Products tagged with 'united states mortgage form'

Multistate Fixed Rate Note (Biweekly) | USA

Prepare a Promissory Note for a mortgage loan to be paid in biweekly payments with this USA Multistate Fixed Rate Note template.

This Promissory Note is designed for use as part of a mortgage loan transaction. It is suitable for use in most U.S. states.

Borrower's Promise to Pay

By signing this Note, the borrower agrees to pay the principal amount of the loan, as well as interest and any applicable late charges or loan fees as permitted by the lender.

Payment Schedule and Application

Loan payments are required every two weeks (biweekly). Each payment will be applied in the following order: first, to any late charges if they exist; second, to accrued interest; and finally, any remaining amount will be applied toward reducing the principal balance.

Late Payment and Lender's Rights

If the borrower fails to make payments on time, the lender reserves the right to terminate the biweekly payment schedule. In such cases, the lender may require that all future payments be made on a monthly basis instead.

Security for the Loan

This Promissory Note may serve as security for a loan in connection with a mortgage, deed of trust, or security deed.

Format

The template is available in Microsoft Word format for easy use and customization.

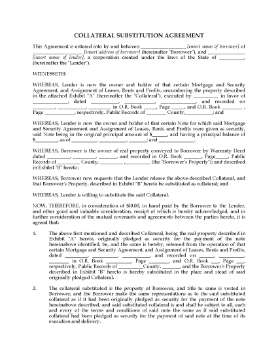

Collateral Substitution Agreement | USA

Replace the property which is collateral for a mortgage with a different one under this Collateral Substitution Agreement.

Purpose of Agreement

This Collateral Substitution Agreement would be used by a mortgage lender in circumstances where a borrower wants to sell their mortgaged property in order to buy another property of approximately equal value.

The original real estate property is released from the mortgage, and the borrower's new property replaces the original one as collateral for the mortgage.

Original Provisions to Remain in Effect

The provisions of the original promissory note and all other loan documentation respecting the mortgage will remain in full force and effect against the borrower and the new property.

Format and Scope of Use

The Collateral Substitution Agreement is available in MS Word format and is fully editable and reusable, making it flexible and cost-effective.

This legal document is intended for use within the the United States. It does not contain any state-specific references.

Balloon Mortgage and Security Agreement | USA

Prepare a Balloon Mortgage and Security Agreement for borrowers with this easy-to-use template.

- The entire unpaid balance of the mortgage loan and interest is due on the maturity date.

- The borrower (mortgagor) will pay all taxes, rates and assessments levied against the mortgaged property.

- The borrower must keep the mortgaged property insured for such risks and in such amounts as the lender may require.

- The borrower must get the lender's consent before making any alterations to the property, and must maintain the property in good condition and repair.

- If the borrower attempts to transfer all or any part of the property, the mortgage loan plus interest will immediately become due.

- The borrower waives all right of homestead exemption in the property.

- The mortgage will secure not only the borrower's existing debt to the lender, but any future advances made within 20 years of the date of the mortgage to the same extent as if they were made on the date of execution of the mortgage.

- This template is not state-specific. Some state laws require specific wording to be added to balloon mortgages. Check your state legislation online for details.

- Intended to be used only within the United States.