earlier by one or more beneficiaries, the trust will automatically terminate twenty years after its effective date.

- The trust will not be administered by any court.

- Any termination of the trust, amendments to the Trust Declaration, and any changes in trustees must be recorded in the county records.

It's never to early to start your estate planning. Buy the USA Declaration of Nominee Trust and get started on yours now.

$17.99

USA Delivery & Receipt of Gift to Minor

Make a gift of real or personal property to a minor with this free Delivery & Receipt of Gift form under the Uniform Gifts to Minors Act (UGMA).

- The UGMA has been enacted in several states to allow assets to be held on behalf of a minor without the need to set up a special trust fund.

- The property is transferred to a custodian who will hold the property on behalf of the minor child.

- Download the form, fill it in and print it, ready for your signature.

The USA Delivery & Receipt of Gift to Minor form is a free download in MS Word format.

$0.00

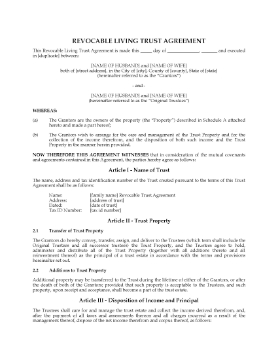

USA Revocable Living Trust Agreement with Change of Jurisdiction Clause

If you have property in other states that you want to place in trust, you need this USA Revocable Living Trust Agreement with a change of jurisdiction clause.

- This Trust Agreement allows the Trustee to move the trust property from one state to another if it will benefit the trust or any beneficiary with respect to taxes or any other reason.

- The Trustee will distribute the trust income as the grantors direct during their lifetime, and following their death, the trust estate is to be distributed to the beneficiaries specified by the grantors.

- The shares of minor beneficiaries are to be held in trust by the trustee and paid out to them when they reach a specific age.

- The share of any beneficiary who dies before receiving all of their share will be paid to any children of that beneficiary or, if there are no children, among the living descendants of the grantors, per stirpes.

- Any beneficiary or legal heir of the grantors who contests the terms of the trust is specifically disinherited by the grantors.

- The grantors may revoke the trust in whole or in part, or amend the Agreement at any time.

The USA Revocable Living Trust Agreement with Change of Jurisdiction Clause is ideal for anyone with out-of-state assets.

$29.99

USA Revocable Living Trust Declaration

Set up a living trust as part of your estate plan with this template USA Revocable Living Trust Declaration.

- Placing your property in a living trust during your lifetime automatically avoids probate, and ensures that when you die your estate will be distributed to your beneficiaries.

- The settlor's property is transferred to the trustee, who holds it in trust on behalf of the beneficiaries.

- After the settlor's death, the trustee will pay all of the estate expenses and then distribute the remainder of the trust proceeds to the beneficiaries.

- This is a revocable trust, which means it can be revoked in whole or in part at any time during your lifetime.

- It should be used in connection with a Pour Over Will.

- Also included is an Approval from Spouse form, which the settlor's spouse must sign to consent to the transfer and release all rights to the trust property.

$29.99

USA Voting Trust Agreement for Shares

Set up a voting trust in the USA with this Voting Trust Agreement for Shares, between several stockholders and a trustee.

The purpose of the voting trust is to ensure continuity of the corporation's management and policies. Provisions of the Agreement include:- deposit of the stock certificates with the trustee,

- issuance of trust certificates to the stockholders,

- the trustee is granted voting privileges and exercise rights associated with the shares.

$12.49

Recently viewed products