Products tagged with 'estate executor form'

Sort by

Display per page

Executor Fee Agreement

Arrange for the executor of your estate to be paid for their services with this Executor Fee Agreement.

- The purpose of the Agreement is to ensure that the person you name in your Will to act as executor of your estate is fairly compensated by setting out the amount of the fee and how it will be paid.

- This is a generic legal document which is not specific to any country or region.

- The template is fully editable to fit your circumstances.

- This Executor Fee Agreement template is available in MS Word format.

$12.49

Survivor Checklist | USA

This Survivor Checklist will guide you through the tasks that need to be dealt with when a loved one passes away, at a time when it is most difficult to deal with such matters.

- This checklist is for the United States and makes reference to US forms and procedures.

- The checklist will help you focus on the necessary tasks and gather the items needed by the executor or administrator (personal representative), including:

- actions that must be taken immediately following the person's death by the spouse, family or personal representative,

- items that must be attended to within a reasonable period of time following the death, such as paying the deceased's creditors and applying for Social Security benefits for the spouse and minor children,

- documents that must be obtained in order to administer the estate,

- procedures for transferring title to the deceased's property.

- Available in MS Word format.

- Intended to be used only in the United States.

$6.29 $5.99

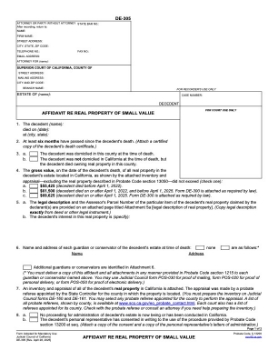

California Affidavits for Release of Estate Property without Probate

Prepare Affidavits to release the property of a deceased person without probate with this package of template California forms.

- If you are acting as executor of an estate in California which is not going through probate or administration, you will require affidavits from the beneficiaries under the Will before you can release property to them.

- This package contains:

- Affidavit re Real Property of Small Value (Form DE-305), rev. April 28, 2025.

- Affidavit Under Probate Code S. 13101 (Probate Affidavit), rev. 2015.

- Affidavit for Collection of Personal Property, to transfer property such as bank accounts, stocks or items held in safe deposit boxes, rev. Jan. 1, 2020.

- Available in PDF format.

- Intended to be used only in the State of California.

$0.00

Receipt and Release by Beneficiary of Estate

Estate executors, when you distribute property to the beneficiaries as set out in the Will of the deceased, have each of them sign this Receipt and Release form.

- The beneficiary acknowledges receipt of the estate property.

- The beneficiary releases the executor from any liability in connection with the beneficiary's interest in the estate.

- The beneficiary indemnifies the executor against any claims with respect to the distribution.

- This is a reusable form which you can use each time you make a distribution of estate assets to a beneficiary.

- The form can be used in any jurisdiction which does not have a statutory form.

$2.49

California Affidavit of Surviving Spouse

File this California Affidavit of Surviving Spouse if you and your spouse owned property which was NOT held as community property before he or she passed away.

- The Affidavit is made under California Probate Code section 13540.

- The surviving spouse states that he/she and the deceased spouse at all times considered the property to be community property.

- The Affidavit must be filed 40 days after the decedent's death to protect the interest of your successors in title and that of other parties with an interest in the property (such as title insurers).

- The affiant must also attest that no election to probate the deceased's interest in the property has been or will be filed.

- Available in MS Word format.

- Intended to be used only in the State of California.

$6.29

New Jersey Executor's Deed

If a deceased person owned real estate property in New Jersey, the executor of the estate can file this Executor's Deed in order to transfer ownership of the property.

- The person signing the Deed as grantor must be the person who is acting as executor (personal representative) of the estate.

- The property is transferred to the grantee named in the Deed for the amount stated, and the grantor acknowledges receipt of the amount.

- The form is available in MS Word format. If there are several properties to be transferred, you can use this template for each one.

- For use only in the State of New Jersey.

$6.50

Recently viewed products