Mortgage Forms

Before you lend money to someone to buy real estate, secure the loan with these downloadable, customizable Mortgage Forms.

According to Wikipedia.com, the word 'mortgage' is French for 'death contract'. As ominous as that may sound, it merely means that the charge against the land which was created by the mortgage ends (dies) when the debt that it secures is paid or, alternatively, if the property is foreclosed.

Few individuals or businesses can afford to buy real estate without getting a loan to fund the purchase. Because the amount being borrowed is so high, the only collateral of sufficient value that can adequately secure the repayment of the debt is the property itself.

Sort by

Display per page

New York Mortgage - Plain Language

Place a mortgage on a residential property in New York with this plain-language standard form.

- The mortgage form contains both uniform covenants pursuant to federal laws, and additional provisions for foreclosure and sale, and the borrower's promise to comply with Section 13 of the New York Lien Law.

- The document is written in accordance with the New York Plain English Law.

- This is a downloadable legal template which can be used for single family or multi-unit dwellings.

- Intended for use only in the State of New York.

$17.99

New York Subordination of Mortgage Agreement

Prepare a Subordination of Mortgage Agreement with this template form for New York lenders.

- Under the Subordination Agreement, the holder of a first mortgage on a property (the original lender) agrees to allow its mortgage to be subordinated to a new mortgage being placed on the property.

- The new mortgage will become the first charge.

- The purpose of the agreement is to induce the new lender to approve the new mortgage.

- Available in MS Word format and fully editable.

- Intended to be used only in the State of New York.

$9.99

North Carolina Contract for Deed

A Contract for Deed is used when you want to sell a property in North Carolina and you plan to finance the purchase by allowing the buyer to pay the purchase price over time.

- The Contract for Deed is also called an installment agreement, land sale contract, or purchase money mortgage because the seller is basically assuming the role of a mortgage lender.

- The template contains several alternate payment clauses with different methods of repaying the loan plus interest (if any). Use the clause that reflects your agreement with the buyer, and delete the others.

- The buyer can take possession of the property but the seller remains the owner on the title deed until everything owing under the contract is paid.

- If there is already a mortgage on the property, the seller remains responsible for making the payments.

- Owner financing is a great option in cases where the buyer cannot get a conventional mortgage loan.

- The form is available in MS Word format.

- Intended to bge used only in the State of North Carolina.

$17.99

North Carolina Deed of Trust

In North Carolina, a Deed of Trust is used instead of a mortgage to secure repayment of a new home loan.

- A Deed of Trust can be used for any real estate property except for agricultural farm land.

- A trustee, such as a title company, holds the title as security to ensure that the borrower makes the loan payments on time, pays the taxes, maintains and keeps the property in good condition, and fulfills all of its obligations.

- Just like with a mortgage, if the purchaser defaults in making any payments, the entire balance immediately becomes due and the trustee can sell the property.

- The Deed of Trust contains uniform covenants as required by federal laws, as well as specific clauses under North Carolina statutes.

- Any attorney's fees payable by a party under the Trust Deed must be reasonable.

- Available in MS Word format.

- Intended to be used only in the State of North Carolina.

$17.99

North Carolina Mortgage Note

Secure repayment of a home loan with this Mortgage Note for North Carolina, which is backed by a mortgage against the borrower's property.

- Repayment of the principal and interest will be made in regular equal monthly installments.

- The borrower has the right to prepay all or part of the principal at any time without a penalty or premium being charged.

- If the borrower defaults in making any payment when it becomes due, the entire balance together with interest becomes immediately due and payable at the option of the lender.

- Each of the persons signing the note is jointly and severally obligated and the lender may enforce its rights against each person individually or against them all together.

- Available in MS Word format.

- Intended to be used only in the State of North Carolina.

$9.99

North Dakota Contract for Deed

If you are selling a real estate property in North Dakota, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- The seller remains on title as the owner of the property, even though the buyer takes possession. Once the purchase price is paid off, the seller will transfer ownership to the buyer.

- If the buyer fails to keep up the payments, the seller can take back the property. The buyer forfeits all of the payments made as liquidated damages.

- This Contract for Deed form is in MS Word format and is fully editable to fit your exact circumstances.

- Intended to be used only in the State of North Dakota.

$17.99

North Dakota Residential Mortgage

Secure a loan on a residential single-family home with this fixed rate mortgage form for North Dakota.

- The mortgage form contains both uniform multi-state covenants under federal laws, and additional provisions specific to North Dakota law, including foreclosure and sale upon default, and waiver of homestead exemption.

- The purpose of the mortgage is to protect the lender's security interest and ensure that the borrower makes the payments and complies with the terms of the mortgage note.

- This standard form legal template is downloadable and reusable.

- Available in MS Word format.

- Intended to be used only in the State of North Dakota.

$17.99

Nova Scotia Condominium Mortgage Schedule

Prepare a schedule for a Condominium Mortgage with this template form for Nova Scotia condominiums.

- The mortgagor covenants and agrees:

- To comply with all the provisions of the Nova Scotia Condominium Act;

- To promptly pay all assessments and payments due to the condo corporation;

- That the mortgagee can treat any default under the schedule as a default under the mortgage;

- To assign all of its voting rights to the mortgagee;

- That if the mortgagor sells the property, the entire balance of the mortgage will become due.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

$6.29

Nova Scotia Postponement Agreement

Use this template to prepare a Postponement Agreement between two mortgage lenders holding mortgages on the same property in Nova Scotia.

- The parties agree that the second mortgage will take priority over the first mortgage.

- The first mortgagee agrees to postpone its security, in return for the second mortgagee paying the first mortgagee a specified sum.

- The template can be re-used over and over again, and edited to fit your business' requirements.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

$6.29

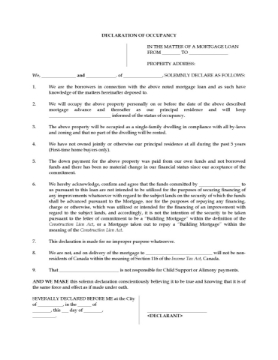

Occupancy Declaration | Canada

Canadian mortgage lenders require mortgagors to provide a Declaration of Occupancy as part of the documentation for a residential mortgage loan.

- The purchasers declare that they do or will occupy the property as their principal residence and will not turn it into a rental property.

- The mortgage lender will require this Declaration as evidence that the purchasers plan to live on the property, as a condition of granting the mortgage.

- This form can be used in any Canadian province or territory.

- This is a free digital download.

$0.00