Accounts Receivable and Credit Forms

Manage your accounts receivable and credit accounts with these convenient forms for credit managers, AR departments, controllers and collections agencies.

- Collections forms, demand letters for arrears, and notices of pending legal action.

- Customer forms to extend credit to new accounts and manage your current credit accounts.

- Legal documents for settling overdue accounts.

- Agreements for factoring and brokering receivables to increase cash flow and enhance your operating capital.

Sort by

Display per page

Factoring and Security Agreement with Limited Recourse | Canada

Purchase accounts receivable from Canadian companies with this Factoring and Accounts Receivable Security Agreement with Limited Recourse.

- Under this Agreement (also called a debt purchase contract), a company needing cash for operations sells its accounts receivable to a factor for an immediate cash injection, at a discounted rate off the face value of the accounts.

- The factor has only limited recourse against the seller for the amount of any receivable which is not paid or disputed by a customer, plus interest on unpaid accounts, up to a predetermined limit.

- The factor will also pay the seller any excess funds received by the factor on customer accounts.

- This legal contract template is available in MS Word format.

- Governed by Canadian laws and intended for use only in Canada.

$29.99

Merchant Cash Advance Agreement | USA

Make a cash advance to a US merchant against its future credit card receivables with this template USA Merchant Cash Advance Agreement.

- The merchant sells to the cash advance company all of its right in a percentage of its future credit card sales for an immediate cash injection, until a specified amount has been paid.

- The purchase and sale of the credit card receivables constitutes a sale of accounts under the Uniform Commercial Code, which vests full ownership in the cash advance company. The merchant has no right to repurchase or resell the receivables.

- The merchant will authorize the credit card company to pay the credit card sales directly to the cash advance company until the specified amount is paid.

- The merchant also grants the cash advance company a security interest in its accounts, inventory, assets, property, all future receivables, and the proceeds thereof.

- The agreement also contains a Personal Guaranty form, to be given by the principal(s) of the merchant, who agree(s) to assume all of the merchant's obligations under the agreement.

- This template is a downloadable and fully editable Microsoft Word document.

- Intended to be used only in the United States.

$29.99

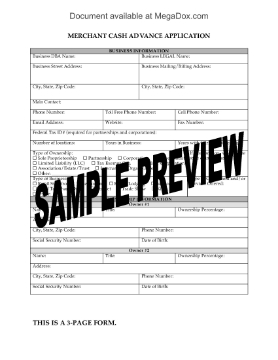

Merchant Cash Advance Application Form | USA

Does your firm make cash advances to merchants against future credit card receivables? Sign up clients with this Merchant Cash Advance Application Form for the USA.

- The information required in the 3-page application form includes:

- information about the merchant's business,

- information about the owners of the business,

- financial and sales information,

- disclosure about liens, lawsuits or judgments against the business.

- This is a downloadable and fully editable Microsoft Word document. Buy the form once, use it as often as required.

- Intended for use in the United States only.

$4.99

Merchant Cash Advance Letter to Credit Card Processor | USA

Notify a credit card transaction processor of a cash advance made to a merchant against its credit card receivables with this template Merchant Cash Advance Letter to Credit Card Processor.

- The letter should also be sent to the credit card issuer.

- The letter sets out the details of the merchant's agreement with the cash advance lender, and instructs the processor to pay a percentage of the credit card receipts to the lender until further written notice is given by the lender and the merchant. All amounts in excess of that percentage will continue to be paid to the merchant.

- The lender's rights under the merchant cash advance agreement are subject to the rights of the credit card processor and the bank.

- The lender and the merchant indemnify and hold harmless the bank and the credit card processor against any claims, losses or liability whatsoever arising from any action taken by the bank or the processor under the terms of the letter.

- This USA Merchant Cash Advance Letter to Credit Card Processor is a downloadable and fully editable Microsoft Word template.

$12.49

Request for Credit Reference

Request a credit reference for a new corporate customer with this easy-to-use template form.

- The form consists of a cover letter to a supplier that already provides credit facilities to the customer and an information sheet to be filled in by the supplier and returned to you.

- Ask for credit references from several suppliers which already deal with your customer.

- The responses you receive will help you determine what the creditworthiness of the customer is, and decide whether or not to extend credit facilities.

- You can re-use the Request for Credit Reference form, edit it as you like, and tailor it for your business.

- This generic MS Word template can be used anywhere.

$2.49

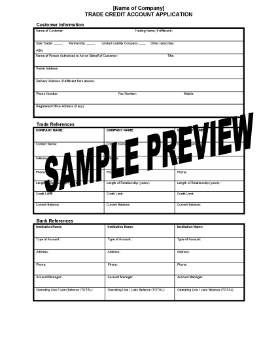

Trade Credit Application | Australia

Set up new customer credit accounts with this Trade Credit Application form for businesses in Australia.

- Applicants must provide trade references and bank references.

- The form includes a statement by the applicant under Section 18 of the Privacy Act 1988 regarding the provision, access and exchange of credit information.

- The application also includes the required notice to applicant for credit under Section 18E(1) regarding disclosure of credit information to a reporting agency.

- Available in MS Word format.

- Intended for use only within Australia.

$12.49

UK Customer Settlement Statement

Settle an outstanding customer account under a consumer credit agreement / hire purchase with this sample Customer Settlement Statement.

- The Statement is made in accordance with regulation 3 of the Consumer Credit (Settlement Information) Regulations 1983, as amended by Consumer Credit (Early Settlement) Regulations 2004.

- The customer may or may not be entitled to a rebate. For that reason, the form includes both options. Just choose the one you want and delete the other.

- This template can be used throughout the United Kingdom.

Don't write off bad debt if you can come to a reasonable agreement with a delinquent customer. Download the UK Customer Settlement Statement for your credit office.

$2.29

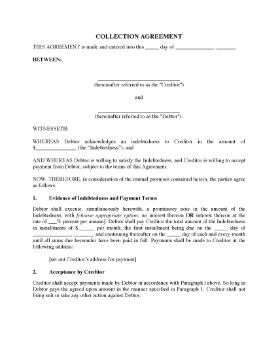

USA Debt Collection Agreement

Work out a debt repayment arrangement with a debtor under the terms of this USA Debt Collection Agreement.

- The creditor agrees to accept payment of an outstanding debt from a debtor (customer) through regular monthly payments.

- The debtor must also sign a promissory note to secure the outstanding balance.

- As long as the debtor continues to make the payments on time, the creditor agrees not to take any legal action against the debtor.

Getting paid over time is always preferable to starting a lawsuit. Give your overdue customers another option with the USA Debt Collection Agreement.

$12.49