Customers who bought this item also bought

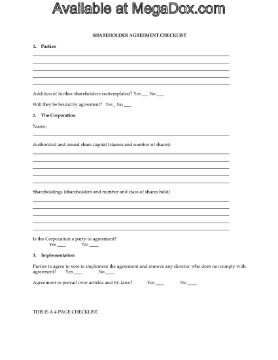

Shareholder Agreement Checklist

Research the issues you need to consider when preparing a shareholder agreement for your company with this Shareholder Agreement Checklist, which covers:

- The share capital of the corporation.

- Composition and powers of the board of directors.

- The corporation's dividend policy.

- Circumstances when additional shareholder capital may be required.

- Procedures for issuing new shares and transferring existing shares.

- Buy-sell provisions governing departing shareholders.

A shareholder agreement is an important legal document for the corporation and its investors. Use the Checklist to make sure you don't leave out any essential items, then purchase the right Shareholder Agreement to suit your needs.

$6.50

Directors Resolution Appointing Officers | Canada

Appoint the corporate officers for a Canadian corporation with this template Directors Resolution.

- A business corporation in Canada must appoint officers to fill the roles set out in its by-laws (such as a president, secretary, treasurer, etc). It is the responsibility of the directors to appoint those individuals.

- The Board of Directors pass resolutions appointing the officers for the corporation and assigning duties to each officer.

- This template can be used by any Canadian or provincial corporation that was formed under a Business Corporations Act. A different form may be required in Quebec.

- This is a downloadable and easy-to-use MS Word document. You can download it immediately after purchase.

$2.50

Corporate Resolutions to Approve Land Purchase | Canada

Approve the purchase of commercial land by a Canadian corporation with these template Corporate Resolutions to Approve Land Purchase.

- The directors of the corporation authorize the corporation to proceed with the purchase of the land.

- The decision is ratified and approved by the shareholders.

- You can use these Corporate Resolutions to Approve Land Purchase for any Canadian or provincial corporation that was formed under a Business Corporations Act. A different form may be required in Quebec.

$2.50

Ontario Annual Corporate Resolutions in Lieu of Meeting

Prepare Annual Corporate Resolutions of the shareholders and directors of an Ontario corporation with these easy-to-use templates.

- The directors and shareholders can pass these Resolutions in lieu of a meeting, which allows them to deal with business generally handled at an annual meeting without actually holding the meeting.

- The Resolutions deal with the following items:

- election of a new board of directors;

- appointment of corporate officers;

- approval of the financial statements;

- appointment of the auditors or, alternatively, waiving the audit requirement.

- Available in MS Word format. Fully customizable to meet your needs.

- Intended to be used only in the Province of Ontario, Canada.

$11.99

Shareholder Agreement Guide | Canada

Discover the legal and practical issues you need to consider when entering into a shareholder agreement with this Shareholder Agreement Guide and Checklist for Canadian companies.

- Topics in the Guide include:

- how to avoid misunderstandings between shareholders;

- distribution of profits;

- decision-making;

- exit strategies;

- employee shareholders;

- default by a shareholder;

- disability or death;

- loss of shareholder control.

- Available as a PDF download.

- This checklist was created for use in Canada.

$29.99