Loan Transaction Forms

Before you lend money, secure the loan and make sure you get repaid with these loan agreements and supporting documents.

- Download the templates, fill them in and have them signed before you advance the loan funds.

- Some forms are country-specific and comply with applicable national, state and provincial legislation. Other forms are generic and can be used in most jurisdictions.

- If you're lending money to a small business, it is also advisable to obtain Personal Guarantees from the business owners.

- Also check out our selection of Promissory Notes.

Tips for Getting a Loan Repaid

Don't let personal feelings sway your better judgment. Quite often people who cannot get a loan from a financial institution will turn to family members or close friends to help them out. And you will probably feel a personal obligation to do just that. If you insist they sign a loan agreement or a promissory note, the borrower may resist, insinuating that you don't trust them to repay the money. Do not get drawn into a guilt trip. There's a reason why a bank won't lend them the money, and for that same reason you shouldn't lend them the money either unless they are willing to put everything in writing.

Set the interest rate at a reasonable level. Check with your bank to see what its prime lending rate is, and add another percentage point. That's as good a rate as the borrower could expect to get on a line of credit.

Set attainable payment levels. Make sure the regular payments are high enough to pay off the debt within a reasonable time period, but not so high as to be difficult for the borrower to maintain.

- Have the borrower provide enough collateral security to back the loan. Get the borrower to sign over assets which can be sold if the borrower defaults in repaying the loan. Collateral could include real estate and rents from investment properties, motor vehicles, heavy equipment, valuable collections such as coins or jewelry, stocks, bonds, GICs and other investments.

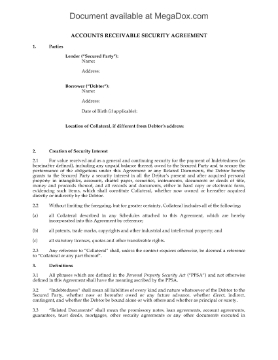

Accounts Receivable Security Agreement | Canada

Document your security interest in a borrower's property with this Accounts Receivable Security Agreement template for Canadian lenders.

- The Agreement is part of the documentation that the borrower must provide to the lender, to secure a loan or line of credit.

- The Agreement grants the lender a security interest in all of the borrower's present and future personal property including inventory, equipment, accounts receivable and book debts.

- The form is governed by Canadian laws and can be used in any province or territory which has Personal Property Security Act legislation.

- Buy and download the template in MS Word format. Other formats available on request.

Assignment of Loan Contracts

Assign various loan documents from one lender to another with this Specific Assignment and Transfer of Loan Contracts.

- The assignee assumes the original lender's rights under the contracts.

- The assignee has no liability with respect to the assigned rights and no obligation to perform the lender's obligations.

- The document includes a Notice of Assignment form that must be sent to each borrower and to any other party that has an interest in the contracts.

- This is a generic legal form which does not contain references to specific countries or jurisdictions.

- The Specific Assignment and Transfer of Contracts template is a downloadable MS Word document and fully editable to meet your needs.

Assignment of Rents Agreement | Canada

Secure the repayment of a mortgage loan by having the borrower execute this Assignment of Rents Agreement for Canadian lenders.

- The borrower assigns to the lender all rent revenues from tenants in the property being mortgaged.

- The assignment is given as security for repayment of the mortgage and performance of the borrower's obligations to the lender.

- The rentals continue to be paid to the borrower / assignor until such time as the lender / assignee gives a demand in writing to the tenants to pay the rents to the assignee.

- The agreement stays in effective until all of the monies due under the mortgage have been paid in full.

- An Assignment of Rents Agreement is a good means of obtaining additional security for performance under a loan agreement. You can download it immediately following purchase.

- This form is governed by the laws of Canada.

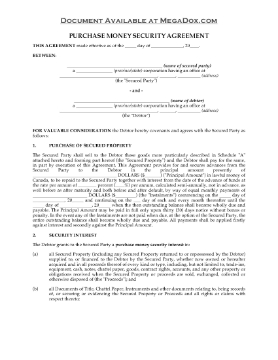

British Columbia Purchase Money Security Agreement

When you sell inventory on credit to a distributor, make sure you protect your security interest in those goods until you're paid in full under this Purchase Money Security Agreement for BC.

- The contract attaches a purchase money security interest (PMSI) to the goods being sold, which then become collateral under the Agreement.

- The supplier (secured party) extends credit to the customer (debtor) for the purchase of the inventory, and the debtor agrees to pay the purchase amount in a series of instalment payments.

- In return for being allowed to pay over time, the debtor grants the secured party a PMSI over the goods and over the proceeds that will be realized from the goods.

- This is a downloadable legal form intended for use in the Province of British Columbia, Canada.

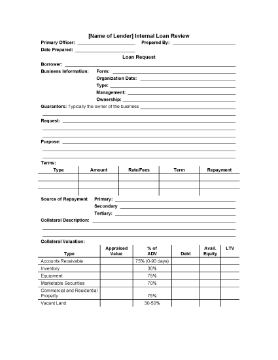

Business Loan Application | Canada

Use this customizable Business Loan Application for clients that are applying for loan funding for an existing or start-up business in Canada.The applicant must provide information about:

- the corporate structure and history of the business;

- the guarantors of the loan;

- the purpose of the loan and terms of repayment;

- what is being used as collateral;

- the financial status of borrower, assets, income, debts and liabilities, including copies of financial statements;

- the business experience of the owners.

You can download a copy of the Canada Business Loan Application immediately after you purchase it.

China Loan Agreement

Document a loan to an individual or a company doing business in China with this fully editable Loan Agreement template.

- The borrower agrees not to use the loan proceeds for any illegal purposes. If the borrower breaches this covenant. the lender may require immediate repayment of the loan.

- Each of the parties agrees not to disclose any information revealed in connection with the Agreement except with the prior written consent of the disclosing party, unless required for compliance with the laws and regulations of PRC.

- Taxes, fees or expenses payable as a result of the loan will be borne by the party exercising its rights, unless a certain party is otherwise required by law to pay the same.

- This Chinese legal form is available in English language version only. A Chinese translation of the document will also be required for it to be legally enforceable.

China Share Pledge Agreement

Pledge shares in a Chinese company as security for a debt obligation with this template Share Pledge Agreement for China.

- The shareholder of a company pledges to a lender certain shares of stock in the company, to be held by the lender as security to ensure that the company honors its payment obligation to the lender.

- The shareholder pledges the shares and the rights attached to the shares, including the right to receive dividends.

- The shareholder will not transfer, assign, encumber or dispose of the shares without the lender's written consent.

- The shareholder will pay for all of the lender's out of pocket costs and expenses, including legal fees, taxes and stamp duty.

This Share Pledge Agreement for China is provided in MS Word format, and is fully editable to meet your needs. This is an English-language form. A Chinese language version of the document may be required.

Commercial Loan Commitment Letter | USA

USA lenders, prepare a Commercial Loan Commitment Letter with this fully customizable template which sets out the terms of the loan and how it is to be repaid.

- The commitment letter template includes:

- monthly payments to be made into escrow for property taxes and hazard insurance,

- documents and other instruments to be given by the borrower as security,

- form and amounts of title insurance and hazard insurance required by the lender,

- payment of closing costs by the borrower,

- protection, preservation and maintenance of the property used as security,

- other standard provisions.

- This is a customizable template that can be used throughout the United States.

Commercial Loan Proposal Letter

Looking for a business loan? Prepare a Commercial Loan Proposal Letter for a lender with this easy-to-use template.

- You could use this template to source out a loan for expansion, research and development, enhancements to your product lines, or additional operating capital.

- The loan proposal letter outlines the company history and background, business operations for the past few years, the company's goals and objectives, equity and growth potential.

- A copy of the company's Business Plan should be included with your loan proposal, along with copies of the latest financial statements.

Demand for Satisfaction from Proceeds of Sale | Canada

Recoup money owed to you by a debtor from a sale of assets by serving this Canada Demand for Satisfaction from Proceeds of Sale on the party selling the collateral.

- The demand is given by a secured party to another secured party who is undertaking a sale of a debtor's assets.

- The party making the demand has no security interest in the items being sold, but is owed money under a loan agreement, mortgage, etc. by the debtor whose assets are being sold.

- This legal form can be used in any Canadian province or territory.

- This form is available as a downloadable MS Word document.