Customers who bought this item also bought

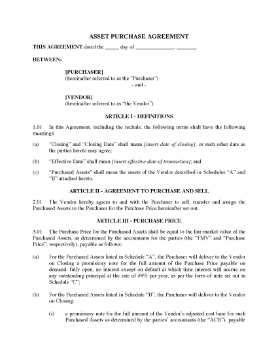

Section 85 Rollover Agreement for Land | Canada

Use this Section 85 rollover agreement to transfer real property to a corporation in exchange for shares while avoiding capital gains tax.

- A rollover allows you to transfer the asset under Section 85 of the Income Tax Act (Canada) without attracting capital gains tax on the transaction.

- In exchange for the land, the corporation purchasing the land issues shares to the vendor in an amount equal to the fair market value of the land.

- The purchaser and vendor agree to jointly file an election under subsection 85(1) of the Income Tax Act.

- A section 85 rollover agreement gives you a means to preserve your assets and reduce your tax liability.

- This document is governed by Canadian tax laws and is intended for use in Canada only.

$31.99

Ontario Section 85 Rollover Agreement to Exchange Assets for Preferred Shares

Exchange (roll over) certain assets for preferred shares in an Ontario company with this Section 85 Rollover Agreement (Assets for Preferred Shares).

- The rollover is pursuant to Subsection 85(1) of the Income Tax Act (Canada).

- The vendor shareholder sells the subject shares to a holding company in exchange for preferred shares in the capital stock of the holding company with a redemption amount equal to the purchase price.

- The parties agree to file joint elections under Section 85(1) under the ITA and as required under the Ontario Corporations Tax Act.

- The file includes a Section 116 Affidavit to be sworn by a corporate officer of the vendor, if applicable.

- The document is available in MS Word format and is fully editable to fit your specific circumstances.

- Intended to be used only in the Province of Ontario, Canada.

$17.99

Ontario Section 85 Asset Rollover (Investments)

Roll over certain investments under Section 85 of the Income Tax Act (Canada) with this Ontario Section 85 Asset Rollover template.

- The vendor sells the investment assets to the purchaser, with part of the purchase price to be paid by way of preference shares in the capital of the purchaser, and the balance secured by a promissory note (included).

- The parties agree to file joint elections under Section 85(1) of the ITA and as required under the Ontario Corporations Tax Act.

- The file includes a Section 116 Affidavit of Residency to be sworn by a corporate officer of the vendor (if applicable).

- This Section 85 Asset Rollover of Investments is provided in MS Word format, and is fully editable to fit your specific circumstances.

- Intended for use only in the Province of Ontario, Canada.

$29.99

Ontario Section 85 Rollover Corporate Approval and Implementation Forms

Transfer shares under subsection 85(1) of the Income Tax Act (Canada) with this Ontario Section 85 Rollover Corporate Approval and Implementation Forms Package.

- The package of forms contains:

- Bill of Sale and Indemnity, including the vendor's indemnity of the purchaser, and representations and warranties with respect to the sale;

- Corporate Resolutions approving and authorizing the transaction;

- Share Transfer Form transferring shares from the vendor to the purchaser;

- Share Subscription from the vendor for new shares being issued by the purchaser as payment for the shares being transferred in the rollover.

- This package of forms is provided in MS Word format, and the forms are all fully editable to fit your specific circumstances.

- Intended to be used only in the Province of Ontario, Canada.

$17.99

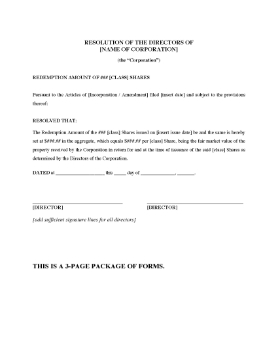

Ontario Directors Resolutions to Redeem Shares

Prepare Directors Resolutions to redeem shares of an Ontario business corporation with this package of template forms.

- This forms package contains the following:

- Directors Resolution setting the redemption price of a certain class of shares,

- Directors Resolution redeeming specified shares,

- Notice of Redemption.

- This corporate forms package complies with the requirements of the Business Corporations Act (Ontario).

- Available in MS Word format, fully editable and reusable.

- Intended for use only in the Province of Ontario, Canada.

$12.49