Related products

USA Non-Qualified Stock Option and Stock Appreciation Rights Plan

Establish a stock incentive plan for your officers and key employees with this Non-Qualified Stock Option and Stock Appreciation Rights Plan.

- The Plan is intended to enable officers and employees to acquire an interest in the company, and to provide incentives and encourage loyalty.

- Executive, administrative, professional and technical personnel are eligible to receive options or stock appreciation rights for common shares under the Plan.

- The Board of Directors may require the employee to remain employed by the company for a specified amount of time.

- A participant may be granted Stock Appreciation rights at the same time that they are awarded options.

- The Plan is written pursuant to United States securities regulations.

Get the Non-Qualified Stock Option and Stock Appreciation Rights Plan template and start rewarding your key people.

$17.99

Stock Appreciation Rights Plan for Employees and Officers | USA

Set up a phantom stock program for employees and officers of a U.S. company under this Stock Appreciation Rights (SAR) Plan.

- SAR Rights will be awarded as a reward for significant contributions, and as a means of attracting and retaining quality personnel.

- The Plan includes provisions for exercise of Rights within a specified time following termination of employment, retirement, death or disability of a participant.

- If the share capital is subdivided or reorganized, the number of SARs under the Plan will be adjusted proportionally.

- SARs are not transferrable except under a will or by law of descent.

- The digital template also contains a Stock Appreciation Rights Agreement to be signed by the participant receiving the SARs.

- This is a digital download that is fully editable and can be easily customized to fit your requirements.

- Intended to be used only in the United States.

$29.99

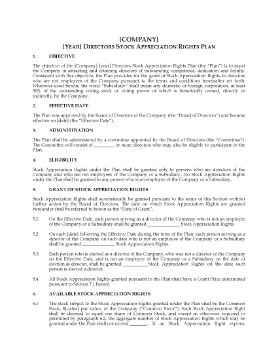

Stock Appreciation Rights Plan for Non-Employee Directors | USA

Establish a Stock Appreciation Rights (SAR) Plan for non-employee directors of a USA company under the terms of this downloadable template.

- The longer the participant has contributed services to the company, the more SAR Rights are vested.

- Rights become fully vested upon the death, disability or retirement of a participant, or upon a merger, consolidation or disposition of substantially all of the company's assets.

- Upon any subdivision or reorganization of the share capital of the company, the number of SARs under the Plan will be adjusted proportionally.

- Rights under the Plan are not transferrable.

- Available in MS Word format and fully customizable.

- Intended to be used only in the United States.

$19.99