Products tagged with 'succession planning form'

Sort by

Display per page

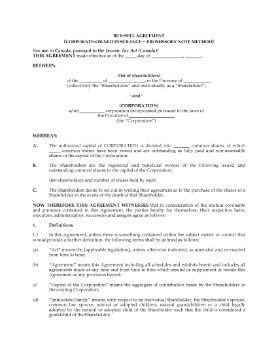

Shareholder Buy-Sell Agreement (Corporate Redemption Method) | Canada

Would your business survive the death or retirement of one of the owners? Provide for the continued existence of the business with this Canada Shareholder Buy-Sell Agreement (Corporate Redemption Method).

- The corporation obtains life insurance policies on each of the shareholders and uses the proceeds to fund the redemption, acquisition or cancellation of the corporation's shares.

- Upon the death of a shareholder, the corporation redeems the deceased shareholder's shares and makes an election that the deemed dividend is to be paid from the capital dividend account to the extent possible.

- The Agreement contains several different options for methods of valuating the shares.

- The Agreement is made pursuant to the Income Tax Act (Canada).

- This Shareholder Buy-Sell Agreement (Corporate Redemption Method) is available as a downloadable and fully editable MS Word template.

$29.99

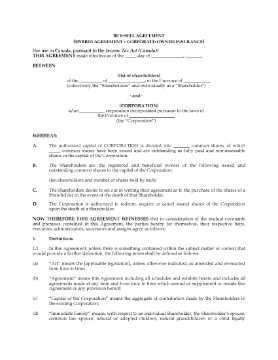

Shareholder Buy-Sell Agreement (Promissory Note Method) | Canada

Plan ahead for the continuation of your business upon the death or retirement of an owner with this Shareholder Buy-Sell Agreement (Promissory Note Method) for Canadian companies.

- The corporation will hold life insurance policies on each of the shareholders and use the proceeds to redeem and acquire its own shares from a deceased shareholder's estate.

- If a shareholder dies, the surviving shareholders can purchase the deceased's shares on a pro rata basis (proportionate to their current shareholdings) by issuing the corporation a promissory note for the purchase price.

- The corporation will loan the purchaser the amount of the purchase price from the insurance proceeds, and then makes an election for a deemed dividend to be paid from the capital dividend account if possible.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

$29.99

Shareholder Buy-Sell Agreement - Hybrid Method | Canada

The Canada Shareholder Buy-Sell Agreement (Hybrid Method) is an option that Canadians can consider to put a succession plan in place for the continuity of their small business.

- This type of buy-sell agreement is known as a 'hybrid' buy-sell.

- Under this Agreement, the corporation holds life insurance policies on each of the shareholders.

- Upon a shareholder's death, the corporation will collect the insurance proceeds, and use the proceeds to fund the purchase of the deceased shareholder's shares by any of the surviving shareholders who are interested, on a pro rata basis (proportional to their existing shareholdings).

- Any unpurchased shares will be redeemed by the corporation.

- The corporation will make an election for a deemed dividend to be paid from the capital dividend account if possible.

- The Agreement is governed by Canadian income tax laws.

- This legal contract form is available in MS word format and is fully editable.

$29.99

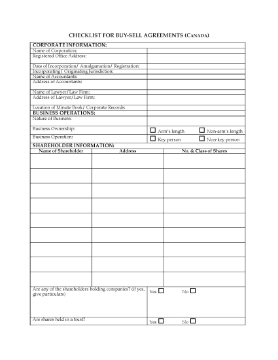

Checklist for Shareholder Buy-Sell Agreement | Canada

Learn how to prepare a Shareholder Buy-Sell Agreement with this checklist for Canadian companies.

- What would happen to your business if one of the owners dies or is no longer able to work? A Shareholder Buy-Sell Agreement provides for continuity of the business in those events.

- Topics included in the Checklist are:

- qualification of shares for capital gains exemption;

- provisions of any existing formal shareholder agreement;

- terms of purchase or redemption (or both) of a deceased shareholder's shares using proceeds of life insurance policies on the life of the deceased;

- whether life insurance policies will be held by the corporation, by the other shareholders or by a trustee.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

$12.49

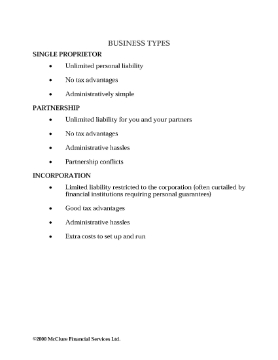

Business Succession Planning in Canada

Plan for the future of your small business - learn what you need to know about Business Succession Planning in Canada with this 8-page expert guide.

The guide describes the different types of business structures under Canadian laws, the pros and cons of each type of corporate entity. In addition, it discusses:

- how to extract value from your business,

- corporate investing,

- exit strategies,

- family businesses,

- tax planning and estate freezes.

Business Succession Planning in Canada is intended for Canadian businesses and is provided in PDF format.

$0.00

Ontario Shareholder Buy-Sell Agreement

Ensure the continuity of ownership and management of your business with this Shareholder Buy-Sell Agreement for Ontario.

- The Agreement includes:

- a procedure for soliciting offers from third parties;

- the remaining shareholders have right of first refusal to purchase shares of a departing shareholder;

- the remaining shareholders have the right to piggyback the sale of their shares onto a proposed sale of more than 50% of the shares;

- a mandatory (shotgun) buy-sell;

- a mandatory buyout on death, to be funded by proceeds of a life insurance policy on the life of the deceased shareholder.

- This template is available in MS word format and is easy to customize to fit your circumstances.

- Intended to be used only in the Province of Ontario, Canada.

$29.99