Incorporation and Company Forms

Download easy-to-use incorporation and corporate minute book forms for corporations, companies and non-profit organizations.

Our platform offers a wide range of easy-to-use incorporation and corporate minute book forms specifically designed for corporations, companies, and non-profit organizations. These resources are fully editable, ensuring they meet the unique requirements of various corporate entities, limited companies, and non-profit organizations.

Essential Documents for Incorporation and Organization

- Access all the necessary documents for incorporating and organizing both stock and non-stock companies.

- These templates facilitate the proper establishment and structuring of your organization, ensuring compliance and efficiency from day one.

Meeting Minutes and Resolutions

- Keep accurate records of meetings with our comprehensive resolutions and minutes templates.

- These forms are suitable for directors, shareholders, members, and committees, providing clear documentation of all decisions and actions taken during official meetings.

Stock Ledgers and Share Transfer Registers

- Maintain detailed records of stock ownership and transfers with our stock ledger and share transfer register templates.

- These forms help ensure transparent and organized tracking of share transactions within your organization.

Administrative Forms

- Our collection includes essential administrative forms such as consents, resignations, and indemnity forms.

- These documents facilitate routine corporate governance and help organizations efficiently manage changes in personnel and responsibilities.

Meeting Notices and Proxy Forms

Easily issue notices of meetings and provide proxy forms to stakeholders, enabling seamless participation and representation in important corporate decisions.

Immediate Access and Simplified Recordkeeping

All forms are available for immediate download upon purchase, allowing you to start organizing and managing your corporate records without delay. With these user-friendly and fully editable templates, corporate recordkeeping has never been easier.

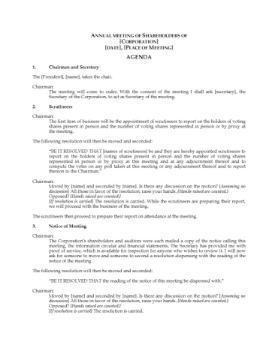

Agenda for Annual Shareholders Meeting | Canada

Set the agenda for an annual shareholders meeting of a Canadian corporation with this template form and procedural guide.

- The agenda form covers:

- the items of business that are required to be dealt with in the meeting (such as the annual election of the directors),

- a set of guidelines for conducting the meeting, and

- the procedure for taking a poll if any shareholder requests a poll to be taken.

- This is a reusable and fully editable form in MS Word format.

- Intended for use only for companies incorporated in Canada under a provincial or federal Business Corporations Act.

Alberta Consent of Non-Voting Shareholder to Waive Audit Requirement

Prepare a Consent of Non-Voting Shareholder for an Alberta corporation with this free template form.

- This form is to be used at the annual shareholder meeting.

- All of the shareholders, including those without voting privileges, must waive the appointment of an auditor under the provisions of the Alberta Business Corporations Act.

- This is a free reusable template available in MS Word format.

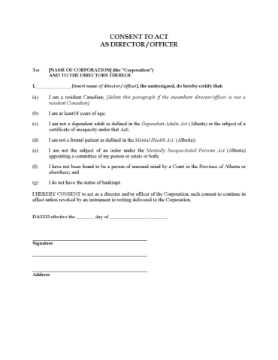

Alberta Consent to Act as Director or Officer

Prepare a Consent to Act as Director or Officer with this template form for Alberta corporations.

- Each person being elected as a director or appointed as an officer must provide the corporation with a signed Consent to Act before taking up their duties.

- This template can be re-used as often as required.

- Download the free Consent to Act as Director or Officer form by clicking the 'Download' button.

- Available in MS Word format.

- Intended for use only by corporations incorporated in the Province of Alberta, Canada.

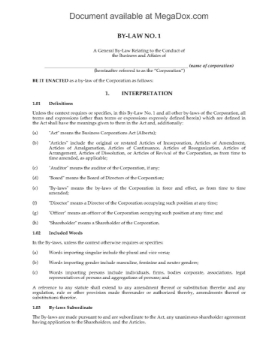

Alberta General Bylaw of Business Corporation

Every new business corporation incorporated in Alberta must adopt this general by-law (By-law No. 1) to set out how the company's affairs will be conducted.

- The corporate by-laws form part of the company's governing documents, together with the Articles of Incorporation. The provisions of the by-laws comply with the Alberta Business Corporations Act.

- The bylaws govern such things as the holding and conduct of shareholder and director meetings, the composition of the Board of Directors, and the issuance of shares.

- The corporation will indemnify each person who acts as a director and/or officer against any costs, charges or expenses he or she may incur by reason of having been a director or officer of the corporation.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

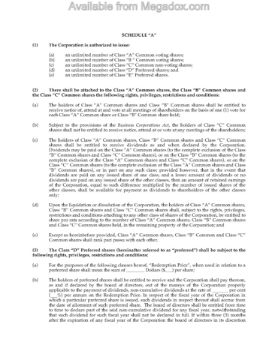

Alberta Share Classes - 2 Common, 3 Preferred Dividend Bearing

Establish the rights and privileges for common and preferred share classes of an Alberta corporation with this ready-made Schedule to the Articles of Incorporation.

- This Schedule is for the following classes of shares:

- Class A and B common voting shares;

- Class C non-voting dividend bearing shares;

- Preferred D and E non-voting redeemable retractable dividend bearing shares with rights on dissolution in priority to all other share classes.

- Available in MS Word format.

- Intended to be used in the Province of Alberta, Canada.

Alberta Share Classes - A and B Common

Create two classes of common shares for a new Alberta corporation with this Schedule to the Articles of Incorporation.

- The Schedule establishes the rights and privileges attaching to the shares, pursuant to Article 3 of the Articles, as follows:

- Class A and B common voting dividend-bearing shares,

- rights on dissolution to rank pari passu (in other words, both classes rank equally).

- The Schedule must be attached to the Articles of Incorporation and submitted to Corporate Registry.

- This document is intended for use solely within the Province of Alberta, under the provincial Business Corporations Act.

Alberta Share Classes - Preferred Redeemable Dividend Bearing

Incorporate an Alberta corporation with common and preferred share classes by attaching this Schedule to the Articles of Incorporation.

- Class A common voting shares;

- Class B common non-voting shares;

- dividends on common shares to be declared contemporaneously;

- Class C preferred non-voting dividend bearing redeemable shares with rights on dissolution in priority to other classes;

- Class D preferred non-voting shares, with rights on dissolution in priority to the common shares.

Alberta Articles of Incorporation Schedule for Share Classes A and B Common, C and D Preferred, available in MS Word format. Download, edit as necessary, print for filing with Corporate Registry.

Alberta Share Classes - Voting, Nonvoting and Redeemable

Create voting, non-voting and redeemable share classes for an Alberta corporation with this Schedule to the Articles of Incorporation.

This Schedule forms an integral part of the Articles of Incorporation and outlines the rights and restrictions associated with various classes of shares issued by an Alberta corporation.

The document is prepared in accordance with the Business Corporations Act (Alberta) and must be attached to the Articles of Incorporation or Amendment for submission to the Corporate Registry. The document is available in Microsoft Word format.

Share Classes Overview

1. Voting Dividend Bearing Shares

- Class A Shares: Voting shares entitled to receive dividends.

- Class B Shares: Voting shares entitled to receive dividends.

2. Non-Voting Dividend Bearing Shares

- Class C Shares: Non-voting shares entitled to receive dividends.

- Class D Shares: Non-voting shares entitled to receive dividends.

3. Non-Voting Redeemable Retractable Dividend Bearing Shares

- Class E Shares: Non-voting shares that are redeemable and retractable, entitled to receive dividends. These shares have priority rights on dissolution over other classes of shares.

4. Voting Redeemable Retractable Non-Dividend Bearing Shares

- Class F Shares: Voting shares that are redeemable and retractable and do not bear dividends. These shares have priority rights on dissolution over all other classes except for Class E shares.

Annual Corporate Resolutions | Canada

Prepare the Annual Resolutions of the shareholders and directors of a Canadian business corporation with this package of forms.

- In small privately held corporations, it is common to pass Resolutions instead of holding a formal annual meeting, to deal with all the business that must be covered in the corporation's annual meeting.

- This package is a convenient time-saver for corporate lawyers and paralegals. It contains the following template forms:

- Resolution of the directors appointing the corporate officers and approving the financial statements.

- Resolution of the voting shareholders approving the financials and electing the directors.

- Resolution of all of the shareholders appointing auditors or waiving the audit requirement.

- Cover letter to be sent by a law firm to its corporate clients, enclosing the forms and giving instructions to the client.

- This package of Canada Annual Resolutions Forms can be used for federal companies and in Alberta, British Columbia, Saskatchewan, Ontario, New Brunswick, Nunavut, Yukon and Northwest Territories. French language translation required for Quebec.

Annual General Meeting Forms Package | UK

Prepare the documents needed for an annual general meeting of a UK private company with this package of template forms.

- The package contains the following forms:

- Board of Directors Resolution to call the meeting,

- Notice of Annual General Meeting,

- Consent to Short Notice,

- Limited Proxy to be used by ordinary shareholders who are unable to attend the meeting,

- Minutes of Annual General Meeting, covering the business which properly comes before an annual meeting.

- The Companies Act 2006 removed any statutory requirement for private companies to hold AGMs, however if your company's Articles have such a requirement then you must still hold the meeting until the Articles are amended.

- Available as a downloadable and fully editable MS Word document.

- Intended to be used only within the United Kingdom.