USA Mortgage Forms

Secure repayment of a home buyer loan with these template USA Mortgage Forms.

- Do-it-yourself notes, loan agreements, assignments, affidavits and other legal documents for mortgage lenders.

- Purchase mortgage forms for your State.

- These forms can be re-used as often as required.

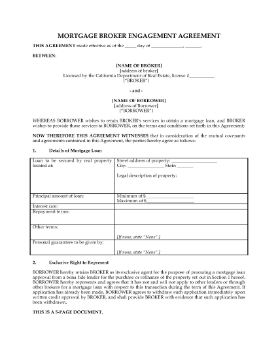

California Mortgage Broker Agreement

Mortgage brokers in California can sign up clients for their services with this customizable contract template.

- The borrower retains the broker as its exclusive agent for obtaining mortgage loan approval from a lender.

- The broker will obtain a credit report and property appraisal, and prepare the loan application.

- Provisions covering the broker's compensation based on the rate and fee combination that the borrower chooses.

- The broker agrees that no hidden compensation will be received from the lender or any other source.

- The borrower agrees to provide the broker with truthful and complete information as required for the purpose of the loan application.

- The broker stipulates that there is no guarantee or promise that the borrower will obtain a mortgage loan as a result of the broker's efforts.

- The parties agree to binding arbitration in the event of a dispute.

You can download the Mortgage Broker Agreement right after you purchase it. See how easy your client paperwork can be with a good digital template!

California Notice of Default

Has a borrower failed to make a payment on time under their mortgage or contract for deed? You can now serve this Notice of Default under Section 2924 of the California Civil Code.

- The Notice must be filed and served properly before you can take possession of the mortgaged property.

- The Notice instructs the borrower on how to remedy the default, and how many days s/he has to take action.

- The form also contains a copy of the applicable Section of the Civil Code.

The foreclosure process starts here. Get your copy of the California Notice of Default form and start the ball rolling.

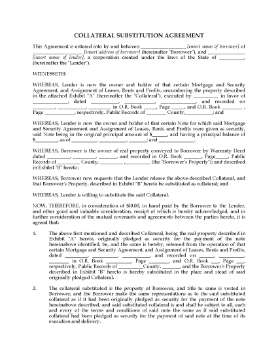

Collateral Substitution Agreement | USA

Replace the property which is collateral for a mortgage with a different one under this Collateral Substitution Agreement.

Purpose of Agreement

This Collateral Substitution Agreement would be used by a mortgage lender in circumstances where a borrower wants to sell their mortgaged property in order to buy another property of approximately equal value.

The original real estate property is released from the mortgage, and the borrower's new property replaces the original one as collateral for the mortgage.

Original Provisions to Remain in Effect

The provisions of the original promissory note and all other loan documentation respecting the mortgage will remain in full force and effect against the borrower and the new property.

Format and Scope of Use

The Collateral Substitution Agreement is available in MS Word format and is fully editable and reusable, making it flexible and cost-effective.

This legal document is intended for use within the the United States. It does not contain any state-specific references.

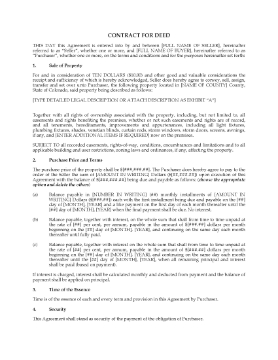

Colorado Contract for Deed

If you have a buyer for your home who can't qualify for a mortgage, you can carry all or part of the purchase price under this Contract for Deed.

- This legal template is governed by Colorado laws.

- A Contract for Deed is also referred to as a purchase money mortgage, owner financed mortgage, land contract, and installment agreement.

- The buyer has possession of the property as long as he/she is not in default.

- The seller can still sell or mortgage the property, but if the seller fails to make the mortgage payments, the buyer has the right to make them and the seller will reimburse the buyer.

- If the buyer defaults the seller can terminate the agreement and retake possession of the property. All payments made by the buyer are forfeited.

- Available in MS Word format.

Colorado Deed of Trust

Secure a home loan in Colorado with this easy-to-use Deed of Trust form.

- The Deed of Trust is used to secure the loan instead of a mortgage.

- A third party trustee must be named to hold title to the property until the loan, interest and any related charges are paid in full. Colorado law requires this to be a public trustee.

- If the borrower breaches the provisions of the Deed of Trust, the home will be foreclosed.

- The form contains all the necessary standard uniform and non-uniform covenants and provisions required by State and federal laws.

- Available in MS Word format.

- Intended for use only in the State of Colorado.

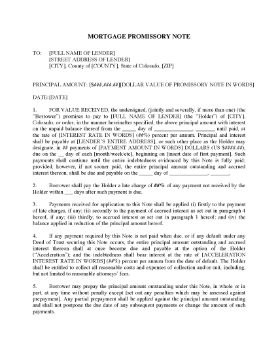

Colorado Mortgage Promissory Note

This Colorado Mortgage Promissory Note is part of the collateral security documentation for a home loan.

- Payments. The mortgagor will make regular payments of principal and interest until the balance is paid in full.

- Interest is a fixed rate.

- Acceleration. The balance owing becomes due and payable immediately if the borrower defaults in making any payment.

- Late payments result in late charges being assessed, which are calculated as a percentage of the late payment.

- Prepayment. The borrower may prepay the loan either with or without penalty, at the lender's discretion when writing up the Note.

- Available in MS Word format, easy to download, fill in and print.

- Intended to be used only in the State of Colorado.

Connecticut Contract for Deed

If you are selling a real estate property in Connecticut, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- Available in MS Word format, fully editable to fit your exact circumstances.

- Intended to be used only in the State of Connecticut.

Connecticut Open End Mortgage Deed

Grant a mortgage over a residential property with this Connecticut Open End Mortgage form.

- The mortgage form contains both uniform (multistate) covenants and non-uniform covenants for acceleration, release / satisfaction, waiver of homestead exemption, and future advance, pursuant to Connecticut laws.

- The mortgage is being granted to the lender as additional security for a mortgage loan, plus any additional prepayment or late payment charges, plus interest on all of the indebtedness.

- This mortgage form is a downloadable and fully editable legal template in MS Word format.

- Intended to be used only in the State of Connecticut.

Delaware Contract for Deed

If you are selling a real estate property in Delaware, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- This Contract for Deed form is available in MS Word format and is fully editable to fit your exact circumstances.

- Intended to be used only in the State of Delaware.

Delaware Fixed Rate Mortgage

Place a mortgage on a residential property with this Delaware Fixed Rate Mortgage form.

- The mortgage form contains both uniform (multistate) covenants and non-uniform covenants for acceleration, future advances, and satisfaction / release in accordance with Delaware law.

- The mortgage is given as additional security for a loan under a promissory note signed by the borrower, plus any additional prepayment or late payment charges, plus interest.

- This mortgage form is a downloadable and fully editable template in MS Word format.

- Intended to be used only in the State of Delaware.