USA Real Estate Forms

Buy, sell and transfer title to residential and commercial real estate properties in the United States with these easy-to-use USA Real Estate Forms. Choose forms for your particular State.

New Mexico Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This New Mexico Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

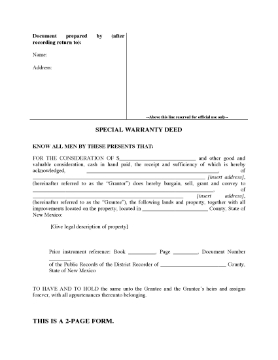

New Mexico Special Warranty Deed

Transfer ownership of a real estate property in New Mexico with this Special Warranty Deed form.

- Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property and not against defects existing before that time.

- This is a downloadable MS Word document which is easy to fill in with the details of your transaction.

- Intended solely for use in the State of New Mexico.

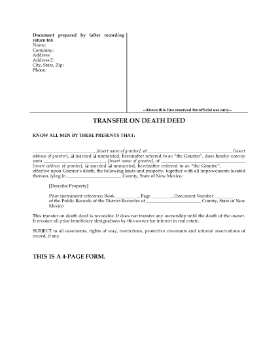

New Mexico Transfer on Death Deed Forms

Avoid probate of your real estate property upon your death with these New Mexico Transfer on Death Deed Forms.

- The Transfer on Death Deed (also called a Beneficiary Deed or a TOD) must be signed and registered with the Recorder's Office before the original owner passes away.

- Even though the property is deed into the beneficiary's name, the original owner still has rights to the property and can do whatever he or she pleases with the property until the time of his or her death, without the beneficiary's permission.

- The package also includes a Revocation of Transfer on Death Deed, in case you want to cancel the Transfer on Death Deed after it has been filed.

- These New Mexico Transfer on Death Deed Forms are easy to use. Fill them in, sign them, and have them notarized before recording the Deed with the County Recorder.

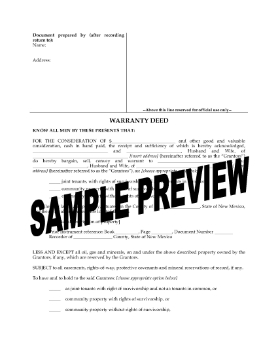

New Mexico Warranty Deed for Joint Ownership

Transfer title of a NM real estate property from two sellers to two buyers with this New Mexico Warranty Deed for joint ownership with rights of survivorship.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

- The buyers can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

- The Warranty Deed includes a Community Property Agreement to be signed by the buyers, if applicable.

- This is a downloadable legal form intended for use in the State of New Mexico.

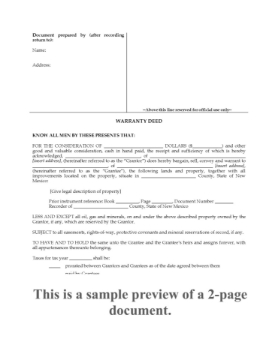

New Mexico Warranty Deed Form

Transfer title of a New Mexico real estate property from a seller to a buyer with this downloadable Warranty Deed form.

What is a warranty deed?

A warranty deed is a legal document that transfers ownership of a real estate property from the seller to the buyer. The seller confirms that the property has a clear title, which ensures that the buyer will not be responsible for any past title defects or encumbrances.

Covenants of Seller (Grantor)

The grantor (seller) covenants that:

- the grantor (seller) has good and marketable title to the property,

- the grantor (seller) has the right and power to transfer the title to the grantee (buyer), and

- the grantor (seller) will forever defend the grantee's (buyer's) right to possession of the property.

Format and Legal Jurisdiction

The Warranty Deed form is available as a downloadable legal document in MS Word format. It is intended to be used only in the State of New Mexico.

New York Bargain and Sale Deed With Covenants

Transfer ownership of a real estate property in the State of New York with this Bargain and Sale Deed With Covenants Against Grantor's Acts.

- A Bargain and Sale Deed makes no warranty as to encumbrances against title.

- This form of Deed is commonly used to transfer title for properties that have been seized for unpaid taxes or that are being sold by the executor of an estate.

- The grantor covenants that it has not encumbered the property, and that it will hold the consideration for the property in compliance with Section 13 of the Lien Law.

This New York Bargain and Sale Deed With Covenants Against Grantor's Acts form is provided in MS Word format and is easy to download, fill in and print.

New York Bargain and Sale Deed Without Covenants

Transfer ownership of a real estate property in the State of New York with this Bargain and Sale Deed Without Covenants Against Grantor's Acts.

- A Bargain and Sale Deed is commonly used to transfer title for properties that have been seized for unpaid taxes or that form part of the estate of a deceased and that is being sold by an executor.

- There are no warranties given as to title.

- The grantor does not make any covenants with the grantee as to any acts of the grantor with respect to the property. But the grantor does covenant to hold the consideration for the property in compliance with Section 13 of the Lien Law.

This New York Bargain and Sale Deed Without Covenants Against Grantor's Acts form is available as a MS Word document and is easy to download, fill in and print.

New York Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This New York Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

New York Quitclaim Deed from Husband and Wife to Individual

Transfer ownership of a real estate property in New York State from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

- Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property.

- This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

- This legal form template is available in MS Word format and is easy to use and fully customizable.

- Intended for use only in New York State.

New York Warranty Deed with Full Covenants

Transfer ownership of a New York real estate property from a seller to a buyer with this Warranty Deed with Full Covenants form.

- The seller (the grantor) covenants that:

- it has good and marketable title to the property,

- it has the legal right and authority to transfer the title to the buyer, and

- it will forever defend the right of the buyer (the grantee) to possess the property.

- This is a downloadable legal document in MS Word format.

- Intended to be used only in the State of New York.