Loan Transaction Forms

Before you lend money, secure the loan and make sure you get repaid with these loan agreements and supporting documents.

- Download the templates, fill them in and have them signed before you advance the loan funds.

- Some forms are country-specific and comply with applicable national, state and provincial legislation. Other forms are generic and can be used in most jurisdictions.

- If you're lending money to a small business, it is also advisable to obtain Personal Guarantees from the business owners.

- Also check out our selection of Promissory Notes.

Tips for Getting a Loan Repaid

Don't let personal feelings sway your better judgment. Quite often people who cannot get a loan from a financial institution will turn to family members or close friends to help them out. And you will probably feel a personal obligation to do just that. If you insist they sign a loan agreement or a promissory note, the borrower may resist, insinuating that you don't trust them to repay the money. Do not get drawn into a guilt trip. There's a reason why a bank won't lend them the money, and for that same reason you shouldn't lend them the money either unless they are willing to put everything in writing.

Set the interest rate at a reasonable level. Check with your bank to see what its prime lending rate is, and add another percentage point. That's as good a rate as the borrower could expect to get on a line of credit.

Set attainable payment levels. Make sure the regular payments are high enough to pay off the debt within a reasonable time period, but not so high as to be difficult for the borrower to maintain.

- Have the borrower provide enough collateral security to back the loan. Get the borrower to sign over assets which can be sold if the borrower defaults in repaying the loan. Collateral could include real estate and rents from investment properties, motor vehicles, heavy equipment, valuable collections such as coins or jewelry, stocks, bonds, GICs and other investments.

General Assignment of Book Debts | Canada

Have a borrower sign over their book debts to secure the loan funding with this General Assignment of Book Debts template for Canada.

- The borrower assigns its book debts and accounts to the lender as general continuing collateral security for a commercial loan or credit facilities provided by the lender.

- The assignment gives the lender the right to collect, demand payment, sue, enforce, receive and recover the borrower's book debts.

- Available in MS Word format.

- Intended to be used only in Canada.

General Assignment of Rents and Leases | Canada

Before loaning money to a borrower, obtain an assignment of rental and lease income from their rental properties with this downloadable template for Canadian lenders.

- The borrower assigns to the lender the amount of all rents and leases payable by the tenants in any rental property owned by the borrower.

- The assignment is given as security for a mortgage loan or other monies being advanced to the borrower by the lender.

- The tenants will continue to pay the rent to the borrower unless and until the lender gives a written demand for it. This would only happen if the borrower defaults.

- The lender does not have any liability or obligation under the lease.

- The Assignment of Rents and Leases can be used in any Canadian province or territory except Quebec.

- Every commercial loan in Canada should include a General Assignment of Rents and Leases as part of its paperwork. Download the form today.

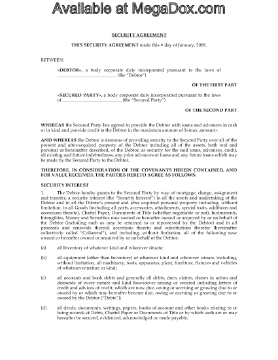

General Security Agreement | Canada

Secure a loan or line of credit with this General Security Agreement for Canadian lenders.

- The borrower grants the lender a security interest in all of the borrower's personal property (inventory, equipment, accounts and book debts), and all income and proceeds from that personal property.

- The General Security Agreement secures payment and performance of all of the borrower's present and future indebtedness to the lender, including the lender's costs of enforcing the Agreement.

- The borrower agrees to protect and preserve the collateral property, to keep it in good condition and repair, to pay all taxes and charges levied against it, and to keep it fully insured.

- So long as the borrower is not in breach of its obligations, the borrower retains possession of the collateral and can use it in the ordinary course of its business.

- This legal document template is intended for use only in Canada.

Inventory Security Agreement | Canada

Extend credit to your customers and secure payment of your accounts with this customizable Inventory Security Agreement for Canadian suppliers.

- The Agreement covers the customer's purchase of inventory, parts and accessories from the supplier.

- The supplier is given a security interest over all of the customer's present and future inventory, accounts, assets and property.

- Title to all inventory supplied remains with the supplier until the customer has paid in full.

- The customer may only sell the goods in the ordinary course of its business.

- This legal contract template is downloadable and editable to fit your business needs.

- Governed by Canadian laws and intended for use only in Canada.

Irrevocable Letter of Credit

Prepare an Irrevocable Letter of Credit with this easy-to-use template form.

- The Letter of Credit cannot be revoked before its expiry date.

- The Letter of Credit will be honored by the issuing bank upon written demand for payment by the beneficiary.

- The beneficiary must confirm in writing that the monies being drawn down will be used to meet the customer's obligations to the beneficiary.

- The Letter of Credit template contains optional provisions depending on whether or not the letter can be transferred to a successor of the beneficiary.

- The Letter of Credit is issued subject to UCP 600, 2007 Revision.

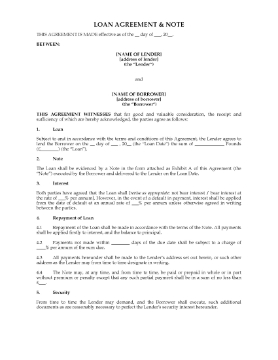

Loan Agreement and Note | UK

Document a loan transaction with this Loan Agreement and Note template for UK lenders.

- The Agreement contains alternative interest clauses, for either a fixed interest rate or for an interest-free loan, depending on the terms you have agreed upon.

- The Note can be paid in whole or in part without interest or penalty, except that any partial payments must be for at least a specified minimum amount.

- The loan becomes immediately due and payable upon any default by the borrower.

- The lender has the right to demand full repayment at any time upon proper written notice.

- Available in MS Word format.

- This agreement is governed by English law and is intended to be used only in the United Kingdom.

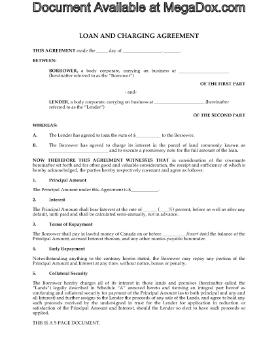

Loan and Charging Agreement | Canada

Canadian lenders can use this downloadable Loan and Charging Agreement to prepare loan documents for a borrower.

- The template includes both the Loan Agreement and a promissory note for the principal amount of the loan plus interest.

- The borrower agrees to register an encumbrance against title to real estate owned by the borrower, as collateral security for the loan.

- If the borrower defaults in repaying the loan, title to the property will be transferred to the lender.

- Available in MS Word format.

- Intended to be used only in Canada.

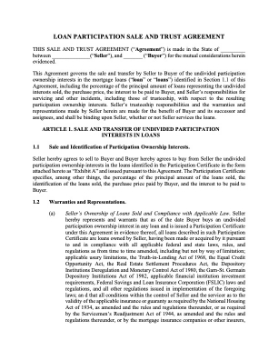

Loan Participation Sale and Trust Agreement | USA

Under this Agreement, a lead lender (Seller) participates in one or more loans by transferring an undivided participation ownership interest in the loan to another lender (Buyer).

- The Buyer receives a percentage yield on its interest, plus a pro rata participation in any interest collected.

- The Seller is entitled to the remainder of the interest plus any default penalties, late charges, etc.

- The Seller will act as trustee with fiduciary duties to hold the participation ownership and legal title to the loans and receipts, and to make the required remittances.

- The Seller, as trustee, will retain all loan documents, mortgage notes, and related items.

- The Seller will continue to service the loans in the same manner as it services loans for its own account.

- Available as a fully editable MS Word template.

- Intended to be used only in the United States.

Loan Security Forms Package | Canada

Are you loaning money or extending credit facilities to a customer or other party? Document your security interest as a creditor with this Loan Security Forms Package for Canadian lenders.

- The package contains the following forms:

- General Security Agreement,

- Unconditional Guarantee and Postponement of Claim,

- Promissory Note to be executed by the borrower.

- Available in MS Word format.

- Intended to be used only in Canada.

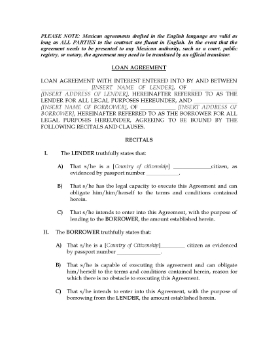

Mexico Loan Agreement

Draw up a Loan Agreement for a loan transaction in Mexico with this downloadable template form.

- The loan is made in US dollars, and all payments will be made in US dollars.

- The Loan Agreement calls for monthly payments on the principal and interest.

- The borrower agrees to sign one or more promissory notes as security for repayment of the loan.

- A penalty fee calculated as a percentage of the total loan amount will be levied for any noncompliance of the terms of the Loan Agreement by the borrower.