Financial

Create paperwork for your financial transactions and do your tax planning with these downloadable legal documents from MegaDox.com.

- Download customizable and reusable templates for lending, borrowing, and collecting money.

- We offer easy-to-use documents and information to help you manage your debt, accounts payable and receivables.

- Protect your assets and lower your taxes with effective tax planning strategies.

- Download template mortgages, bills of sale, loan agreements, promissory notes, and supporting documentation.

- Find information and forms to help you with retirement and succession planning.

Jurisdictions Covered

MegaDox.com carries financial contracts, forms and documents for buyers and sellers, lenders and borrowers in various countries, including Canada, the United States, Australia, United Kingdom, New Zealand, Mexico, China and India.

Browse through our catalog of professionally prepared documents.

Access a comprehensive library of professional, well-written documents that are affordable, reusable, and fully editable.

These forms are not AI-generated. They were prepared and vetted by financial professionals.

MegaDox.com offers instant access and flexible purchasing options.

- Instantly download forms that can be easily customized to fit your specific requirements.

- There is no subscription required—pay as you go, purchase only the documents you need when you need them.

- All forms are reusable. Buy once, use as often as required.

- Monthly, half-yearly, and annual subscription options are available on request.

Sort by

Display per page

Connecticut Contract for Deed

If you are selling a real estate property in Connecticut, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- Available in MS Word format, fully editable to fit your exact circumstances.

- Intended to be used only in the State of Connecticut.

$17.99

Connecticut Open End Mortgage Deed

Grant a mortgage over a residential property with this Connecticut Open End Mortgage form.

- The mortgage form contains both uniform (multistate) covenants and non-uniform covenants for acceleration, release / satisfaction, waiver of homestead exemption, and future advance, pursuant to Connecticut laws.

- The mortgage is being granted to the lender as additional security for a mortgage loan, plus any additional prepayment or late payment charges, plus interest on all of the indebtedness.

- This mortgage form is a downloadable and fully editable legal template in MS Word format.

- Intended to be used only in the State of Connecticut.

$17.99

Convertible Debenture

Issue debentures as security for funding with this downloadable Convertible Debenture template.

- The Debenture is issued by a corporation to a lender as security for a commercial loan.

- The Debenture is convertible into shares in the capital of the corporation at any time prior to the repayment of the principal amount of the loan (but not including any accrued but unpaid interest).

- This is a generic legal form which is not specific to any country, state or province.

- The Convertible Debenture template is fully editable and can be easily customized to meet your needs.

$12.49

Convertible Debenture Certificate with RRSP and RRIF Eligibility | Canada

Issue debentures to investors and lenders with this Canada Convertible Debenture Certificate with RRSP and RRIF Eligibility.

- The Debenture has a 21-year term.

- This is a qualified investment for RRSP and RRIF funds under the Income Tax Act.

- The Debenture is convertible into shares of the issuing corporation.

- Available in MS Word format.

- Governed by Canadian tax laws and intended for use only in Canada.

$6.29

Co-Ownership Agreement for Syndicated Mortgage | Canada

Raise funds to complete a development through the sale of syndicated mortgage interests with this Co-Ownership Agreement for Canadian land developers.

- The agreement is between the various investors (co-owners of undivided interests in the syndicated mortgage), a trustee holding the land and an agent acting on behalf of the co-owners.

- The co-owners grant the agent power to act as attorney on their behalf with respect to leasing, subdividing, rezoning, sale or otherwise dealing with the lands which are subject to the mortgage.

- The mortgaged lands are registered in the name of the trustee, who holds the lands in trust for the co-owners. The co-owners each hold an undivided interest in the lands as tenants-in-common.

- The agent will collect funds under the mortgage on behalf of the co-owners and make distributions to the owners from those funds.

- The agreement provides for meetings of co-owners, and the keeping of books, records and financial information by the agent.

- This form is part of the paperwork required for a syndicated mortgage investment in Canada.

$29.99

Corporate Resolutions re Syndicated Mortgage | Canada

Use these templates to prepare corporate resolutions for a Canadian corporation to make a loan under a syndicated mortgage.

- The resolutions authorize the corporation to:

- lend money to a related corporation (typically a land development company) under the terms of a syndicated mortgage on the lands owned by the borrowing company, and

- enter into a co-ownership agreement with the investors who purchase fractional interests in the mortgage.

- This package of templates is available as a downloadable MS Word file.

- Intended for use only for corporations incorporated in Canada.

$6.29

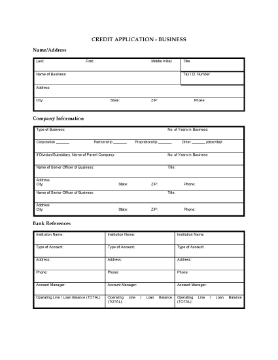

Credit Application Package for Corporate Customers

Your corporate customers can apply for a credit account with your company by filling out these Credit Application forms.

The package includes:

- Credit Application Form for Business;

- Credit Check form, for obtaining information from the trade and banking references supplied by the customer;

- template letter of refusal, to notify the customer if the application for credit has been denied due to the results of the credit check.

This Credit Application Forms Package for Corporate Customers is a downloadable MS Word file which can be filled in by hand or computer.

$4.99

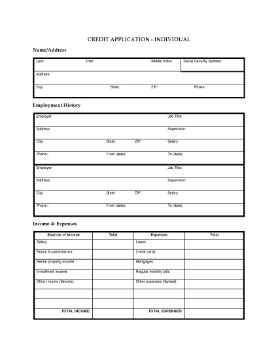

Credit Application Package for Personal Accounts

Extend credit to individuals with this Credit Application Package for personal accounts.

- The package includes:

- Credit Application for Individual, to be completed by the customer;

- Credit Check, to gather information from employment and banking references supplied by the customer;

- Letter of Refusal, to notify the customer if the application for credit has been denied due to the results of the credit check.

- The Credit Application forms package for personal accounts is easy to download and use. You can customize it to reflect your unique business image.

$4.99

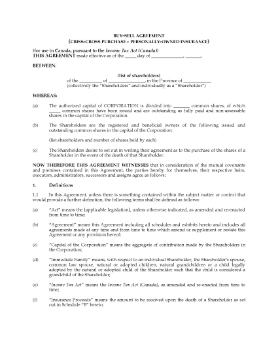

Criss-cross Shareholder Buy-Sell Agreement | Canada

Have you started succession planning for your business? Ensure continuity of ownership and management with this Criss-Cross Shareholder Buy-Sell Agreement for Canada.

- The Buy-Sell Agreement provides for the purchase of one shareholder's interest by the other shareholder upon the death of the first shareholder.

- The purchase is made by a method called the 'criss cross' method. That means that each shareholder holds a life insurance policy on the other shareholder, and the deceased shareholder's shares are purchased using the proceeds of the life insurance.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

$29.99

Criss-Cross Shareholder Buy-Sell Agreement with Trustee | Canada

Ensure the continuity of ownership and management of your company, even if one of the owners dies, with this Shareholder Buy-Sell Agreement for Canadian businesses.

- The shareholders have appointed a trustee for the purpose of holding life insurance policies on each shareholder in trust to the benefit of the other shareholders.

- If a shareholder dies, the trustee, on behalf of the surviving shareholders, will purchase the deceased's shares in the company using the proceeds of the life insurance.

- This is a fully editable legal form in MS Word format which can be customized to fit your circumstances.

- Governed by Canadian tax laws and ntended to be used only in Canada.

$29.99