Product tags

Related products

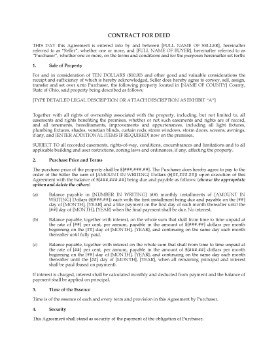

Ohio Installment Land Contract

An Installment Land Contract is used when you want to sell a property in Ohio and you plan to finance the purchase by allowing the buyer to pay the purchase price over time.

- An installment contract is also called a Contract for Deed, because at the end of the contract when the buyer has paid all of the amounts due under the contract, the seller transfers the title deed to the buyer.

- This type of contract is often used when selling property to a family member.

- You can only use the land contract for selling a property that has a home built on it, or a mobile home which is attached to the property. You can't use this contract to sell bare land.

- If the buyer fails to keep up the payments or does not perform any of its other obligations, the seller can repossess the property and keep all payments made as liquidated damages.

- The template includes a Lead Paint Disclosure, as required by federal laws.

- Intended to be used only in the State of Ohio.

$17.99

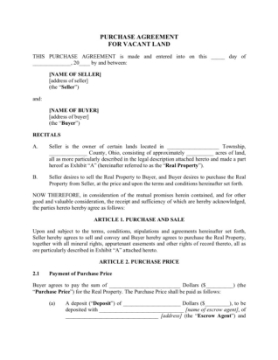

Ohio Purchase Agreement for Vacant Land

Buy and sell bare land in the State of Ohio with this Land Purchase Agreement.

- There is a 30-day period for satisfaction or waiver of the buyer's contingencies prior to closing. The closing date may be extended if agreed to by the parties.

- The escrow agent will hold the buyer's deposit and apply it to the purchase price as earnest money at closing. The balance of the purchase price will be paid over time under the terms of a promissory note, which will be secured by a pledge agreement.

- The purchase is contingent on the seller obtaining an acceptable Phase I environmental report on the property.

- The buyer must obtain a commitment for title insurance on the parcel.

- The buyer will be responsible for the costs of any desired surveys or additional environmental reports, as well as the cost of the title insurance. The seller will be responsible at its sole cost for curing any defects in title that are not acceptable to the buyer.

- At closing the seller will provide the buyer with a registrable warranty deed, a seller's affidavit regarding all off-record title matters, a FIRPTA affidavit, a closing statement, and any other documents that are necessary to complete the conveyance of the real property.

- Both parties agree to indemnify and hold the other party harmless from any commissions or broker's fees.

- Available in MS Word format. Fully editable.

- Intended to be used only in the State of Ohio.

$39.99

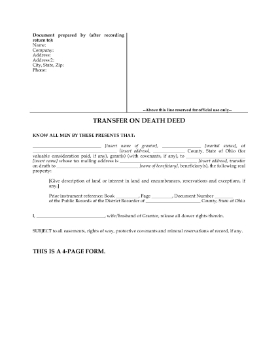

Ohio Transfer on Death Designation Affidavit

Avoid probate and transfer your real property to a beneficiary with this Ohio Transfer on Death Designation Affidavit.

- The Transfer on Death Designation Affidavit (also called a TOD Designation Affidavit) is signed and filed with the Recorder's Office before the original owner passes away.

- When the owner dies, the transfer is completed by filing a death certificate and an affidavit signed by any person who knows all of the facts (this person can be the beneficiary).

- Even though title to the property will transfer to the beneficiary, the original owner still has full ownership rights to the property and can mortgage, rent, lease, or sell the property, without the beneficiary's consent.

- The TOD Designation Affidavit does not any eliminate any estate taxes that are payable.

$6.29