Promissory Note Forms

Loaning money to someone? Selling a business or property on payment terms? Make sure you get paid - get the borrower or buyer to sign one of these Promissory Note Forms.

A promissory note is a promise by the borrower to pay back the money at the agreed rate of interest by a specified date. Once it is signed, it is a legally binding contract. Some jurisdictions require a promissory note to be executed in front of a notary.

Polonius said 'Neither a borrower nor a lender be. For oft loan loses both itself and friend.' Good advice! However, if you do plan to lend money to anyone (including family and friends), then put it all in writing and signed before you hand over a penny. Otherwise you run a very significant risk of never seeing your money again.

Installment Note with Prepayment Fee | Canada

This form of Installment Promissory Note is for a loan that is backed by collateral belonging to the borrower.

Repayment Terms

The principal amount of the loan, along with the accrued interest, will be repaid through a series of regular, fixed installment payments.

Prepayment Option

The borrower has the ability to prepay the Note before the final due date. However, if the borrower chooses to pay off the loan early, the lender will impose a prepayment fee as a condition for early repayment.

Default and Acceleration

In the event the borrower fails to make a scheduled payment, or if the borrower becomes bankrupt or insolvent, the entire outstanding balance of the loan, including all interest, becomes immediately due and payable.

Collateral and Lender Rights

If the borrower defaults on the loan, the lender is entitled to dispose of the pledged collateral. The lender may choose to sell the collateral privately or through a public auction.

Format and Legal Jurisdiction

The Installment Note with Prepayment Fee template is a downloadable MS Word document that is editable and reusable. Once you pay for the form, it's yours. There are no license fees or subscriptions.

This legal document can be used throughout Canada. English-language version only.

Interest-Free Demand Promissory Note

Secure repayment of an interest-free loan with this downloadable Demand Promissory Note for principal only (no interest).

- This type of Promissory Note would most commonly be used when the borrower and the lender have a close relationship, such as family members, when no interest would be charged on the loan balance.

- The form is a generic template which can be used anywhere.

- This Demand Promissory Note with No Interest form is available in MS Word format and is easy to use. Just download, fill in with the details of the transaction, and print.

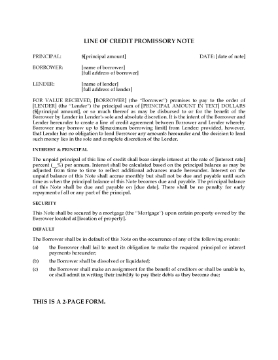

Line of Credit Promissory Note

If you are offering a line of credit to a customer, secure your interest with this Line of Credit Promissory Note form.

- The Note allows for multiple advances, up to a specified maximum amount.

- Interest on the secured amount is simple interest, accruing monthly.

- The Note is secured by a mortgage on the Borrower's property.

- There is no prepayment penalty.

- This is a generic legal template which is not specifically written for any country, state or province.

- This form is provided in MS Word format and is easy to customize.

Mississippi Balloon Promissory Note

Secure the repayment of a loan in Mississippi with this easy template Balloon Promissory Note.

- The borrower agrees to make a series of equal monthly payments against the secured amount, until the date of the final payment which will be a balloon payment, i.e. payment in full of the entire balance of principal and interest outstanding at that date.

- The borrower may make additional payments in addition to the monthly installments by paying a prepayment penalty, which will be reduced each year of the term of the Note.

- Any finance charges payable to the lender will conform to the usury laws of the State of Mississippi.

Add the Balloon Promissory Note to your shopping cart and pay for it via the secure checkout. Then download it, fill it in, print it and get it signed.

Mortgage Promissory Note | USA

This Promissory Note form is for loans that are backed by a mortgage against the borrower's real property.

- You can use the template in any U.S. state.

- There is no prepayment penalty or premium if the borrower prepays the loan in whole or in part.

- If the borrower defaults under the note or the mortgage, the borrower promises to pay interest at the highest rate allowed by law.

- The borrower will pay any collection costs incurred by the lender, including reasonable legal fees.

- Intended to be used only in the United States.

- Available in MS Word format.

Multistate Fixed Rate Note (Biweekly) | USA

Prepare a Promissory Note for a mortgage loan to be paid in biweekly payments with this USA Multistate Fixed Rate Note template.

This Promissory Note is designed for use as part of a mortgage loan transaction. It is suitable for use in most U.S. states.

Borrower's Promise to Pay

By signing this Note, the borrower agrees to pay the principal amount of the loan, as well as interest and any applicable late charges or loan fees as permitted by the lender.

Payment Schedule and Application

Loan payments are required every two weeks (biweekly). Each payment will be applied in the following order: first, to any late charges if they exist; second, to accrued interest; and finally, any remaining amount will be applied toward reducing the principal balance.

Late Payment and Lender's Rights

If the borrower fails to make payments on time, the lender reserves the right to terminate the biweekly payment schedule. In such cases, the lender may require that all future payments be made on a monthly basis instead.

Security for the Loan

This Promissory Note may serve as security for a loan in connection with a mortgage, deed of trust, or security deed.

Format

The template is available in Microsoft Word format for easy use and customization.

Notice of Default on Note and Demand for Payment

Prepare a Notice of Default on Note and Demand for Payment with this easy-to-use form.

- The Notice of Default is given by a creditor who holds a promissory note, to a debtor who has defaulted on an installment payment under the note.

- The creditor demands that the debtor immediately pay the outstanding amount owing on the note.

- Buy the form, download, fill in the blanks, print - use it as often as you like.

- This Notice of Default on Note and Demand for Payment form is a generic template (not country-specific) and is fully editable.

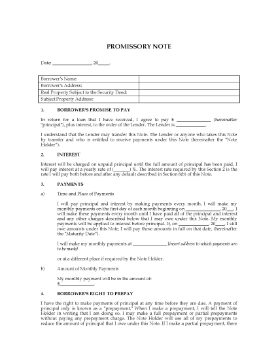

Plain Language Promissory Note | USA

USA lenders, secure repayment of a loan with this Plain Language Promissory Note.

- The Promissory Note form is drafted in language that is clear, concise, and easy for a borrower to understand.

- The principal and interest are to be repaid by a series of equal monthly installment payments.

- Any amount of principal and/or interest not paid on time bears late charges calculated as a percentage of the overdue payment amount.

- The template is not State-specific and can used anywhere in the United States.

- This is a downloadable and customizable legal form template in MS Word format.

Promissory Note (Debt Forgiven on Death of Lender)

If you are loaning money to a family member or close friend, you can secure the loan with this Promissory Note to be Forgiven on Death.

- This promissory note template provides that the balance outstanding on the loan will be forgiven when the lender dies.

- The borrower agrees to make monthly payments against the loan secured by the promissory note.

- The borrower can prepay the full amount at any time without paying a prepayment penalty.

- If the lender dies before the loan is completely repaid, any balance remaining unpaid at that time is forgiven.

- This Promissory Note to be Forgiven on Death of Lender form is a downloadable MS Word file which can be used anywhere.

Promissory Note (Regular Payments, No Interest)

This promissory note template is made by a borrower to secure an interest-free loan to be repaid by regular payments.

- The Promissory Note allows the borrower to repay the loan in monthly, weekly, or bi-weekly payments.

- No interest will be charged on the outstanding loan balance. The borrower will only be repaying the principal amount.

- This is a generic legal form which can be used anywhere.

- You can download the form immediately after purchasing it.